Question: ABC Corporation acquired ( 3 0 % ) shareholding of a foreign company, XYZ Corporation, on 3 1 December 2 0 2

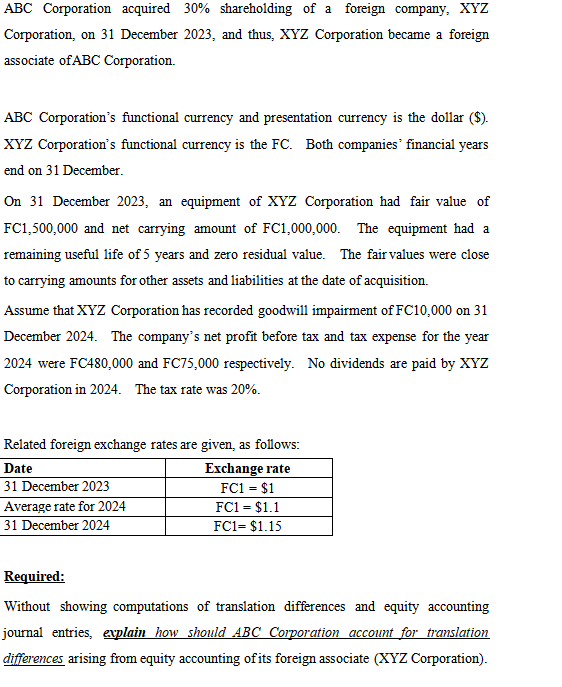

ABC Corporation acquired shareholding of a foreign company, XYZ Corporation, on December and thus, XYZ Corporation became a foreign associate of ABC Corporation.

ABC Corporation's functional currency and presentation currency is the dollar $ XYZ Corporation's functional currency is the FC Both companies' financial years end on December.

On December an equipment of XYZ Corporation had fair value of mathrmFC and net carrying amount of FC The equipment had a remaining useful life of years and zero residual value. The fair values were close to carrying amounts for other assets and liabilities at the date of acquisition.

Assume that XYZ Corporation has recorded goodwill impairment of FC on December The company's net profit before tax and tax expense for the year were FC and FC respectively. No dividends are paid by XYZ Corporation in The tax rate was

Related foreign exchange rates are given, as follows:

Required:

Without showing computations of translation differences and equity accounting journal entries, explain how should A B C Corporation account for translation differences arising from equity accounting of its foreign associate XYZ Corporation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock