Question: Above is the work from the sample problem that I received. Bond Dave has a 7 percent coupon rate, makes semiannual payments, a 5 percent

Above is the work from the sample problem that I received.

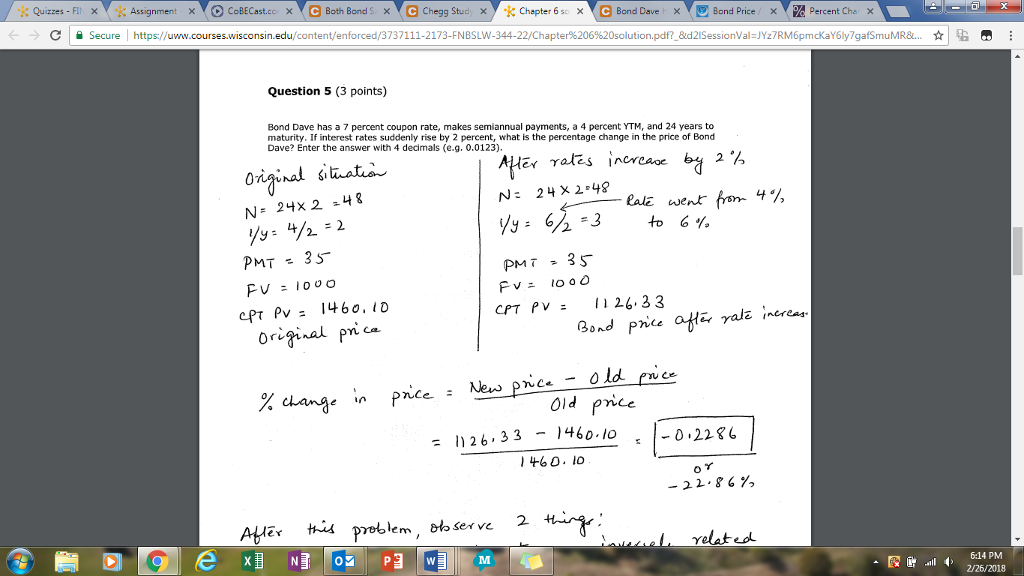

Bond Dave has a 7 percent coupon rate, makes semiannual payments, a 5 percent YTM, and 9 years to maturity. If interest rates suddenly rise by 3 percent, what is the percentage change in the price of Bond Dave? Enter the answer with 4 decimals (e.g. 0.0123).

.er Y. Assignmen -,TO CoBECast.co Ve Both Bond S. e Chegg Stud ,TE BondPrice > Chapter 6s e Bond Dave ercent cha Secure https://uw isconsin.edu/content/enforced/3737111-2173-FNBSLW 344-22/Chapte%206920solution.pdf?&d2ISessionVal=JYz7RM6p courses cKaY6ly7gaf muMR& Question 5 (3 points) Bond Dave has a 7 percent coupon rate, makes semiannual payments, a 4 percent YTM, and 24 years to maturity, If interest rates suddenly rise by 2 percent, what is the percentage change in the price of Bond Dave? Enter the answer with 4 decimals (e.g. 0.0123). 2 N: 24 X 2-48 N- 24x 2 -48 ealz went 2. 2. CPT PV26.33 Old price 26 3 3 146o lo 460. lo -22.86%, @t.all 614 PM 2/26/2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts