Question: abc Corp is considering opening a new store the project is to be evaluated based on following information the building would have an upfront cost

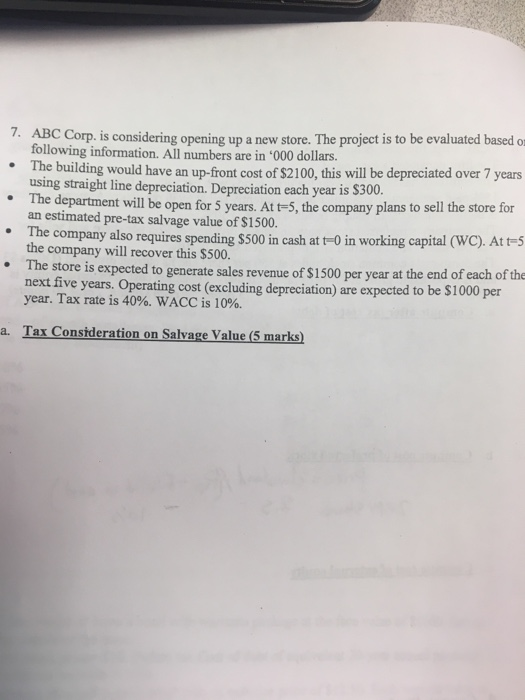

7. ABC Corp. is considering opening up a new store. The project is to be evaluated based o * The building would have an up-front cost of $2100, this will be depreciated over 7 years 5 years. At t-5, the company plans to sell the store for nding $500 in cash at t-0 in working capital (WC). Att-5 following information. All numbers are in '000 dollars. using straight line depreciation. Depreciation each year is $300. an estimated pre-tax salvage value of $1500. the company will recover this $500. .The department will be open for The company also requires sp The store is expected to generate sales revenue of $1500 per year at the end of each of the next five years. Operating cost (excluding depreciation) are expected to be $1000 per year. Tax rate is 40%. WACC is 10%. .Tax Constdration on Salkae Valse marksl

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts