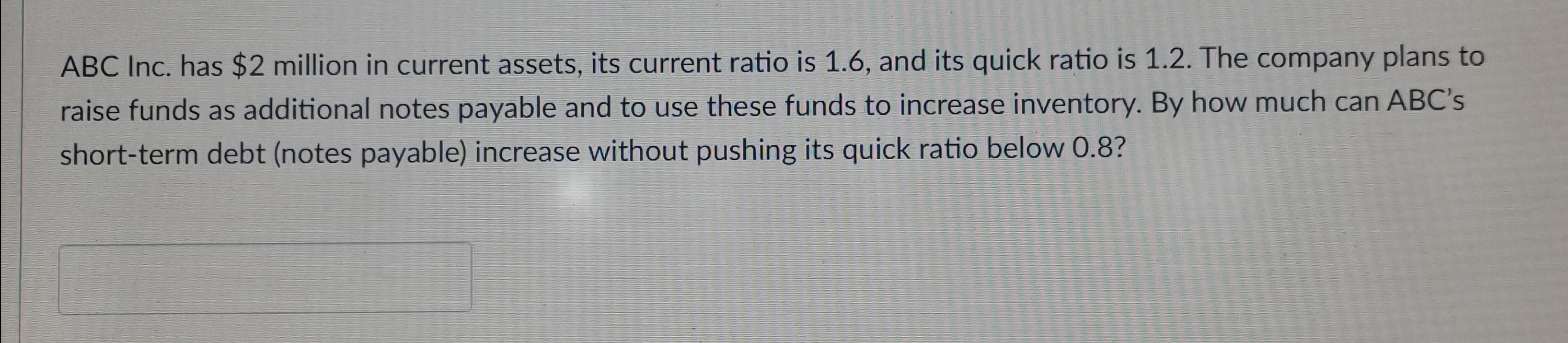

Question: ABC Inc. has $2 million in current assets, its current ratio is 1.6, and its quick ratio is 1.2. The company plans to raise funds

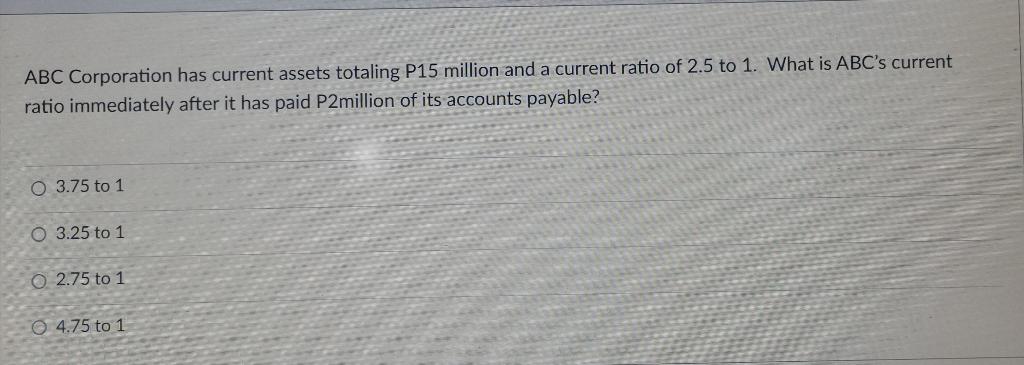

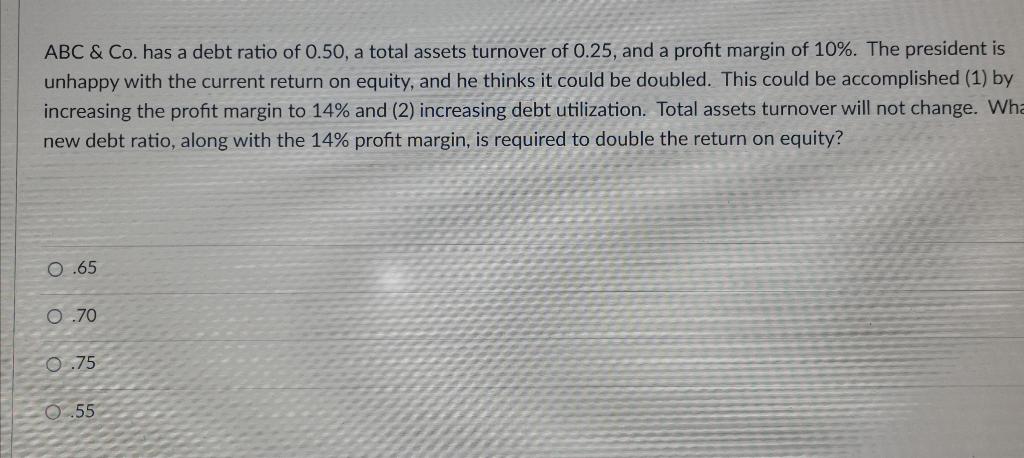

ABC Inc. has $2 million in current assets, its current ratio is 1.6, and its quick ratio is 1.2. The company plans to raise funds as additional notes payable and to use these funds to increase inventory. By how much can ABC's short-term debt (notes payable) increase without pushing its quick ratio below 0.8? ABC Corporation has current assets totaling P15 million and a current ratio of 2.5 to 1. What is ABC's current ratio immediately after it has paid P2million of its accounts payable? O 3.75 to 1 O 3.25 to 1 0 2.75 to 1 0 4.75 to 1 ABC & Co. has a debt ratio of 0.50, a total assets turnover of 0.25, and a profit margin of 10%. The president is unhappy with the current return on equity, and he thinks it could be doubled. This could be accomplished (1) by increasing the profit margin to 14% and (2) increasing debt utilization. Total assets turnover will not change. Wha new debt ratio, along with the 14% profit margin, is required to double the return on equity? 0.65 O 70 0.75 0..55

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts