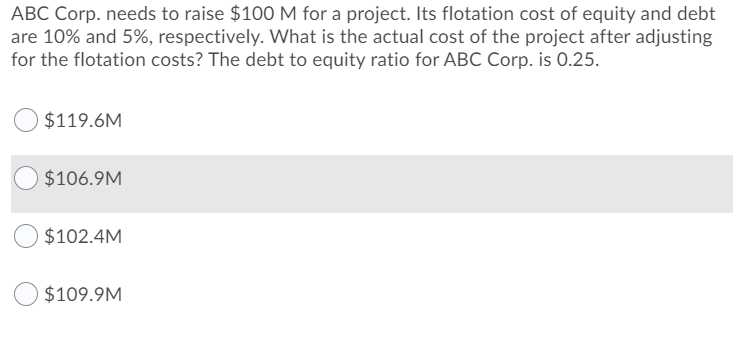

Question: ABC Corp. needs to raise $100 M for a project. Its flotation cost of equity and debt are 10% and 5%, respectively. What is the

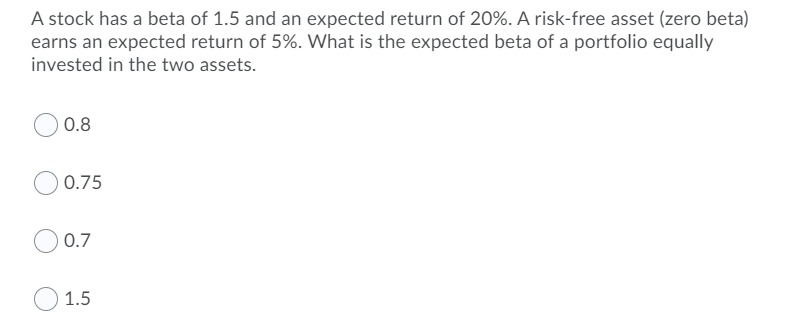

ABC Corp. needs to raise $100 M for a project. Its flotation cost of equity and debt are 10% and 5%, respectively. What is the actual cost of the project after adjusting for the flotation costs? The debt to equity ratio for ABC Corp. is 0.25. $119.6M $106.9M $102.4M $109.9M A stock has a beta of 1.5 and an expected return of 20%. A risk-free asset (zero beta) earns an expected return of 5%. What is the expected beta of a portfolio equally invested in the two assets. 0.8 0.75 0.7 O 1.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts