Question: Abe Factor opened a new accounting practice called X-Factor Accounting and completed these activities during March 2020: ded a March 1 Invested $59,000 in cash

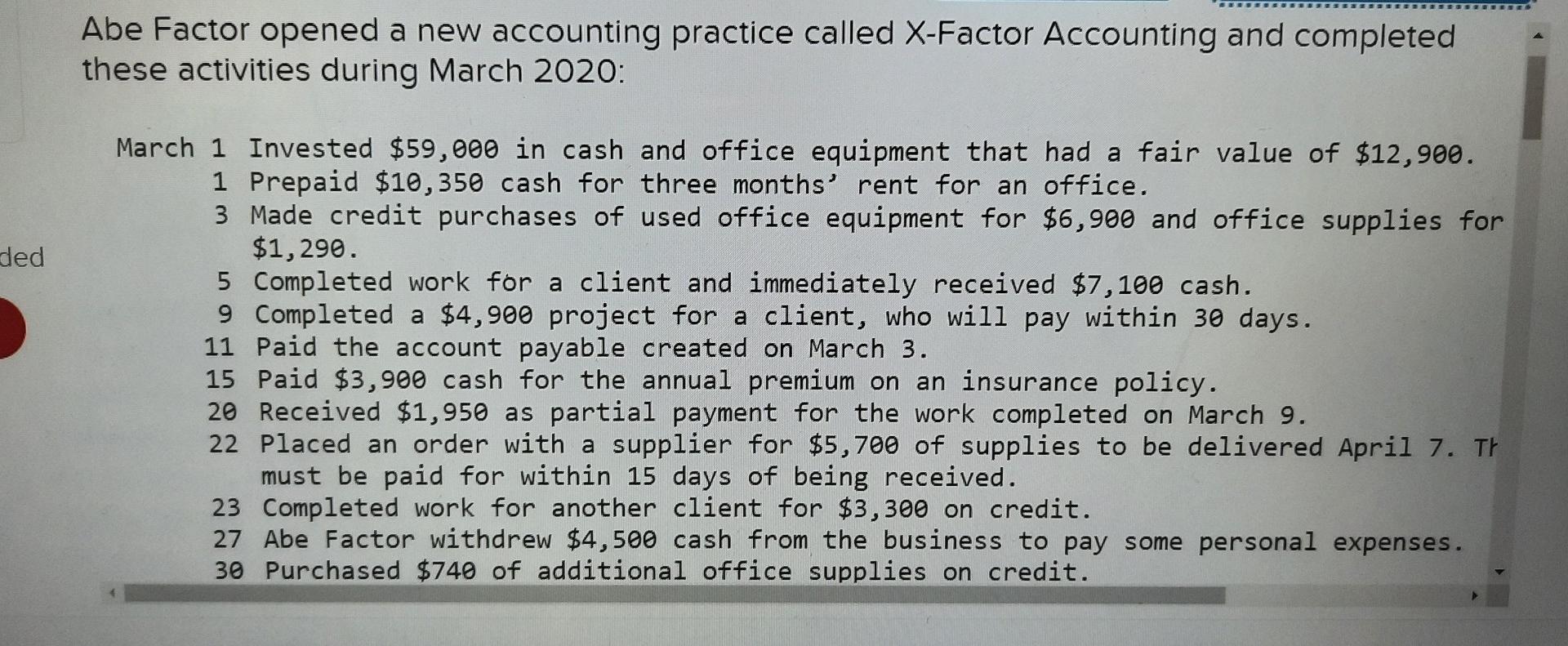

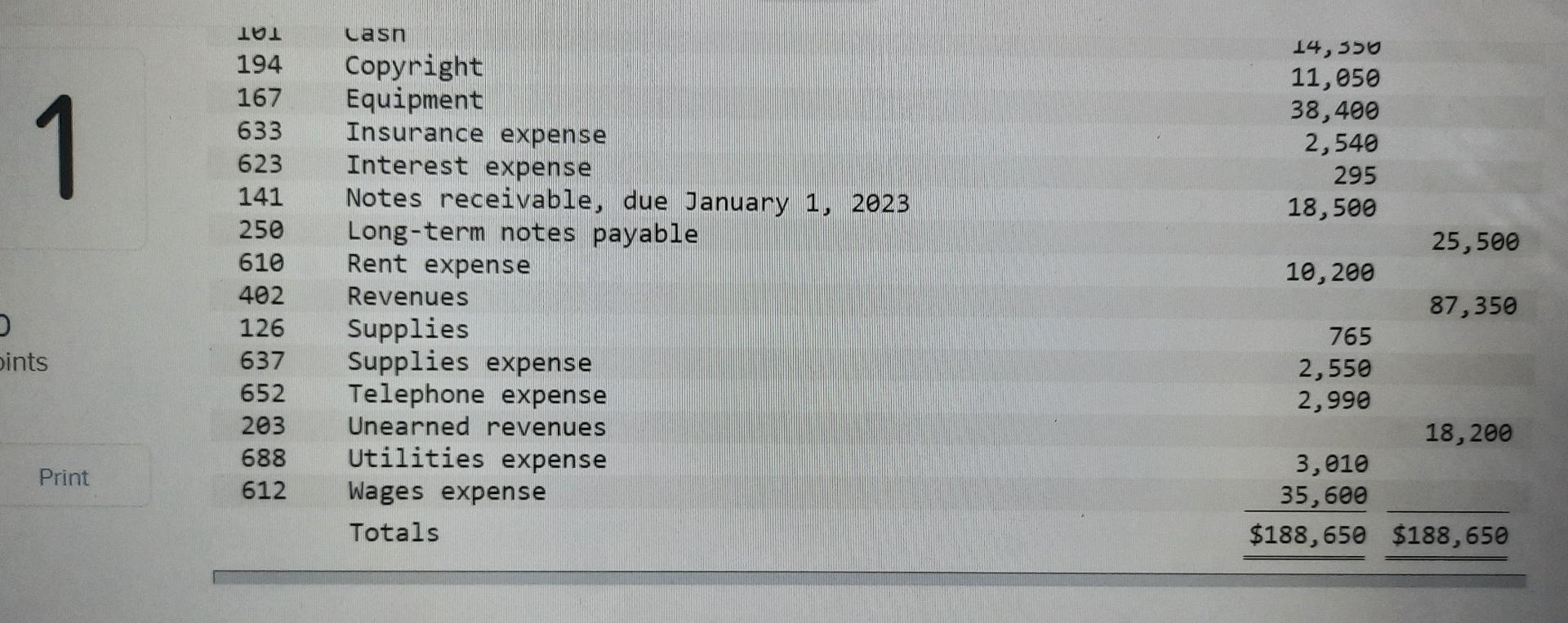

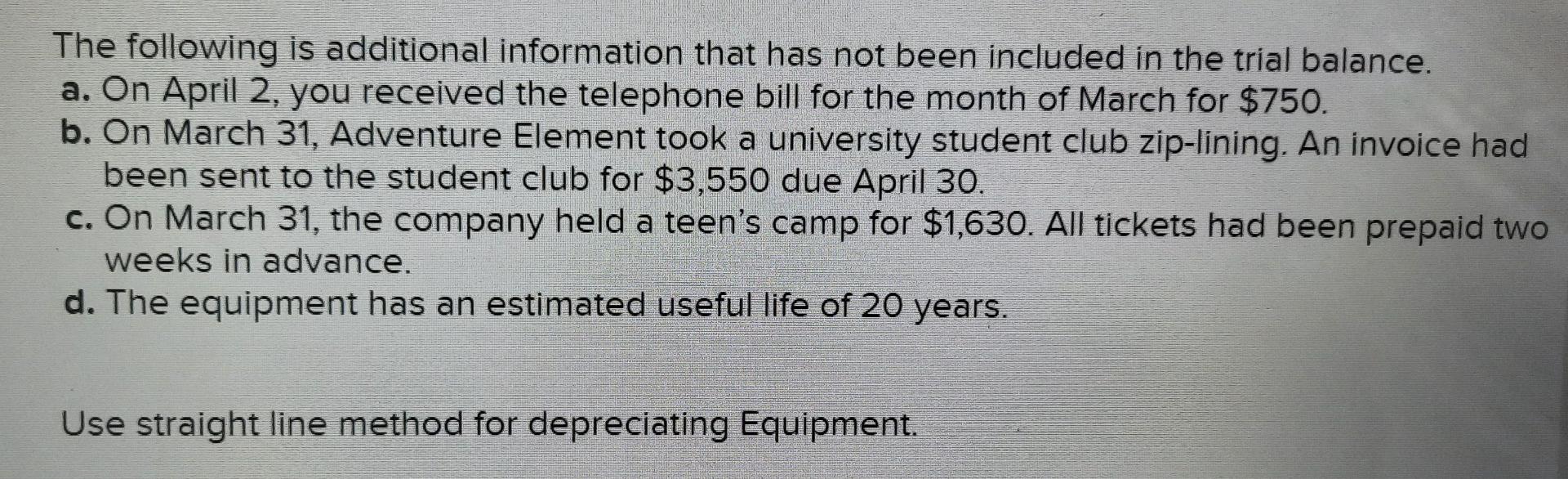

Abe Factor opened a new accounting practice called X-Factor Accounting and completed these activities during March 2020: ded a March 1 Invested $59,000 in cash and office equipment that had a fair value of $12,900. 1 Prepaid $10,350 cash for three months rent for an office. 3 Made credit purchases of used office equipment for $6,900 and office supplies for $1,290. 5 Completed work for a client and immediately received $7,100 cash. 9 Completed a $4,900 project for a client, who will pay within 30 days. 11 Paid the account payable created on March 3. 15 Paid $3,900 cash for the annual premium on an insurance policy. 20 Received $1,950 as partial payment for the work completed on March 9. 22 Placed an order with a supplier for $5,700 of supplies to be delivered April 7. TH must be paid for within 15 days of being received. 23 Completed work for another client for $3,300 on credit. 27 Abe Factor withdrew $4,500 cash from the business to pay some personal expenses. 30 Purchased $740 of additional office supplies on credit. Lasn 1 101 194 167 633 623 141 250 610 402 126 637 652 203 688 612 Copyright Equipment Insurance expense Interest expense Notes receivable, due January 1, 2023 Long-term notes payable Rent expense Revenues Supplies Supplies expense Telephone expense Unearned revenues Utilities expense Wages expense Totals 14,350 11,850 38,400 2,540 295 18,500 25,500 10,200 87,350 765 2,550 2,990 18,200 3,010 35,600 $188,650 $188,650 pints Print The following is additional information that has not been included in the trial balance. a. On April 2, you received the telephone bill for the month of March for $750. b. On March 31, Adventure Element took a university student club zip-lining. An invoice had been sent to the student club for $3,550 due April 30. c. On March 31, the company held a teen's camp for $1,630. All tickets had been prepaid two weeks in advance. d. The equipment has an estimated useful life of 20 years. Use straight line method for depreciating Equipment. 1. Prepare the missing adjusting entries for transactions a-d. View transaction list Journal entry worksheet Record the accrual of telephone expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts