Question: ABC is looking to purchase a new machine for a 4 year project, that will cost $ 8 0 0 , 0 0 0 and

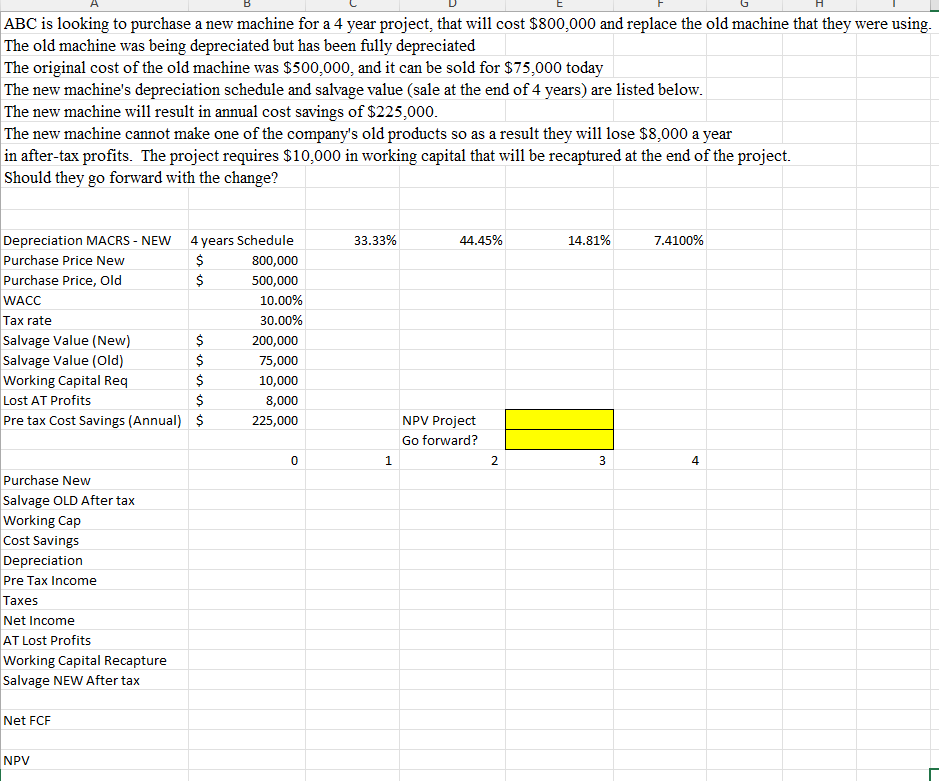

ABC is looking to purchase a new machine for a year project, that will cost $ and replace the old machine that they were using.

The old machine was being depreciated but has been fully depreciated

The original cost of the old machine was $ and it can be sold for $ today

The new machine's depreciation schedule and salvage value sale at the end of years are listed below.

The new machine will result in annual cost savings of $

The new machine cannot make one of the company's old products so as a result they will lose $ a year

in aftertax profits. The project requires $ in working capital that will be recaptured at the end of the project.

Should they go forward with the change?

Depreciation MACRS NEW years Schedule

Purchase Price New $

Purchase Price, Old $

WACC

Tax rate

Salvage Value New $

Salvage Value Old $

Working Capital Req $

Lost AT Profits $

Pre tax Cost Savings Annual $ NPV Project

Go forward?

Purchase New

Salvage OLD After tax

Working Cap

Cost Savings

Depreciation

Pre Tax Income

Taxes

Net Income

AT Lost Profits

Working Capital Recapture

Salvage NEW After tax

Net FCF

NPVABC is looking to purchase a new machine for a year project, that will cost $ and replace the old machine that they were using.

The old machine was being depreciated but has been fully depreciated

The original cost of the old machine was $ and it can be sold for $ today

The new machine's depreciation schedule and salvage value sale at the end of years are listed below.

The new machine will result in annual cost savings of $

The new machine cannot make one of the company's old products so as a result they will lose $ a year

in aftertax profits. The project requires $ in working capital that will be recaptured at the end of the project.

Should they go forward with the change?

Depreciation MACRS NEW

Purchase Price New

Purchase Price, Old

WACC

Tax rate

Salvage Value New

Salvage Value Old

Working Capital Req

Lost AT Profits

Pre tax Cost Savings Annual

Purchase New

Salvage OLD After tax

Working Cap

Cost Savings

Depreciation

Pre Tax Income

Taxes

Net Income

AT Lost Profits

Working Capital Recapture

Salvage NEW After tax

Net FCF

NPV

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock