Question: Able Company has a possible project. It takes an initial investment of $ 2 , 5 0 0 , and will produce ten years of

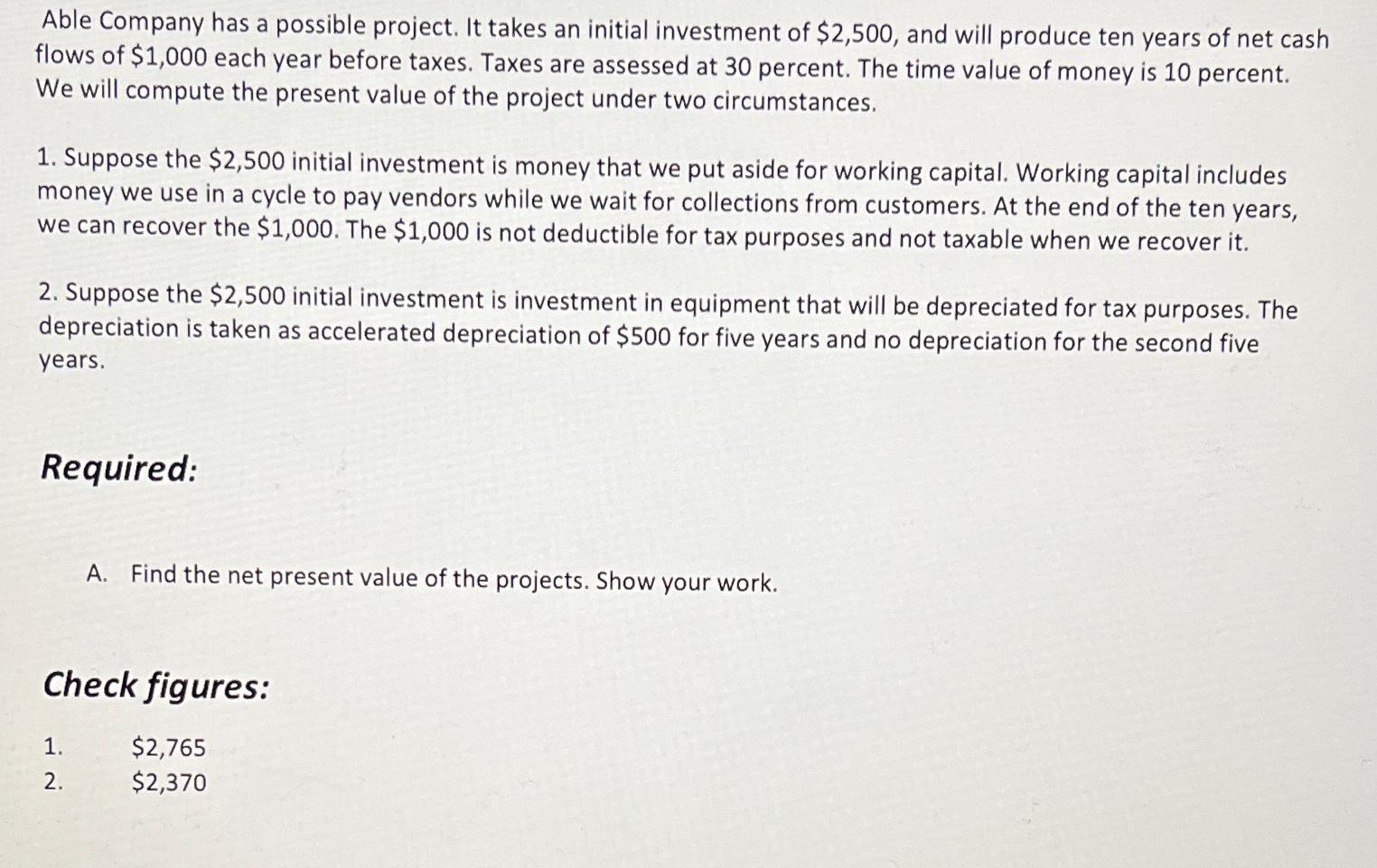

Able Company has a possible project. It takes an initial investment of $ and will produce ten years of net cash flows of $ each year before taxes. Taxes are assessed at percent. The time value of money is percent. We will compute the present value of the project under two circumstances.

Suppose the $ initial investment is money that we put aside for working capital. Working capital includes money we use in a cycle to pay vendors while we wait for collections from customers. At the end of the ten years, we can recover the $ The $ is not deductible for tax purposes and not taxable when we recover it

Suppose the $ initial investment is investment in equipment that will be depreciated for tax purposes. The depreciation is taken as accelerated depreciation of $ for five years and no depreciation for the second five years.

Required:

A Find the net present value of the projects. Show your work.

Check figures:

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock