Question: ABC, Inc. is looking at raising additional capital for a future project. The project is expected to provide a return on investment of13%) in order

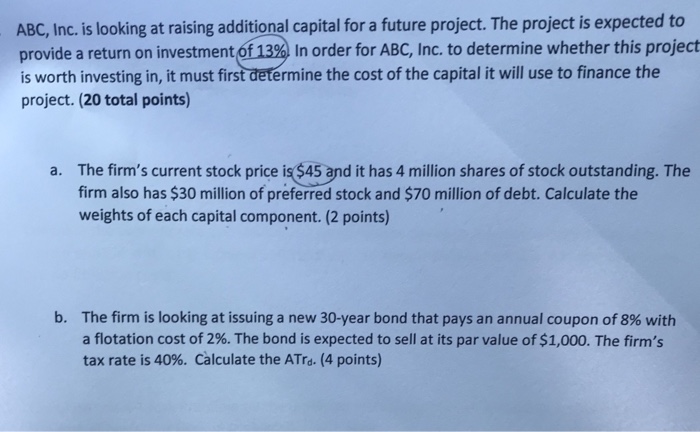

ABC, Inc. is looking at raising additional capital for a future project. The project is expected to provide a return on investment of13%) in order for ABC, Inc. to determine whether this project is worth investing in, it must first determine the cost of the capital it will use to finance the project. (20 total points) The firm's current stock price is $45 and it has 4 million shares of stock outstanding. The firm also has $30 million of preferred stock and $70 million of debt. Calculate the weights of each capital component. (2 points) a. b. The firm is looking at issuing a new 30-year bond that pays an annual coupon of 8% with a flotation cost of 2%. The bond is expected to sell at its par value of $1,000. The firm's tax rate is 40%. Calculate the ATrs(4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts