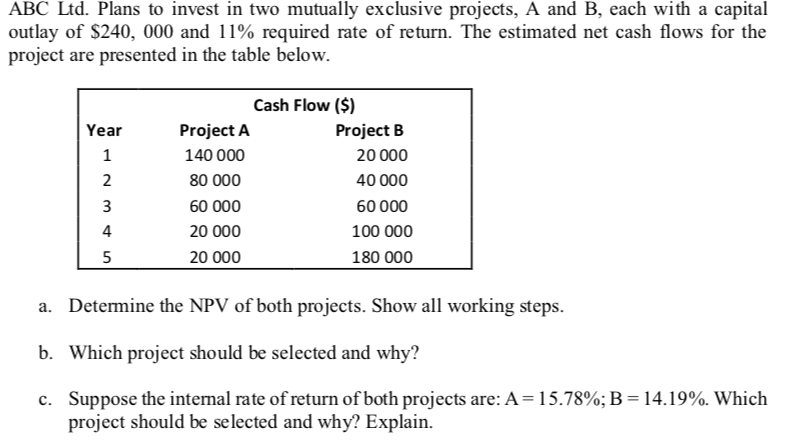

Question: ABC Ltd. Plans to invest in two mutually exclusive projects, A and B, each with a capital outlay of $240, 000 and 11% required rate

ABC Ltd. Plans to invest in two mutually exclusive projects, A and B, each with a capital outlay of $240, 000 and 11% required rate of return. The estimated net cash flows for the project are presented in the table below. Cash Flow (S) Year Project A Project B 140 000 20000 40 000 80 000 60 000 60000 4 20 000 100 000 5 20 000 180 000 Determine the NPV of both projects. Show all working steps a. b. Which project should be selected and why? Suppose the intemal rate of return of both projects are: A-1 5.78%; B project should be selected and why? Explain. 14. 19%. Which c

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock