Question: About Adidas - You should include a qualitative analysis where you detail the reasons supporting your chosen super-normal growth rate. You should also justify your

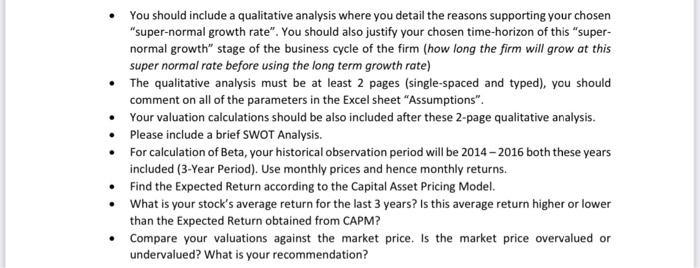

- You should include a qualitative analysis where you detail the reasons supporting your chosen "super-normal growth rate". You should also justify your chosen time-horizon of this "supernormal growth" stage of the business cycle of the firm (how long the firm will grow at this super normal rate before using the long term growth rate) - The qualitative analysis must be at least 2 pages (single-spaced and typed), you should comment on all of the parameters in the Excel sheet "Assumptions". - Your valuation calculations should be also included after these 2-page qualitative analysis. - Please include a brief SWOT Analysis. - For calculation of Beta, your historical observation period will be 20142016 both these years included (3-Year Period). Use monthly prices and hence monthly returns. - Find the Expected Return according to the Capital Asset Pricing Model. - What is your stock's average return for the last 3 years? Is this average return higher or lower than the Expected Return obtained from CAPM? - Compare your valuations against the market price. Is the market price overvalued or undervalued? What is your recommendation? - You should include a qualitative analysis where you detail the reasons supporting your chosen "super-normal growth rate". You should also justify your chosen time-horizon of this "supernormal growth" stage of the business cycle of the firm (how long the firm will grow at this super normal rate before using the long term growth rate) - The qualitative analysis must be at least 2 pages (single-spaced and typed), you should comment on all of the parameters in the Excel sheet "Assumptions". - Your valuation calculations should be also included after these 2-page qualitative analysis. - Please include a brief SWOT Analysis. - For calculation of Beta, your historical observation period will be 20142016 both these years included (3-Year Period). Use monthly prices and hence monthly returns. - Find the Expected Return according to the Capital Asset Pricing Model. - What is your stock's average return for the last 3 years? Is this average return higher or lower than the Expected Return obtained from CAPM? - Compare your valuations against the market price. Is the market price overvalued or undervalued? What is your recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts