Question: ABC electronics makes audio player model 'AB 100'. It has 80 components. ABC sells 10,000 units each month at Rs.3,000 per unit. The cost

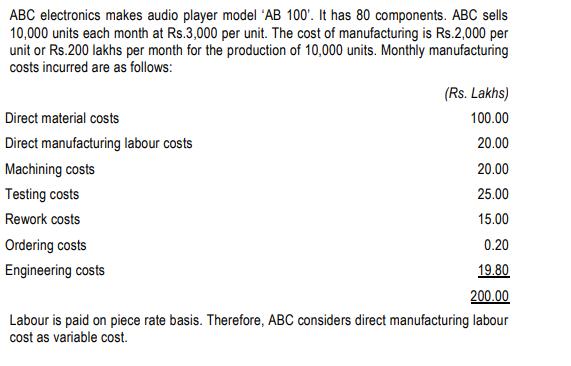

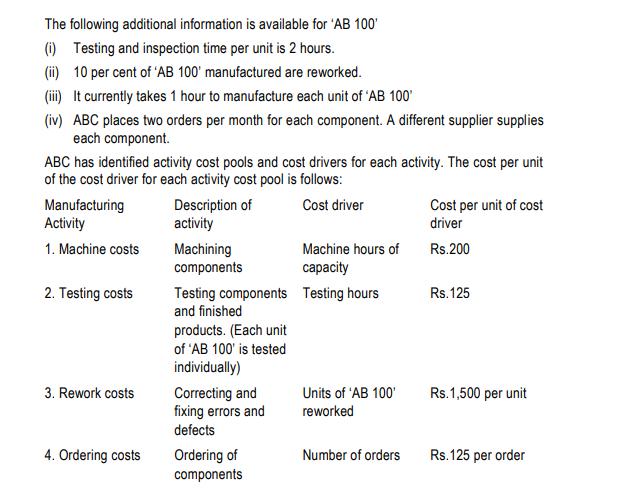

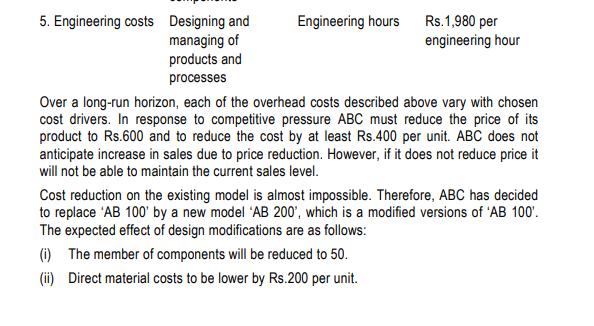

ABC electronics makes audio player model 'AB 100'. It has 80 components. ABC sells 10,000 units each month at Rs.3,000 per unit. The cost of manufacturing is Rs.2,000 per unit or Rs.200 lakhs per month for the production of 10,000 units. Monthly manufacturing costs incurred are as follows: (Rs. Lakhs) 100.00 20.00 20.00 25.00 15.00 0.20 19.80 200.00 Labour is paid on piece rate basis. Therefore, ABC considers direct manufacturing labour cost as variable cost. Direct material costs Direct manufacturing labour costs Machining costs Testing costs Rework costs Ordering costs Engineering costs The following additional information is available for 'AB 100' (i) Testing and inspection time per unit is 2 hours. (ii) 10 per cent of 'AB 100' manufactured are reworked. (iii) It currently takes 1 hour to manufacture each unit of 'AB 100' (iv) ABC places two orders per month for each component. A different supplier supplies each component. ABC has identified activity cost pools and cost drivers for each activity. The cost per unit of the cost driver for each activity cost pool is follows: Cost driver Manufacturing Activity 1. Machine costs 2. Testing costs 3. Rework costs 4. Ordering costs Description of activity Machining components Testing components and finished products. (Each unit of 'AB 100' is tested individually) Correcting and fixing errors and defects Ordering of components Machine hours of capacity Testing hours Units of 'AB 100' reworked Number of orders Cost per unit of cost driver Rs.200 Rs.125 Rs.1,500 per unit Rs.125 per order 5. Engineering costs Designing and managing of products and processes Engineering hours Rs.1,980 per engineering hour Over a long-run horizon, each of the overhead costs described above vary with chosen cost drivers. In response to competitive pressure ABC must reduce the price of its product to Rs.600 and to reduce the cost by at least Rs.400 per unit. ABC does not anticipate increase in sales due to price reduction. However, if it does not reduce price it will not be able to maintain the current sales level. Cost reduction on the existing model is almost impossible. Therefore, ABC has decided to replace 'AB 100' by a new model 'AB 200', which is a modified versions of 'AB 100'. The expected effect of design modifications are as follows: (i) The member of components will be reduced to 50. Direct material costs to be lower by Rs.200 per unit. (ii) (iii) Direct manufacturing labour costs to be lower by Rs.20 per unit. (iv) Machining time required to be lower by 20 per unit. (v) Testing time required to be lower by 20 per cent. (vi) Rework to decline to 5 per cent. (vii) Machining capacity and engineering hours capacity to remain the same. ABC currently out sources the rework on defective units. Required: (i) Compare the manufacturing cost per unit of 'AB 100' and 'AB 200. (ii) Determine the immediate effect of design change and pricing decision on the operating to apply to 'AB 200'. Ignore income tax, Assume that the cost per unit of each cost driver for 'AB 100' continues to apply to 'AB 200'

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Question 1 The manufacturing cost per unit of AB 100 is Rs2000 and the manufacturing cost per unit o... View full answer

Get step-by-step solutions from verified subject matter experts