Question: ABC, Ltd had the following production data for August: Beginning Inventory, Materials: $22,000 Beginning Inventory, WIP: $17,000 Beginning Inventory, Finished Goods: $54,000 (Job 1) Purchases,

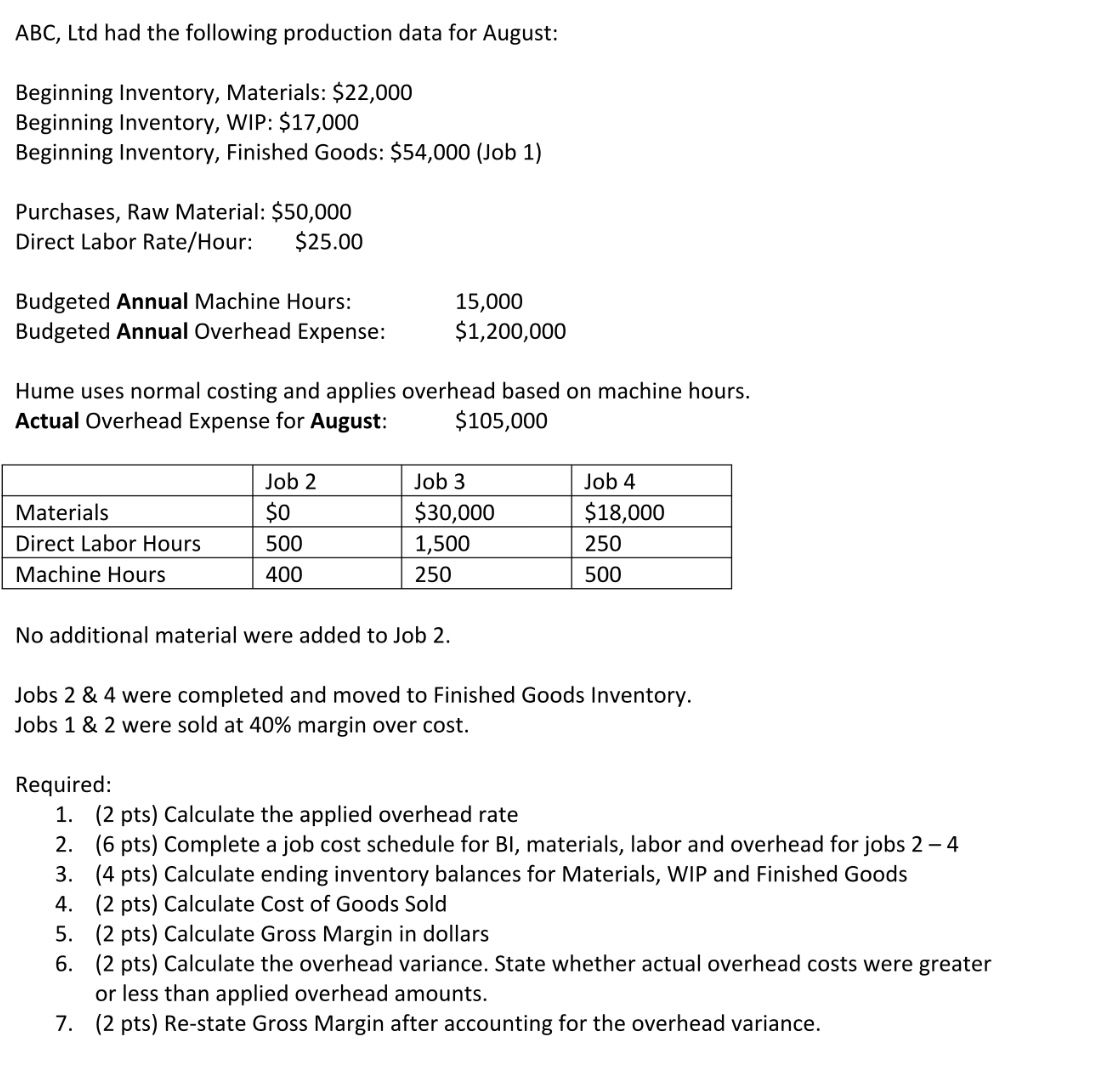

ABC, Ltd had the following production data for August: Beginning Inventory, Materials: $22,000 Beginning Inventory, WIP: $17,000 Beginning Inventory, Finished Goods: $54,000 (Job 1) Purchases, Raw Material: $50,000 Direct Labor Rate/Hour: $25.00 Budgeted Annual Machine Hours: Budgeted Annual Overhead Expense: 15,000 $1,200,000 Hume uses normal costing and applies overhead based on machine hours. Actual Overhead Expense for August: $105,000 Materials Direct Labor Hours Machine Hours Job 2 $0 500 400 Job 3 $30,000 1,500 250 Job 4 $18,000 250 500 No additional material were added to Job 2. Jobs 2 & 4 were completed and moved to Finished Goods Inventory. Jobs 1 & 2 were sold at 40% margin over cost. Required: 1. (2 pts) Calculate the applied overhead rate 2. (6 pts) Complete a job cost schedule for BI, materials, labor and overhead for jobs 2 - 4 3. (4 pts) Calculate ending inventory balances for Materials, WIP and Finished Goods 4. (2 pts) Calculate Cost of Goods Sold 5. (2 pts) Calculate Gross Margin in dollars 6. (2 pts) Calculate the overhead variance. State whether actual overhead costs were greater or less than applied overhead amounts. 7. (2 pts) Re-state Gross Margin after accounting for the overhead variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts