Question: ABC COSTING Chapter 18 Practice Exercise (ABC Costing) Bright Day Company manufactures and sells two beverages, Hi-Voltage and EasySlim, through two production departments, Mixing and

ABC COSTING

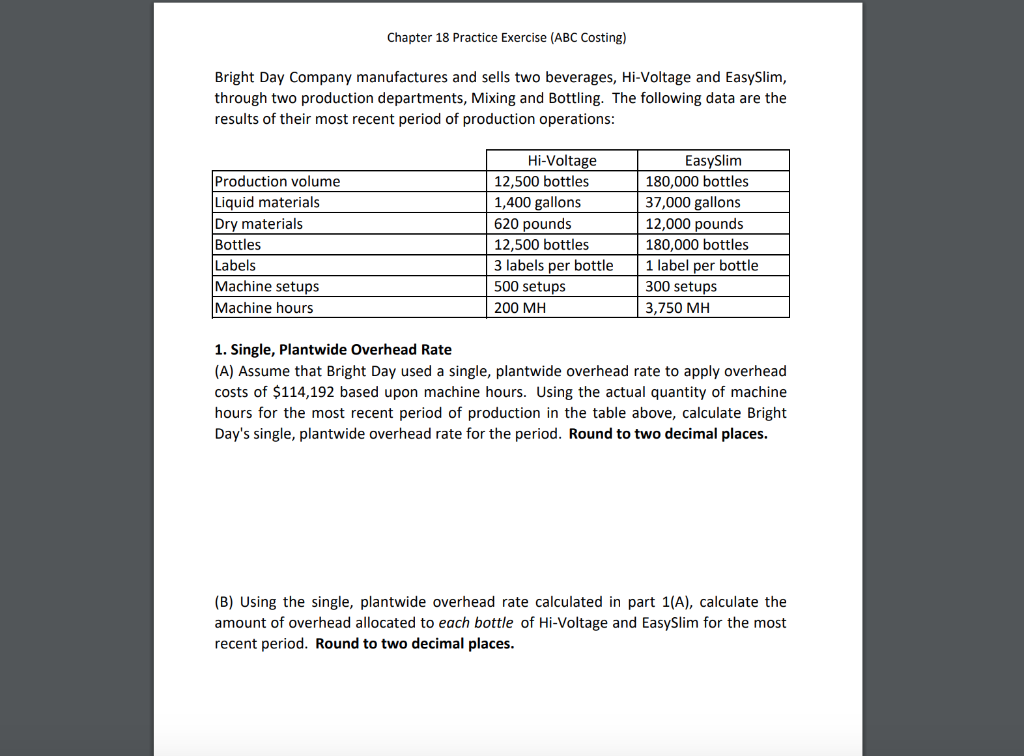

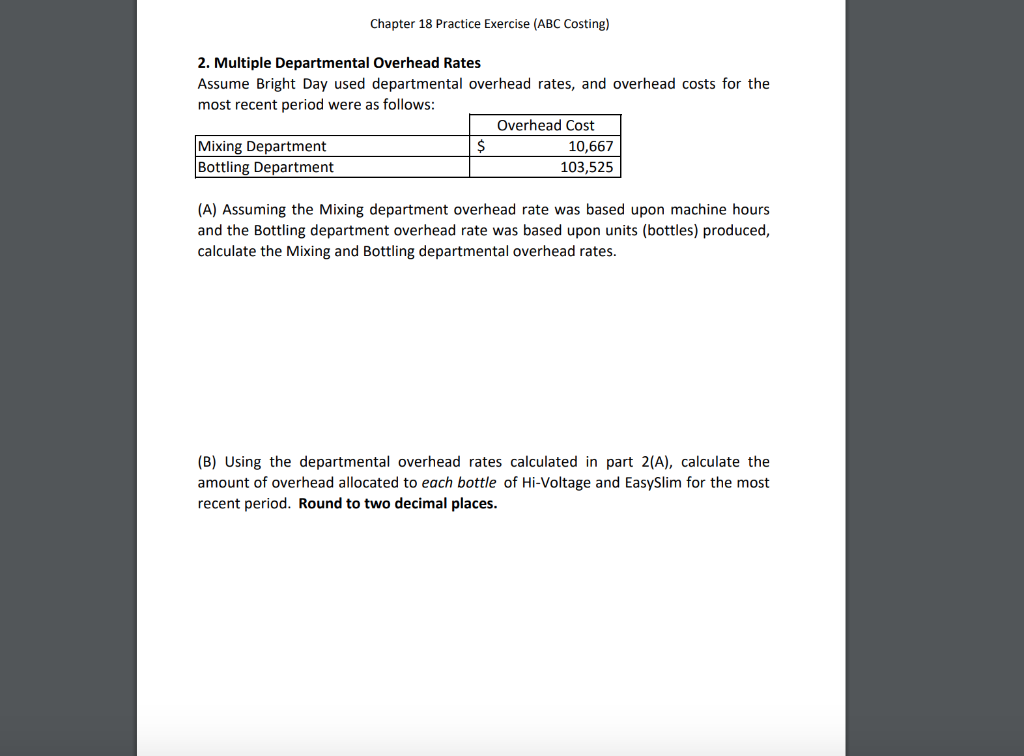

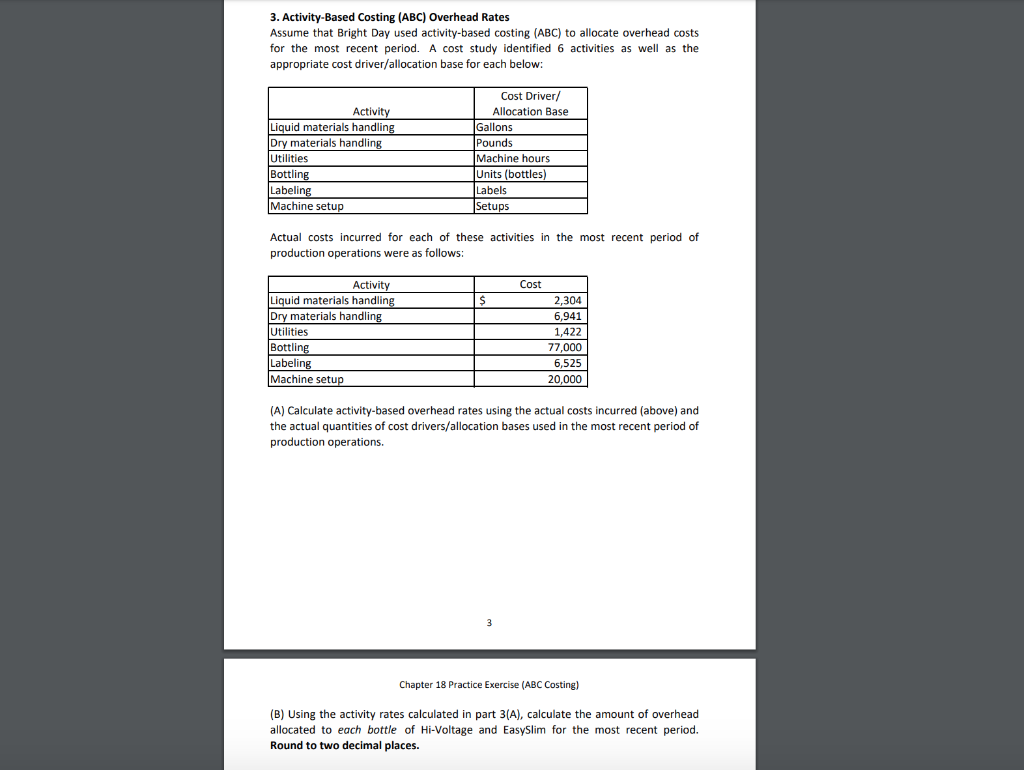

Chapter 18 Practice Exercise (ABC Costing) Bright Day Company manufactures and sells two beverages, Hi-Voltage and EasySlim, through two production departments, Mixing and Bottling. The following data are the results of their most recent period of production operations: Production volume Liquid materials Dry materials Bottles Labels Machine setups Machine hours Hi-Voltage 12,500 bottles 1,400 gallons 620 pounds 12,500 bottles 3 labels per bottle 500 setups 200 MH 3 Easy Slim 180,000 bottles 37,000 gallons 12,000 pounds 180,000 bottles 1 label per bottle 300 setups ,750 MH 1. Single, Plantwide Overhead Rate (A) Assume that Bright Day used a single, plantwide overhead rate to apply overhead costs of $114,192 based upon machine hours. Using the actual quantity of machine hours for the most recent period of production in the table above, calculate Bright Day's single, plantwide overhead rate for the period. Round to two decimal places. (B) Using the single, plantwide overhead rate calculated in part 1(A), calculate the amount of overhead allocated to each bottle of Hi-Voltage and EasySlim for the most recent period. Round to two decimal places. Chapter 18 Practice Exercise (ABC Costing) 2. Multiple Departmental Overhead Rates Assume Bright Day used departmental overhead rates, and overhead costs for the most recent period were as follows: Overhead Cost Mixing Department 10,667 Bottling Department 103,525 (A) Assuming the Mixing department overhead rate was based upon machine hours and the Bottling department overhead rate was based upon units (bottles) produced, calculate the Mixing and Bottling departmental overhead rates. (B) Using the departmental overhead rates calculated in part 2(A), calculate the amount of overhead allocated to each bottle of Hi-Voltage and EasySlim for the most recent period. Round to two decimal places. 3. Activity-Based Costing (ABC) Overhead Rates Assume that Bright Day used activity-based costing (ABC) to allocate overhead costs for the most recent period. A cost study identified 6 activities as well as the appropriate cost driver/allocation base for each below: Activity Liquid materials handling Dry materials handling Utilities Bottling Labeling Machine setup Cost Driver/ Allocation Base Gallons Pounds Machine hours Units (bottles) Labels Setups Actual costs incurred for each of these activities in the most recent period of production operations were as follows: $ Activity Liquid materials handling Dry materials handling Utilities Bottling Labeling Machine setup Cost 2,304 6,941 1,422 77,000 6,525 20,000 (A) Calculate activity-based overhead rates using the actual costs incurred (above) and the actual quantities of cost drivers/allocation bases used in the most recent period of production operations. Chapter 18 Practice Exercise (ABC Costing) (B) Using the activity rates calculated in part 3(A), calculate the amount of overhead allocated to each bottle of Hi-Voltage and EasySlim for the most recent period. Round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts