Question: ABOVE IMAGE IS THE QUESTION. THIS IS A STEP IN THE THE SOLUTION, I AM UNABLE TO UNDERSTAND(CIRCLED IT). CAN YOU PLEASE EXPLAIN IT 1.

ABOVE IMAGE IS THE QUESTION.

ABOVE IMAGE IS THE QUESTION.

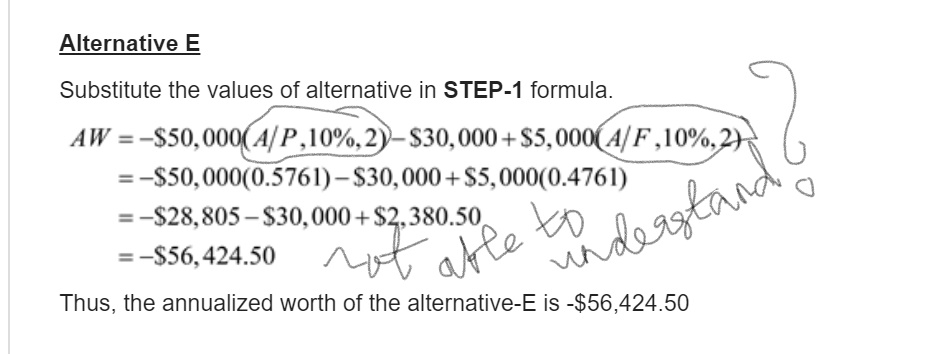

THIS IS A STEP IN THE THE SOLUTION, I AM UNABLE TO UNDERSTAND(CIRCLED IT). CAN YOU PLEASE EXPLAIN IT

1. NORMALLY

2. IN FINANCIAL CALCULATOR.

(I WANT BOTH THE WAYS).

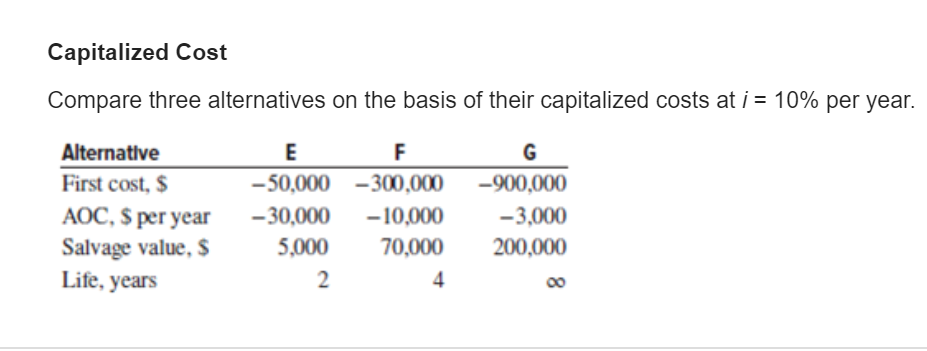

Capitalized Cost Compare three alternatives on the basis of their capitalized costs at i = 10% per year. Alternative First cost, $ AOC, $ per year Salvage value, $ Life, years EF -50,000 -300,000 -30,000 -10,000 5,000 70,000 -900,000 -3,000 200,000 Alternative E Substitute the values of alternative in STEP-1 formula. AW =-$50,000(A/P,10%,2)-$30,000+ $5,000(A/F,10%,27 =-$50,000(0.5761) - $30,000+$5,000(0.4761) Rondo =-$28,805 $30,000+ $2,380.50 to Rootu = -856,424.50 not the thindegge Thus, the annualized worth of the alternative-E is -$56,424.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts