Question: abox - XM - Assessm Simulation Report Relaunch to update : Exit Inbox Identifying Stars and Cash Cows LS Lawrence Shift Board Member, Strategy Fri,

aboxXM Assessm

Simulation Report

Relaunch to update :

Exit Inbox

Identifying Stars and Cash Cows

LS

Lawrence Shift

Board Member, Strategy

Fri, : pm

Shania,

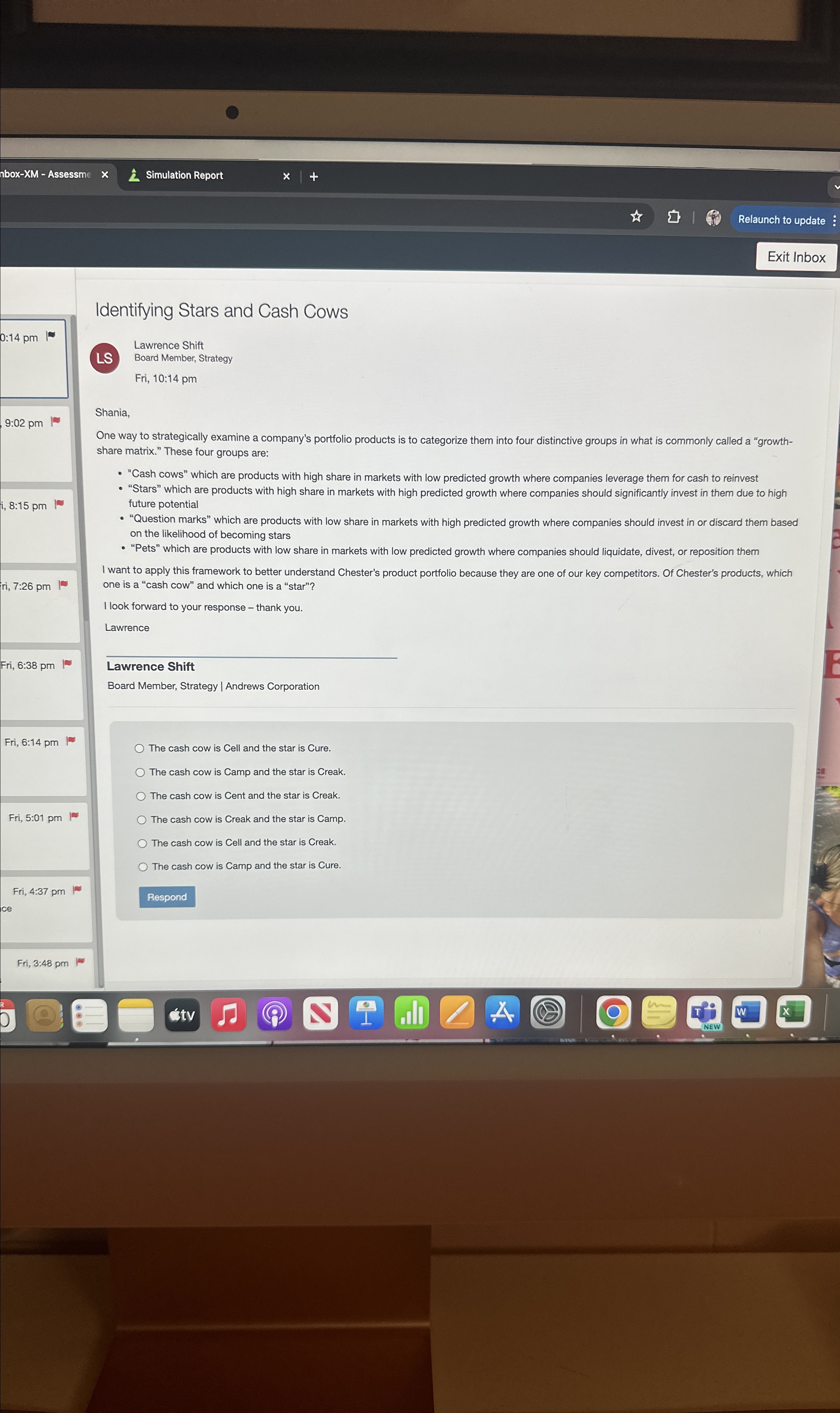

One way to strategically examine a company's portfolio products is to categorize them into four distinctive groups in what is commonly called a "growthshare matrix." These four groups are:

"Cash cows" which are products with high share in markets with low predicted growth where companies leverage them for cash to reinvest

"Stars" which are products with high share in markets with high predicted growth where companies should significantly invest in them due to high future potential

"Question marks" which are products with low share in markets with high predicted growth where companies should invest in or discard them based on the likelihood of becoming stars

Pets" which are products with low share in markets with low predicted growth where companies should liquidate, divest, or reposition them

I want to apply this framework to better understand Chester's product portfolio because they are one of our key competitors. Of Chester's products, which one is a "cash cow" and which one is a "star"?

I look forward to your response thank you.

Lawrence

Lawrence Shift

Board Member, Strategy Andrews Corporation

The cash cow is Cell and the star is Cure.

The cash cow is Camp and the star is Creak.

The cash cow is Cent and the star is Creak.

The cash cow is Creak and the star is Camp.

The cash cow is Cell and the star is Creak.

The cash cow is Camp and the star is Cure.

Fri, : pm

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock