Question: Abe Factor opened a new accounting practice called X-Factor Accounting and completed these activities d March 1 Invested $55,000 in cash and office equipment that

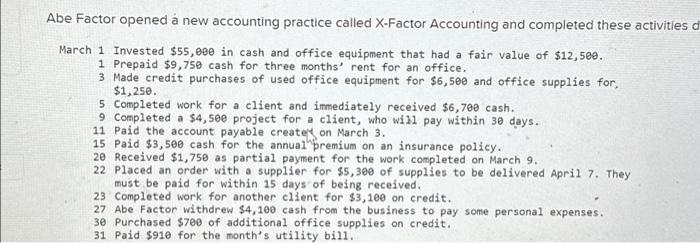

Abe Factor opened new accounting practice called X-Factor Accounting and completed these activities March 1 Invested $55,000 in cash and office equipment that had a fair value of $12,500. 1 Prepaid $9,750 cash for three month' rent for an office. 3 Made credit purchases of used office equipment for $6,500 and office supplies for. $1,250. 5 Completed work for a client and immediately received $6,700 cash. 9 Completed a $4,500 project for a client, who will pay within 30 days. 11 Paid the account payable createf on March 3. 15 Paid $3,500 cash for the annual premium on an insurance policy. 20 Received $1,750 as partial payment for the work completed on March 9. 22 Placed an order with a supplier for $5,300 of supplies to be delivered April 7. They must be paid for within 15 days of being received. 23 Completed work for another client for $3,100 on credit. 27 Abe Factor withdrew $4,100 cash from the business to pay some personal expenses. 30 Purchased $700 of additional office supplies on credit. 31 Paid $910 for the month's utility bill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts