Question: abled: Ch 7 - 9 Exam ( 7 5 min ) ( i ) Help Sove & Exit Yoonah sells a piece of specialized equipment

abled: Ch Exam min

i

Help

Sove & Exit

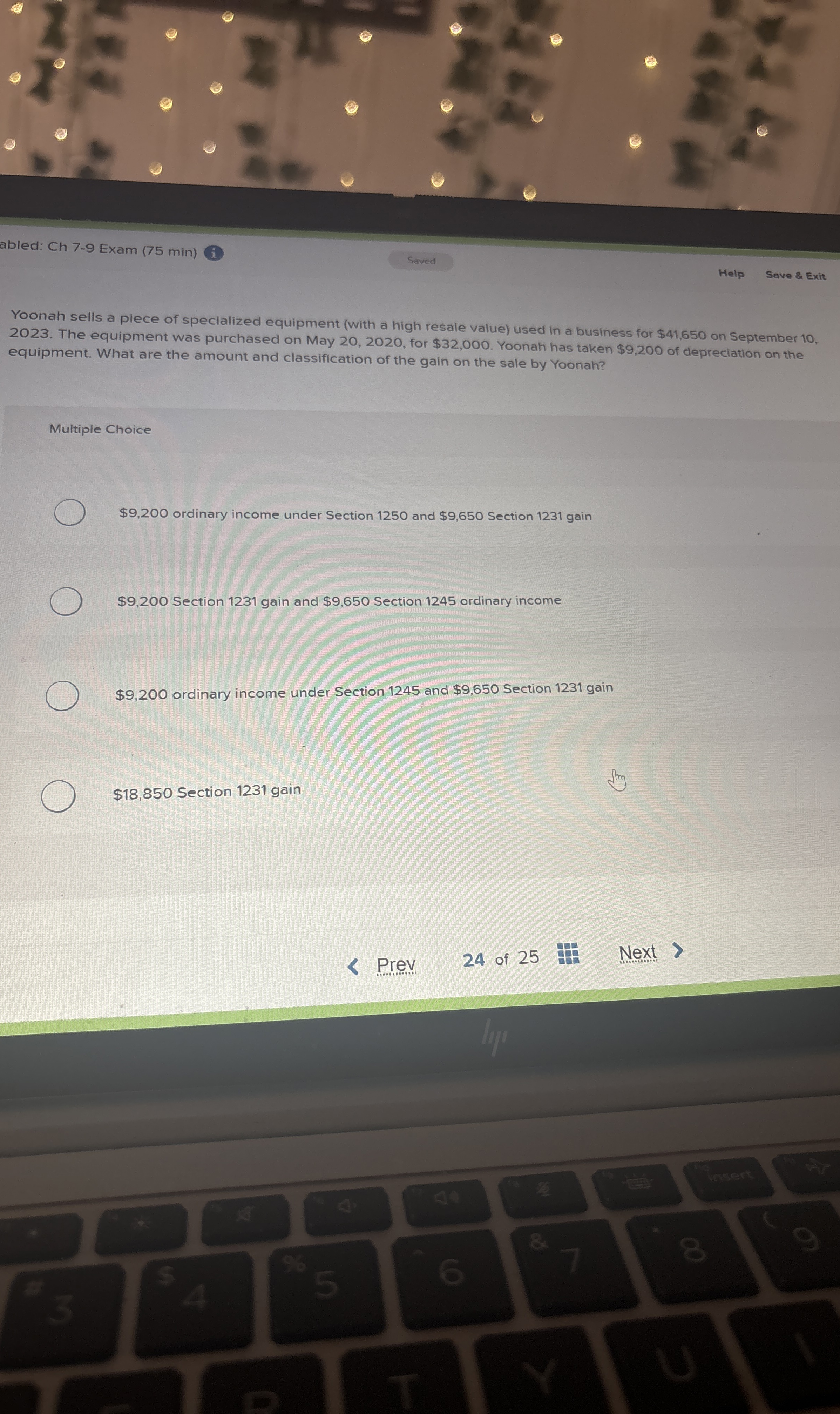

Yoonah sells a piece of specialized equipment with a high resale value used in a business for $ on September The equipment was purchased on May for $ Yoonah has taken $ of depreciation on the equipment. What are the amount and classification of the gain on the sale by Yoonah?

Multiple Choice

$ ordinary income under Section and $ Section gain

$ Section gain and $ Section ordinary income

$ ordinary income under Section and $ Section gain

$ Section gain

Prev

of Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock