Question: ABC Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The

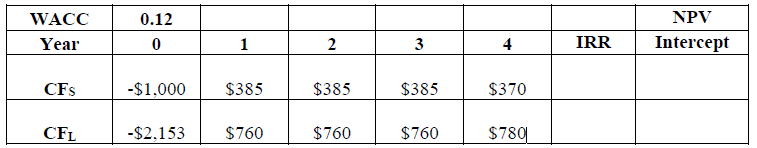

ABC Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The firms WACC is 12%.

(b) Given that WACC is 12%, and given your crossover IRR in part (a), based on this information what project should ABC choose if you use the IRR method? You must show your work to receive credit. (5 points).

WACC Year CFS CFL 0.12 0 -$1,000 -$2,153 1 $385 $760 2 $385 $760 3 $385 $760 4 $370 $780 IRR NPV Intercept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts