Question: ABC, Inc. stock will pay a dividend this year should the stock be selling? will pay a dividend this year of $7.20 per share. Its

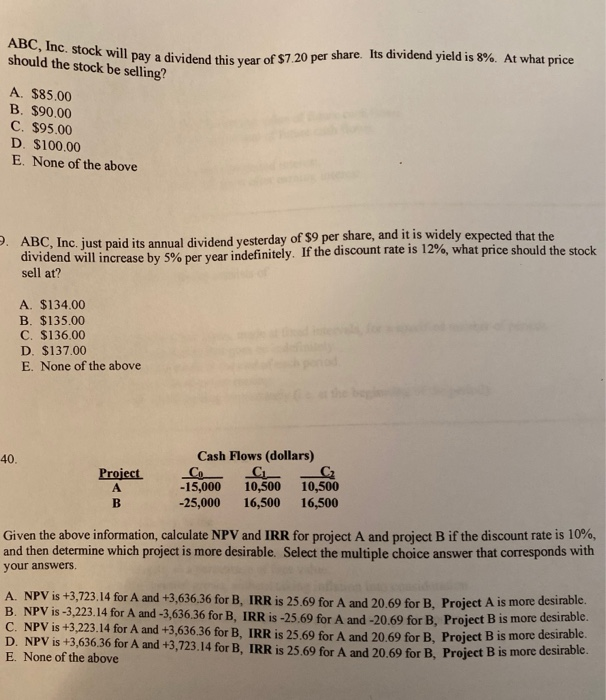

ABC, Inc. stock will pay a dividend this year should the stock be selling? will pay a dividend this year of $7.20 per share. Its dividend yield is 8%. At what price A. $85.00 B. $90.00 C. $95.00 D. $100.00 E. None of the above 3. ABC, Inc. just paid its annual dividend vesterday of $9 per share, and it is widely expected that the dividend will increase by 5% per vear indefinitely. If the discount rate is 12%, what price should the stock sell at? A. $134.00 B. $135.00 C. $136.00 D. $137.00 E. None of the above 10 Project Cash Flows (dollars) COC C -15,000 10,500 10,500 -25,000 16,500 16,500 Given the above information, calculate NPV and IRR for project A and project B if the discount rate is 10%, and then determine which project is more desirable. Select the multiple choice answer that corresponds with your answers. A NPV is +3.723.14 for A and +3,636 36 for B. IRR is 25 69 for A and 20 60 for B. Proiect A is more des B. NPV IS-3.223.14 for A and -3,636.36 for B. IRR is -25.69 for A and -20.69 for B. Project B is more desirable, C. NPV is +3,223.14 for A and +3.636.36 for B. IRR is 25.69 for A and 20.69 for B. Project B is more desire D. NPV is +3,636.36 for A and +3,723.14 for B. IRR is 25.69 for A and 20.69 for B. Project B is more des E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts