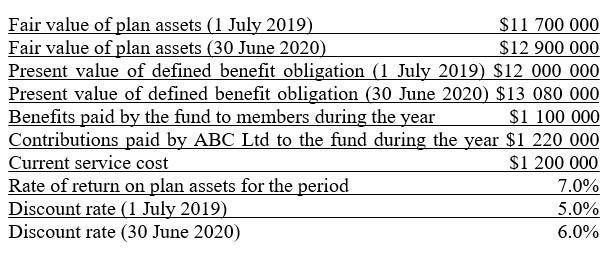

Question: ABC Ltd contributes to a defined benefit superannuation plan for its employees. The following information is available for the plan at 30 June 2020. REQUIRED:

ABC Ltd contributes to a defined benefit superannuation plan for its employees. The following information is available for the plan at 30 June 2020.

REQUIRED:

a). Calculate the actuarial gain or loss of the plan assets for the period ended 30 June 2020. Please specify whether it is a gain or loss.

b). Calculate the actuarial gain or loss of defined benefit obligation for the period ended 30 June 2020. Please specify whether it is a gain or loss.

c). Calculate the defined benefit cost or income recognized in other comprehensive income for the period ended 30 June 2020. Please specify whether it is a cost or income?

Fair value of plan assets (1 July 2019) Fair value of plan assets (30 June 2020) Present value of defined benefit obligation (1 July 2019) $12 000 000 Present value of defined benefit obligation (30 June 2020) $13 080 000 Benefits paid by the fund to members during the year Contributions paid by ABC Ltd to the fund during the year $1 220 000 Current service cost Rate of return on plan assets for the period Discount rate (1 July 2019) Discount rate (30 June 2020) $11 700 000 $12 900 000 $1 100 000 $1 200 000 7.0% 5.0% 6.0%

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Angwer Summasized the data provided in the question ABC Hd contsi bates a defined bene... View full answer

Get step-by-step solutions from verified subject matter experts