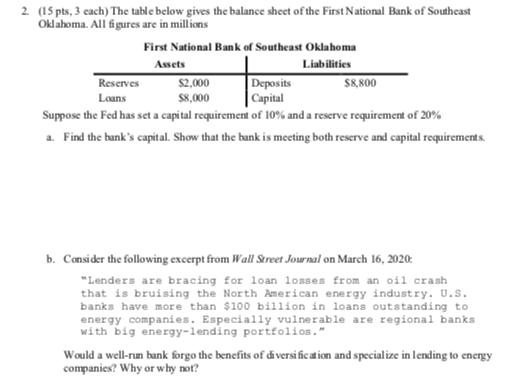

Question: 2. (15 pts, 3 cach) The table below gives the balance sheet of the First National Bank of Southeast Oklahoma. All figures are in

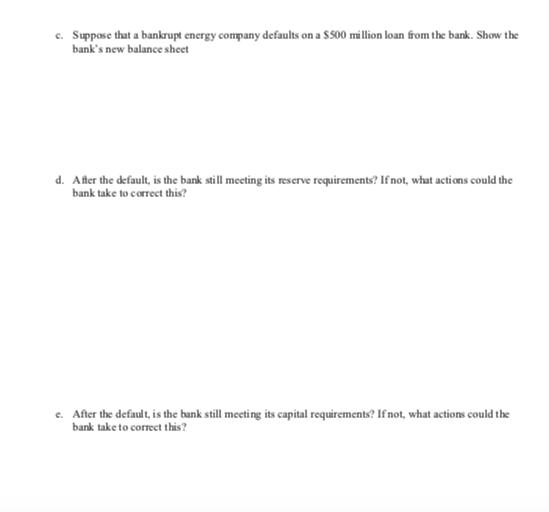

2. (15 pts, 3 cach) The table below gives the balance sheet of the First National Bank of Southeast Oklahoma. All figures are in millions First National Bank of Southeast Oklahoma Liabilities Assets Reserves $2,00 Deposits S8,800 Loans $8,000 Capital Suppose the Fed has set a capital requirement of 10% and a reserve requirement of 20% a. Find the bank's capital. Show that the bank is meeting both reserve and capital requirements. b. Consider the following excerpt from Wall Street Journal on March 16, 2020: "Lenders are bracing for loan losses from an oil crash that is bruising the North American energy industry. U.S. banka have more than $100 billion in loans outstanding to energy companies. Especially vulnerable are regional banks with big energy-lending portfolios." Would a well-run bank forgo the benefits of diversi fic ation and specialize in lending to energy companies? Why or why not? c. Suppose that a bankrupt energy company defaults on a $500 million loan from the bank. Show the bank's new balance sheet d. After the default, is the bank still meeting its reserve requirements? If not, what actions could the bank take to correct this? e. After the default, is the bank still meeting its capital requirements? If not, what actions could the bank take to correct this?

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Question Answer a Answer Reserve requirement 20 Capital requirement 10 Reserve requirement 8800 20 7... View full answer

Get step-by-step solutions from verified subject matter experts