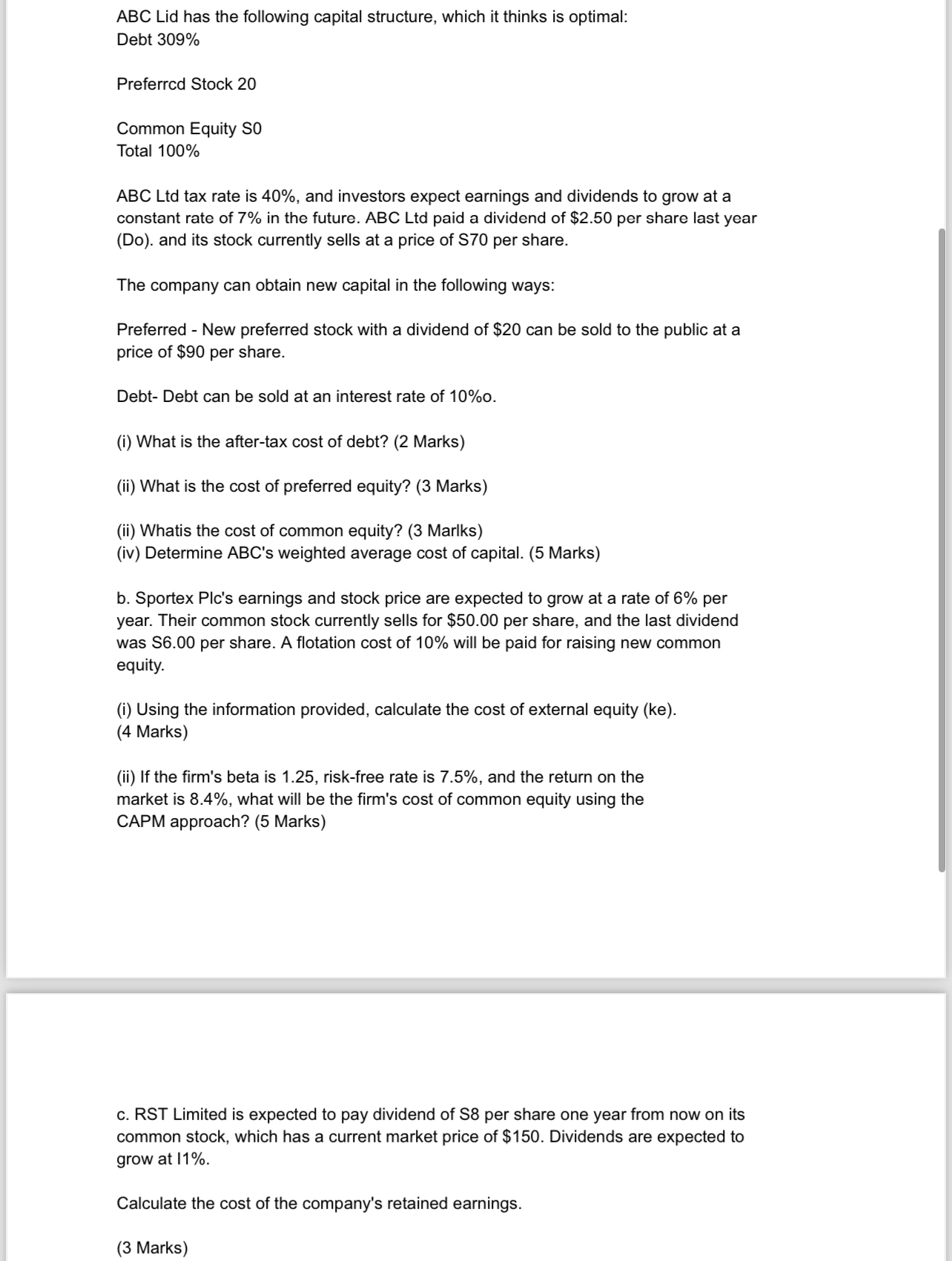

Question: ABC Lid has the following capital structure, which it thinks is optimal: Debt 3 0 % Preferrcd Stock 2 0 Common Equity 5 0 Total

ABC Lid has the following capital structure, which it thinks is optimal:

Debt

Preferrcd Stock

Common Equity

Total

ABC Ltd tax rate is and investors expect earnings and dividends to grow at a constant rate of in the future. ABC Ltd paid a dividend of $ per share last year Do and its stock currently sells at a price of S per share.

The company can obtain new capital in the following ways:

Preferred New preferred stock with a dividend of $ can be sold to the public at a price of $ per share.

Debt Debt can be sold at an interest rate of

i What is the aftertax cost of debt? Marks

ii What is the cost of preferred equity? Marks

ii Whatis the cost of common equity?

iv Determine ABC's weighted average cost of capital.

b Sportex Plcs earnings and stock price are expected to grow at a rate of per year. Their common stock currently sells for $ per share, and the last dividend was $ per share. A flotation cost of will be paid for raising new common equity.

i Using the information provided, calculate the cost of external equity ke

Marks

ii If the firm's beta is riskfree rate is and the return on the market is what will be the firm's cost of common equity using the CAPM approach? Marks

c RST Limited is expected to pay dividend of $ per share one year from now on its common stock, which has a current market price of $ Dividends are expected to grow at

Calculate the cost of the company's retained earnings.

Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock