Question: able Window Help Document3 lings Review View Table Design Layout AaBbCcDdEe AaBbCcDdEe AaBbCcD No Spacing .|.E | tj.IS | | Heading 1Heading 12. A beta

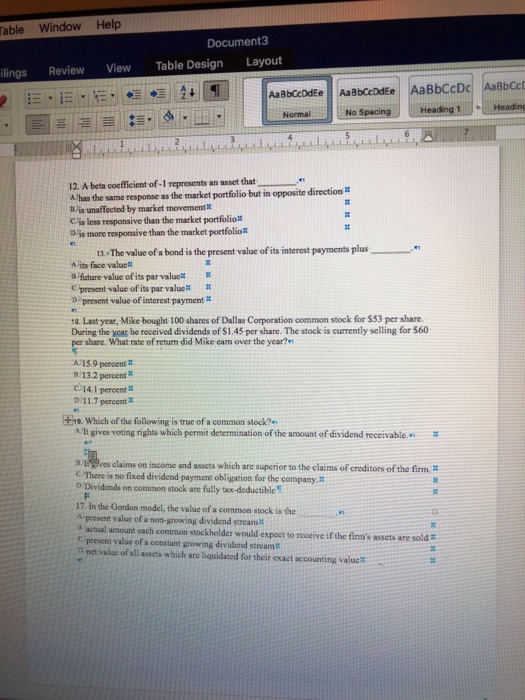

able Window Help Document3 lings Review View Table Design Layout AaBbCcDdEe AaBbCcDdEe AaBbCcD No Spacing .|.E | tj.IS | | Heading 1Heading 12. A beta cocfficient of-1 represents an asset that A has the same response as the market portfolio but in opposite direction n Bis unaffected by market movement C/is less responsive than the market portfolio Dis more responsive than the market portfolio . The value of a bond is the present value of its interest payments plus A/its face value future value ofits par valu C present value of its par value D present value of interest payment t 18. Last year, Mike bought 100 shares of Dallas Corporation common stock for $53 per share. During the ycar he received dividends of $1.45 per share. The stock is currently selling for S60 share. What rate of retum did Mike eam over the year?n 15.9 percent 32 percent # c 14.1 percent D11.7 percent Es. Which of the following is truc of a common stock? A It gives voting rights which permit determination of the amount of dividend receivablen an es claims on income and assets which are superior to the claims of creditors of the firm C There is no fixed dividend payment obligation for the company D Dividends on common stock are fully tax-deductible 17. In the Gordon model, the value of a common stock is the A peesent value of a non-growing dividend stream actual amount each common stockholder would expect to receive if the firm's assets are sold C present value of a constant growing dividend stream P net valuc of all assets which are liquidated for their exact accounting value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts