Question: About a page for each response, prefer in depth responses to also get a better understanding Explain: 10 pts each 1. Aggressive vs. Conservation policies

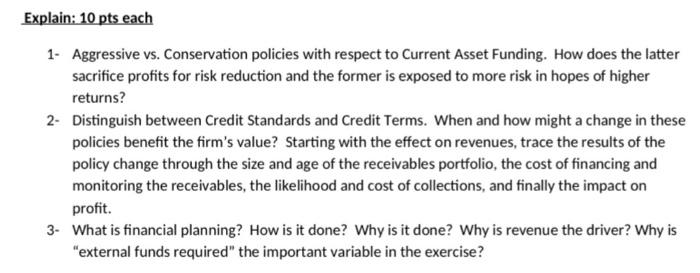

Explain: 10 pts each 1. Aggressive vs. Conservation policies with respect to Current Asset Funding. How does the latter sacrifice profits for risk reduction and the former is exposed to more risk in hopes of higher returns? 2- Distinguish between Credit Standards and Credit Terms. When and how might a change in these policies benefit the firm's value? Starting with the effect on revenues, trace the results of the policy change through the size and age of the receivables portfolio, the cost of financing and monitoring the receivables, the likelihood and cost of collections, and finally the impact on profit. 3- What is financial planning? How is it done? Why is it done? Why is revenue the driver? Why is "external funds required" the important variable in the exercise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts