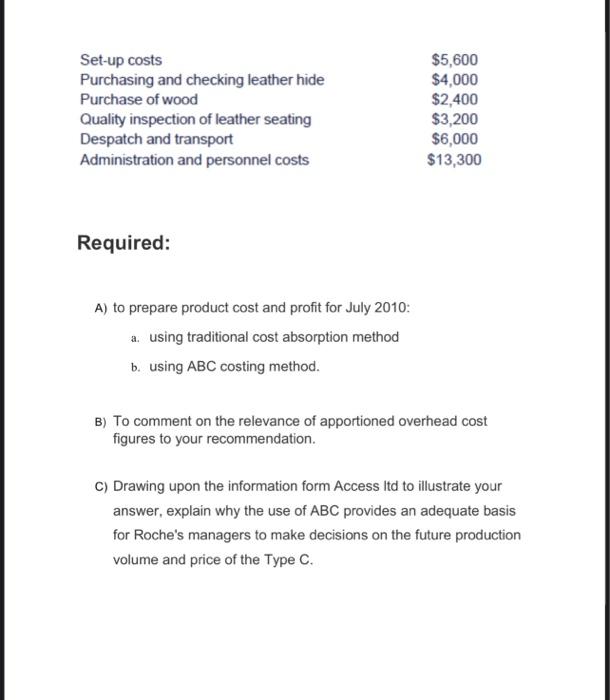

Question: ABC question (I NEED 100% CORRECT ANSWERS!) Set-up costs Purchasing and checking leather hide Purchase of wood Quality inspection of leather seating Despatch and transport

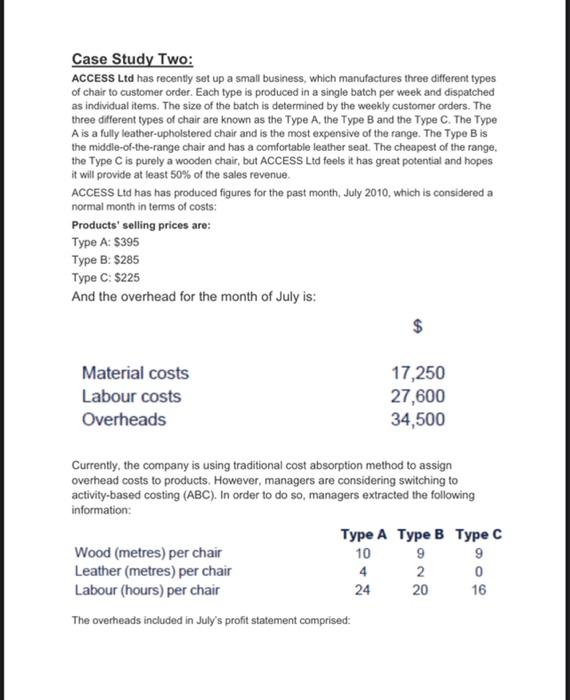

Set-up costs Purchasing and checking leather hide Purchase of wood Quality inspection of leather seating Despatch and transport Administration and personnel costs $5,600 $4,000 $2,400 $3,200 $6,000 $13,300 Required: A) to prepare product cost and profit for July 2010: a. using traditional cost absorption method b. using ABC costing method. B) To comment on the relevance of apportioned overhead cost figures to your recommendation. C) Drawing upon the information form Access Itd to illustrate your answer, explain why the use of ABC provides an adequate basis for Roche's managers to make decisions on the future production volume and price of the Type C. Case Study Two: ACCESS Ltd has recently set up a small business, which manufactures three different types of chair to customer order. Each type is produced in a single batch per week and dispatched as individual items. The size of the batch is determined by the weekly customer orders. The three different types of chair are known as the Type A, the Type B and the Type C. The Type A is a fully leather-upholstered chair and is the most expensive of the range. The Type B is the middle-of-the-range chair and has a comfortable leather seat. The cheapest of the range. the Type C is purely a wooden chair, but ACCESS Ltd feels it has great potential and hopes it will provide at least 50% of the sales revenue. ACCESS Ltd has has produced figures for the past month, July 2010, which is considered a normal month in terms of costs: Products' selling prices are: Type A: $395 Type B: $285 Type C: $225 And the overhead for the month of July is: $ Material costs Labour costs Overheads 17,250 27,600 34,500 Currently, the company is using traditional cost absorption method to assign overhead costs to products. However, managers are considering switching to activity-based costing (ABC). In order to do so, managers extracted the following information: Type A Type B Type C Wood (metres) per chair 10 9 9 Leather (metres) per chair 4 2 0 Labour (hours) per chair 24 20 16 The overheads included in July's profit statement comprised: Set-up costs Purchasing and checking leather hide Purchase of wood Quality inspection of leather seating Despatch and transport Administration and personnel costs $5,600 $4,000 $2,400 $3,200 $6,000 $13,300 Required: A) to prepare product cost and profit for July 2010: a. using traditional cost absorption method b. using ABC costing method. B) To comment on the relevance of apportioned overhead cost figures to your recommendation. C) Drawing upon the information form Access Itd to illustrate your answer, explain why the use of ABC provides an adequate basis for Roche's managers to make decisions on the future production volume and price of the Type C. Case Study Two: ACCESS Ltd has recently set up a small business, which manufactures three different types of chair to customer order. Each type is produced in a single batch per week and dispatched as individual items. The size of the batch is determined by the weekly customer orders. The three different types of chair are known as the Type A, the Type B and the Type C. The Type A is a fully leather-upholstered chair and is the most expensive of the range. The Type B is the middle-of-the-range chair and has a comfortable leather seat. The cheapest of the range. the Type C is purely a wooden chair, but ACCESS Ltd feels it has great potential and hopes it will provide at least 50% of the sales revenue. ACCESS Ltd has has produced figures for the past month, July 2010, which is considered a normal month in terms of costs: Products' selling prices are: Type A: $395 Type B: $285 Type C: $225 And the overhead for the month of July is: $ Material costs Labour costs Overheads 17,250 27,600 34,500 Currently, the company is using traditional cost absorption method to assign overhead costs to products. However, managers are considering switching to activity-based costing (ABC). In order to do so, managers extracted the following information: Type A Type B Type C Wood (metres) per chair 10 9 9 Leather (metres) per chair 4 2 0 Labour (hours) per chair 24 20 16 The overheads included in July's profit statement comprised

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts