Question: ABC Ltd, a firm with a fully integrated dividend imputation system, is contemplating taking on two projects. The first project would cost $2 million and

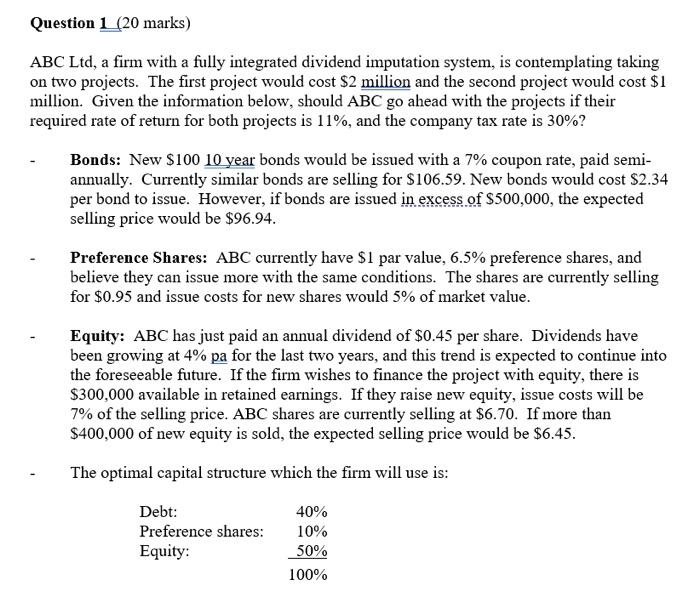

ABC Ltd, a firm with a fully integrated dividend imputation system, is contemplating taking on two projects. The first project would cost $2 million and the second project would cost $1 million. Given the information below, should ABC go ahead with the projects if their required rate of return for both projects is 11%, and the company tax rate is 30% ? - Bonds: New $10010 year bonds would be issued with a 7% coupon rate, paid semiannually. Currently similar bonds are selling for $106.59. New bonds would cost $2.34 per bond to issue. However, if bonds are issued in excess of $500,000, the expected selling price would be $96.94. - Preference Shares: ABC currently have $1 par value, 6.5% preference shares, and believe they can issue more with the same conditions. The shares are currently selling for $0.95 and issue costs for new shares would 5% of market value. - Equity: ABC has just paid an annual dividend of $0.45 per share. Dividends have been growing at 4% pa for the last two years, and this trend is expected to continue into the foreseeable future. If the firm wishes to finance the project with equity, there is $300,000 available in retained earnings. If they raise new equity, issue costs will be 7% of the selling price. ABC shares are currently selling at $6.70. If more than $400,000 of new equity is sold, the expected selling price would be $6.45. - The optimal capital structure which the firm will use is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts