Question: ABC has issued a 6-year coupon bond with face value $1,000. Coupon rate is 5 percent per annum and the coupon is paid semi-annually. What

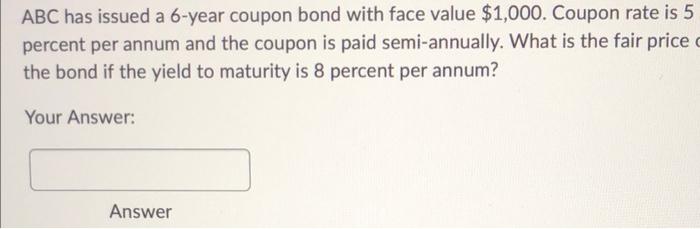

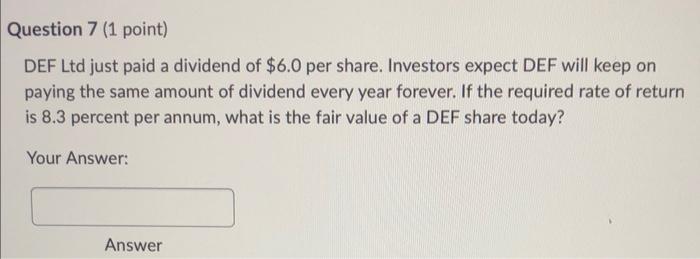

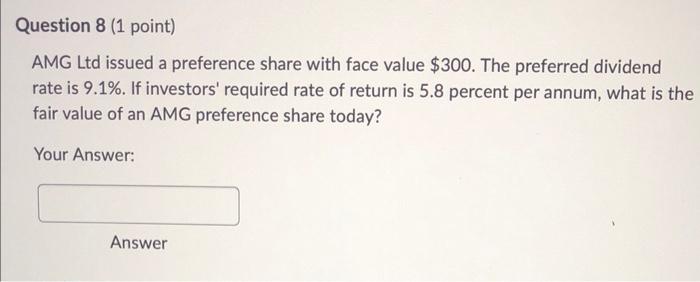

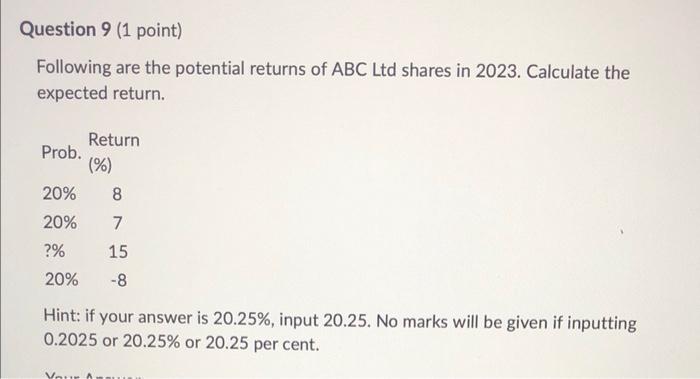

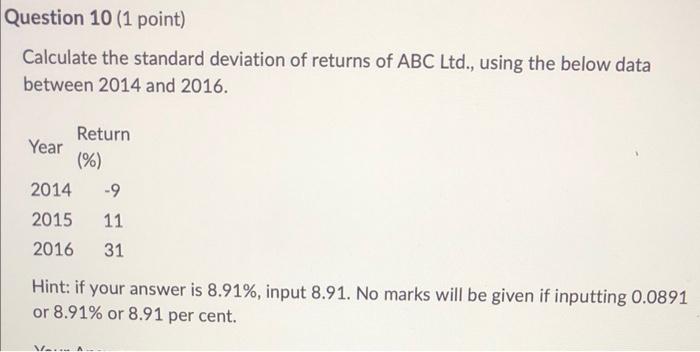

ABC has issued a 6-year coupon bond with face value $1,000. Coupon rate is 5 percent per annum and the coupon is paid semi-annually. What is the fair price the bond if the yield to maturity is 8 percent per annum? Your Answer: Answer DEF Ltd just paid a dividend of $6.0 per share. Investors expect DEF will keep on paying the same amount of dividend every year forever. If the required rate of return is 8.3 percent per annum, what is the fair value of a DEF share today? Your Answer: Answer AMG Ltd issued a preference share with face value $300. The preferred dividend rate is 9.1%. If investors' required rate of return is 5.8 percent per annum, what is the fair value of an AMG preference share today? Your Answer: Answer Following are the potential returns of ABC Ltd shares in 2023. Calculate the expected return. Hint: if your answer is 20.25%, input 20.25. No marks will be given if inputting 0.2025 or 20.25% or 20.25 per cent. Calculate the standard deviation of returns of ABCLtd., using the below data between 2014 and 2016. Hint: if your answer is 8.91%, input 8.91. No marks will be given if inputting 0.0891 or 8.91% or 8.91 per cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts