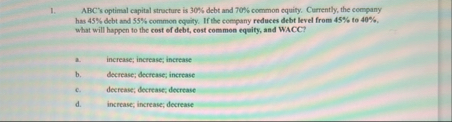

Question: ABC's optimal capital strocture is 3 0 % debt and 7 0 % common equity. Currently, the company has 4 5 % debt and 5

ABC's optimal capital strocture is debt and common equity. Currently, the company has debt and common eqpity. If the company reduces debt level from to what will happen to the cost of debt, cost common equity, and WACC?

a increase; increase; increase

b decrease; decresse; incresse

c decrease; decrease; decrease

d increase; increase; decrease

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock