Question: abled: Midterm Test 1 i) Sutton Inc, a small service company, keeps its records without the help of an accountant. After much effort, an outside

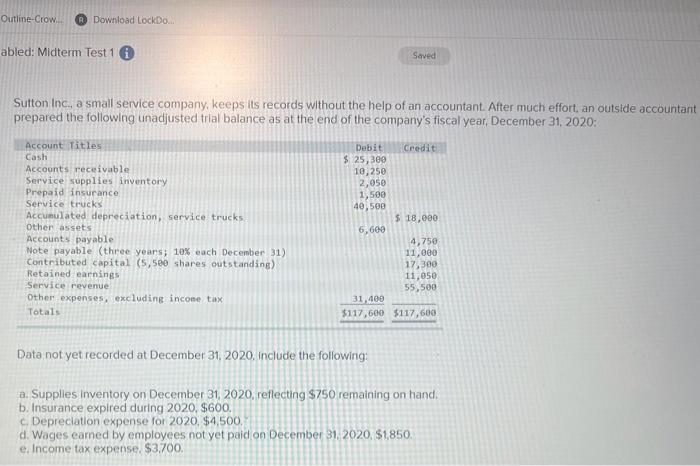

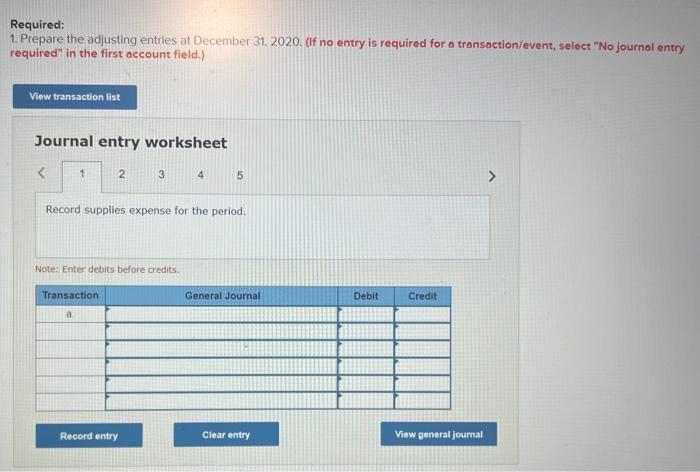

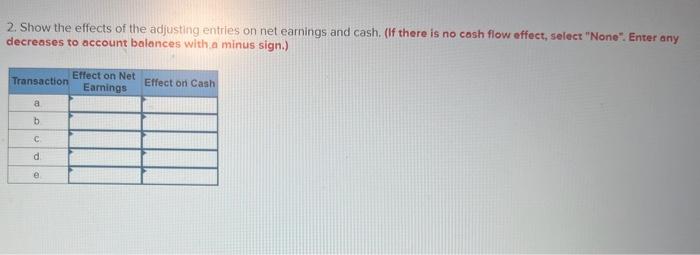

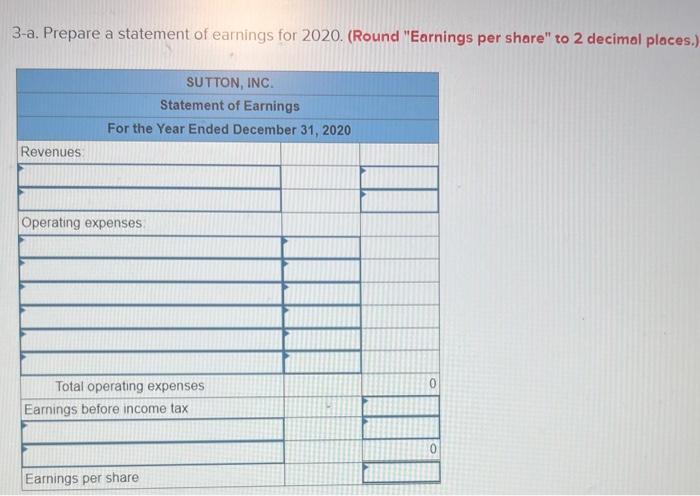

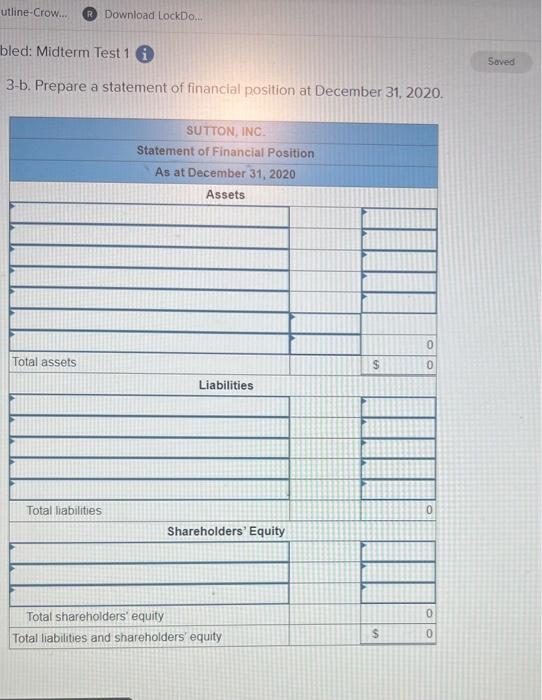

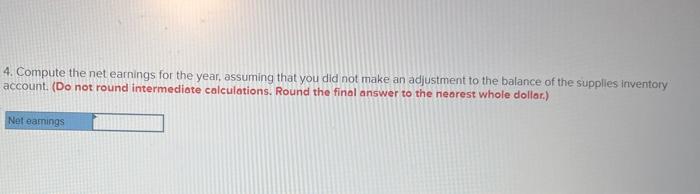

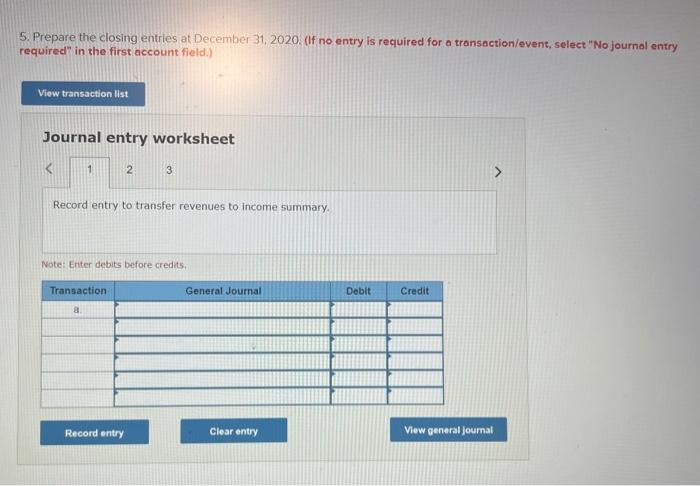

abled: Midterm Test 1 i) Sutton Inc, a small service company, keeps its records without the help of an accountant. After much effort, an outside accountant prepared the following unadjusted trial balance as at the end of the company's fiscal year, December 31, 2020: Data not yet recorded at December 31, 2020. include the following: a. Supplies inventory on December 31, 2020. reflecting $750 remaining on hand. b. Insurance expired during 2020, $600. c. Depreciation expense for 2020, $4,500. d. Wages earned by employees not yet paid on December 31, 2020, $1,850. e. Income tax expense. $3.700. Required: 1. Prepare the adjusting entries at December 31, 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 45 Record supplies expense for the period. Note: Enter debits before credits. 2. Show the effects of the adjusting entries on net earnings and cash. (If there is no cash flow effect, select "None". Enter any decreases to account balances with. a minus sign.) 3-a. Prepare a statement of earnings for 2020. (Round "Earnings per share" to 2 decimal places.) 3-b. Prepare a statement of financial position at December 31, 2020. 4. Compute the net earnings for the year, assuming that you did not make an adjustment to the balance of the supplies inventory account. (Do not round intermediate calculations. Round the final answer to the nearest whole dollar.) 5. Prepare the closing entrles at December 31, 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record entry to transfer revenues to income summary. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts