Question: ABC Inc. is looking at recapitalizing its current structure. The firm currently has no debt. It has an unlevered beta of 1. The current risk

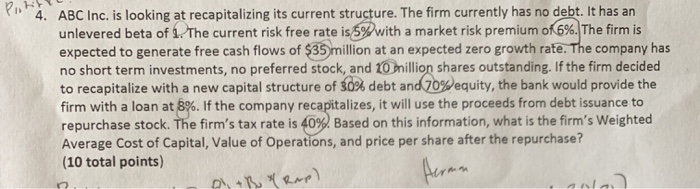

ABC Inc. is looking at recapitalizing its current structure. The firm currently has no debt. It has an unlevered beta of 1. The current risk free rate is 5%with a market risk premium of 6% . The firm is expected to generate free cash flows of $35 million at an expected zero growth rate. The company has no short term investments, no preferred stock, and 1Omillion shares outstanding. If the firm decided to recapitalize with a new capital structure of 30% debt and 70% equity, the bank would provide the firm with a loan at 8%. If the company recapitalizes, it will use the proceeds from debt issuance to repurchase stock. The firm's tax rate is 40% Based on this information, what is the firm's Weighted Average Cost of Capital, Value of Operations, and price per share after the repurchase? (10 total points) 4. Aeran

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts