Question: Abel and Baker decided to form a partnership. Abel contributed equipment (book value $65,000) inventory (paid $20,000), and $10,000 cash. The equipment and inventory

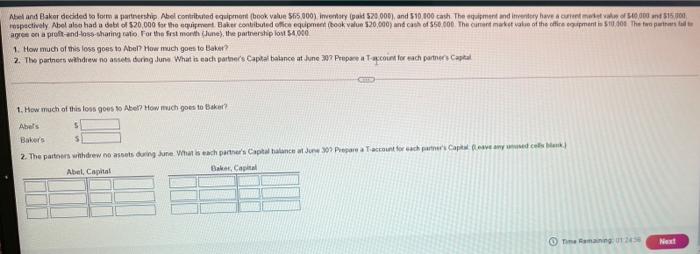

Abel and Baker decided to form a partnership. Abel contributed equipment (book value $65,000) inventory (paid $20,000), and $10,000 cash. The equipment and inventory have a current market value of $40,000 and $15,000 respectively. Abel also had a debt of $20,000 for the equipment. Baker contributed office equipment (book value $20,000) and cash of $50.000. The cument market value of the office equipment is $10.000 The two parts agree on a proft-and-loss-sharing ratio. For the first month (June), the partnership lost $4,000 1. How much of this loss goes to Abel? How much goes to Baker? 2. The partners withdrew no assets during June What is each partner's Capital balance at June 307 Prepare a T-account for each partner's Capital 1. How much of this loss goes to Abel? How much goes to Baker? Abel's Baker's 2. The partners withdrew no assets during June. What is each partner's Capital balance at June 30 Prepare a T-account for each partner's Capital (Leave any unused cells blank) Abel, Capital Baker, Capital Time Remaining: 01:2458 Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts