Question: ABC is growing quickly. Dividends are expected to grow at a rate of 28.7 percent for the next three years, with the growth rate falling

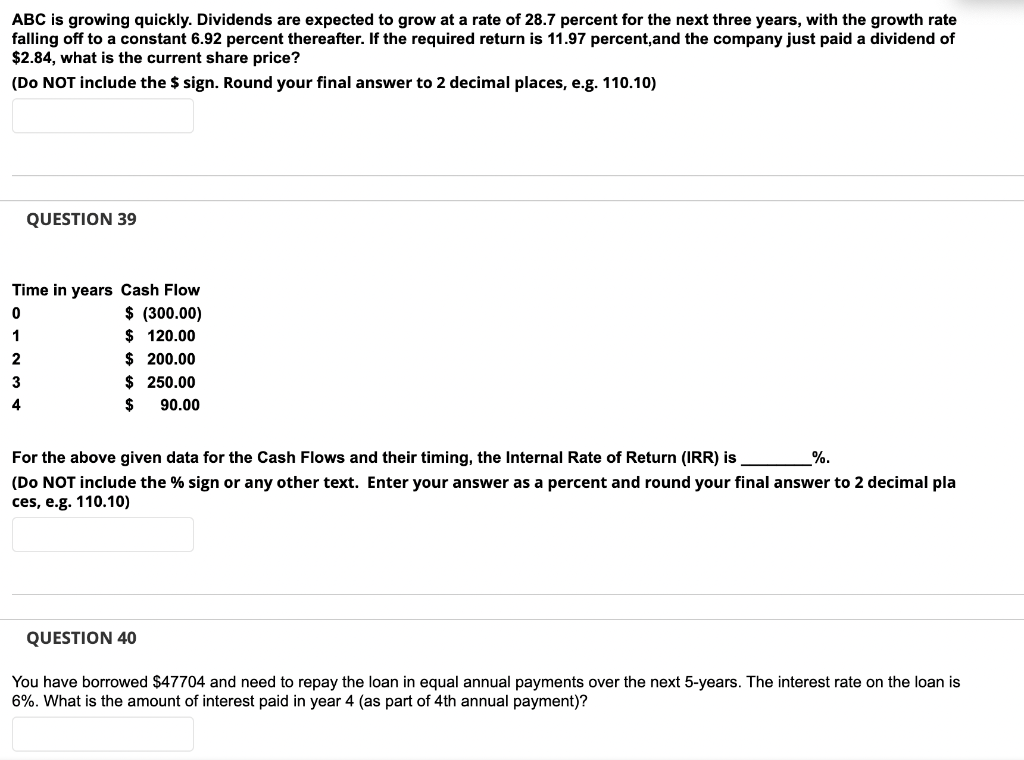

ABC is growing quickly. Dividends are expected to grow at a rate of 28.7 percent for the next three years, with the growth rate falling off to a constant 6.92 percent thereafter. If the required return is 11.97 percent,and the company just paid a dividend of \$2.84, what is the current share price? (Do NOT include the $ sign. Round your final answer to 2 decimal places, e.g. 110.10) QUESTION 39 For the above given data for the Cash Flows and their timing, the Internal Rate of Return (IRR) is %. (Do NOT include the \% sign or any other text. Enter your answer as a percent and round your final answer to 2 decimal pla ces, e.g. 110.10) QUESTION 40 You have borrowed $47704 and need to repay the loan in equal annual payments over the next 5 -years. The interest rate on the loan is 6%. What is the amount of interest paid in year 4 (as part of 4 th annual payment)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts