Question: ABC Corp. invests $550,000 this year in a five-year project. The investment will have the salvage value of $70,000. The performance of the project over

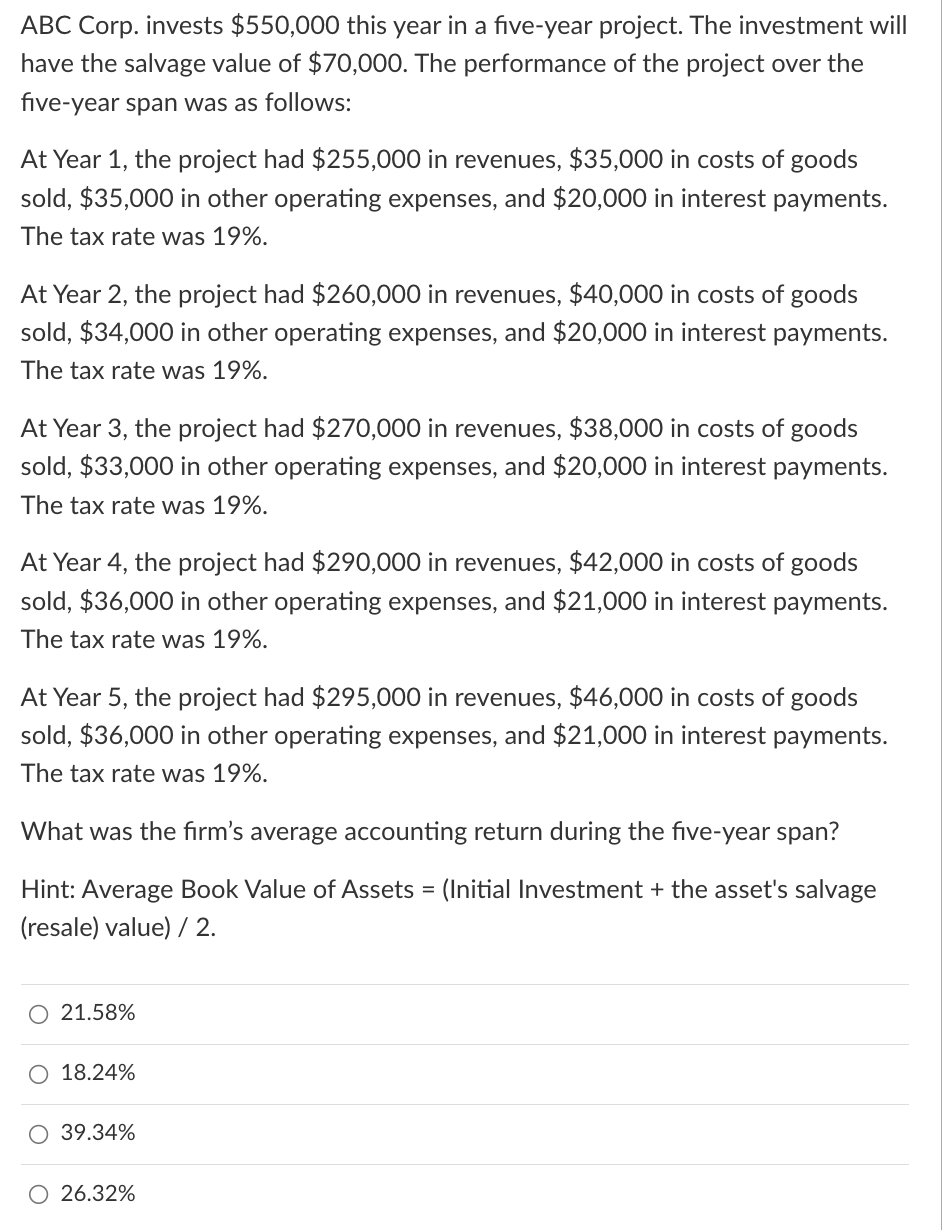

ABC Corp. invests $550,000 this year in a five-year project. The investment will have the salvage value of $70,000. The performance of the project over the five-year span was as follows: At Year 1, the project had $255,000 in revenues, $35,000 in costs of goods sold, $35,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 19%. At Year 2, the project had $260,000 in revenues, $40,000 in costs of goods sold, $34,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 19%. At Year 3, the project had $270,000 in revenues, $38,000 in costs of goods sold, $33,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 19%. At Year 4, the project had $290,000 in revenues, $42,000 in costs of goods sold, $36,000 in other operating expenses, and $21,000 in interest payments. The tax rate was 19%. At Year 5, the project had $295,000 in revenues, $46,000 in costs of goods sold, $36,000 in other operating expenses, and $21,000 in interest payments. The tax rate was 19%. What was the firm's average accounting return during the five-year span? Hint: Average Book Value of Assets = (Initial Investment + the asset's salvage (resale) value) / 2. \begin{tabular}{l} \hline 21.58% \\ \hline 18.24% \\ \hline 39.34% \\ \hline 26.32% \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts