Question: ABC Inc. is analyzing a project that has projected sales of $1,357,000 per year and incremental costs of $876,000 per year. However, if the project

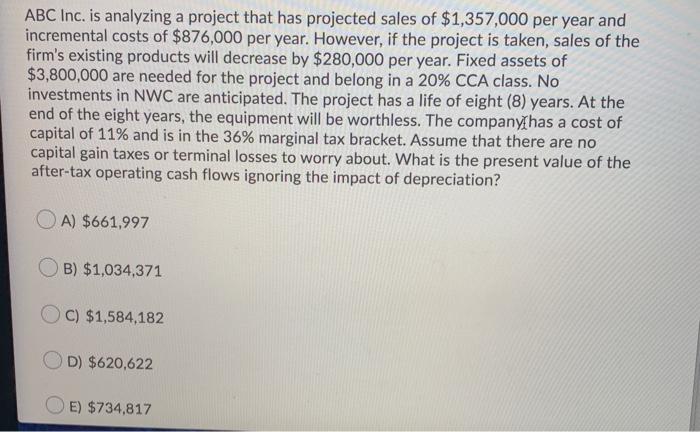

ABC Inc. is analyzing a project that has projected sales of $1,357,000 per year and incremental costs of $876,000 per year. However, if the project is taken, sales of the firm's existing products will decrease by $280,000 per year. Fixed assets of $3,800,000 are needed for the project and belong in a 20% CCA class. No investments in NWC are anticipated. The project has a life of eight (8) years. At the end of the eight years, the equipment will be worthless. The company has a cost of capital of 11% and is in the 36% marginal tax bracket. Assume that there are no capital gain taxes or terminal losses to worry about. What is the present value of the after-tax operating cash flows ignoring the impact of depreciation? O A) $661,997 B) $1,034,371 C) $1,584,182 OD) $620,622 O E) $734,817

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts