Question: ABC Inc. is planning to buy machine A which will cost $ 10 million. The expected life of the machine is 5 years. The

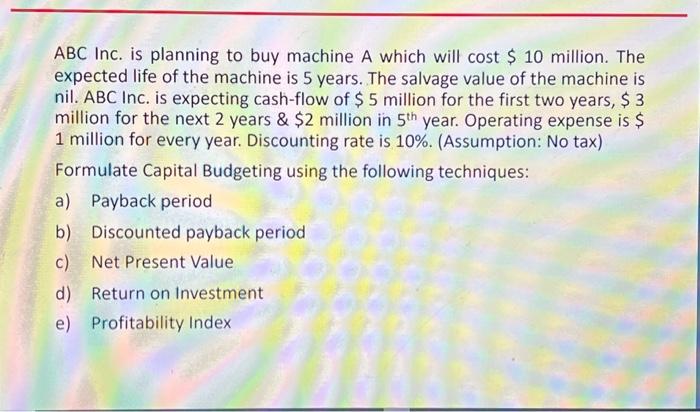

ABC Inc. is planning to buy machine A which will cost $ 10 million. The expected life of the machine is 5 years. The salvage value of the machine is nil. ABC Inc. is expecting cash-flow of $ 5 million for the first two years, $ 3 million for the next 2 years & $2 million in 5th year. Operating expense is $ 1 million for every year. Discounting rate is 10%. (Assumption: No tax) Formulate Capital Budgeting using the following techniques: a) Payback period b) Discounted payback period c) Net Present Value d) Return on Investment e) Profitability Index

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

a Payback period The payback period is the amount of time it takes for the initial investment to be recovered through the cash inflows generated by th... View full answer

Get step-by-step solutions from verified subject matter experts