Question: ABC plc, which currently has no assets, is considering two projects that each cost 1 million. Project A is expected to pay off 1.6 million

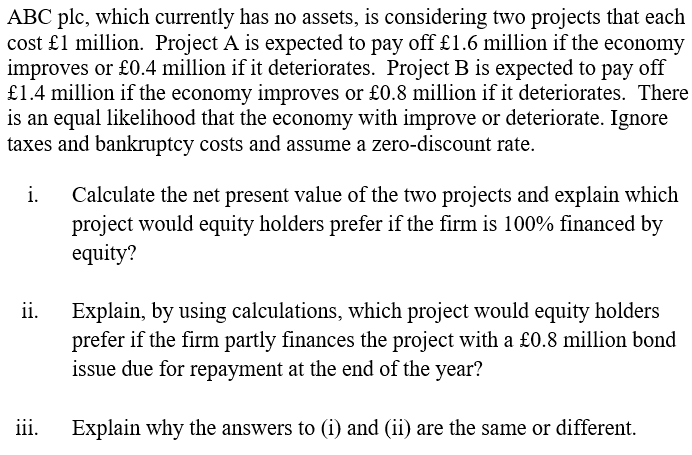

ABC plc, which currently has no assets, is considering two projects that each cost 1 million. Project A is expected to pay off 1.6 million if the economy improves or 0.4 million if it deteriorates. Project B is expected to pay off 1.4 million if the economy improves or 0.8 million if it deteriorates. There is an equal likelihood that the economy with improve or deteriorate. Ignore taxes and bankruptcy costs and assume a zero-discount rate. i. Calculate the net present value of the two projects and explain which project would equity holders prefer if the firm is 100% financed by equity? ii. Explain, by using calculations, which project would equity holders prefer if the firm partly finances the project with a 0.8 million bond issue due for repayment at the end of the year? iii. Explain why the answers to (i) and (ii) are the same or different

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts