Question: Absorption and Variable Costing Comparisons: Sales Exceed Production Wright Development purchases, develops, and sells commercial building sites. As the sites are sold, they are cleared

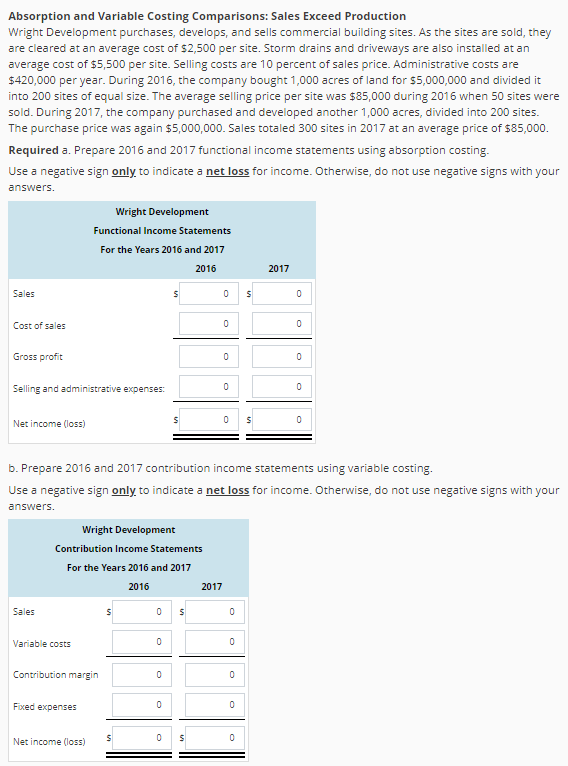

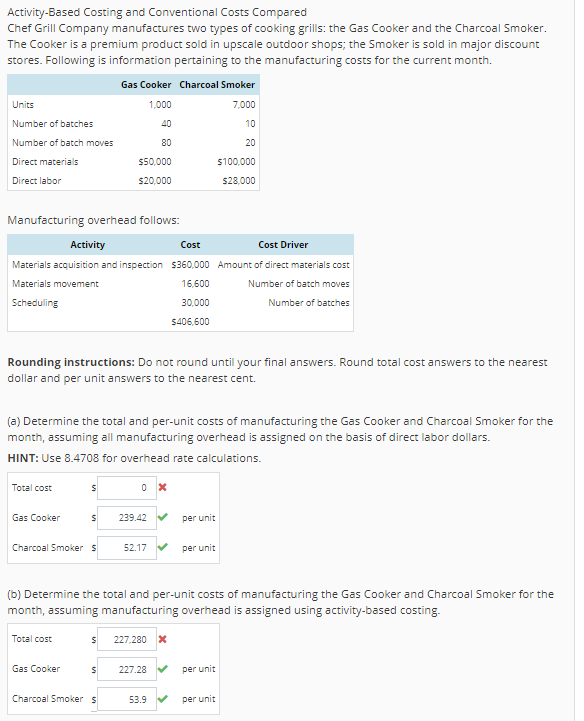

Absorption and Variable Costing Comparisons: Sales Exceed Production Wright Development purchases, develops, and sells commercial building sites. As the sites are sold, they are cleared at an average cost of $2,500 per site. Storm drains and driveways are also installed at an average cost of $5,500 per site. Selling costs are 10 percent of sales price. Administrative costs are $420,000 per year. During 2016, the company bought 1,000 acres of land for s5,000,000 and divided it into 200 sites of equal size. The average selling price per site was $85,000 during 2016 when 50 sites were sold. During 2017, the company purchased and developed another 1,000 acres, divided into 200 sites. The purchase price was again $5,000,000. Sales totaled 300 sites in 2017 at an average price of $85,000 Required a. Prepare 2016 and 2017 functional income statements using absorption costing Use a negative sign only to indicate a net loss for income. Otherwise, do not use negative signs with your answers Wright Development Functional Income Statements For the Years 2016 and 2017 2016 2017 Sales Cost of sales Gross profit Selling and administrative expenses: Net income (loss) b. Prepare 2016 and 2017 contribution income statements using variable costing. Use a negative sign only to indicate a net loss for income. Otherwise, do not use negative signs with your answers. Wright Development Contribution Income Statements For the Years 2016 and 2017 2016 2017 Sales Variable costs Contribution margin Foxed expenses Net income (loss) Activity-Based Costing and Conventional Costs Compared Chef Grill Company manufactures two types of cooking grills: the Gas Cooker and the Charcoal Smoker The Cooker is a premium product sold in upscale outdoor shops; the Smoker is sold in major discount stores. Following is information pertaining to the manufacturing costs for the current month. Gas Cooker 1,000 40 Units Number of batches Number of batch moves Direct materials Direct labor Charcoal Smoker 7,000 10 20 $100,000 28,000 $50,000 20,000 Manufacturing overhead follows: Activity Cost Cost Driver Materials acquisition and inspection Materials movement Schedulinge S360,000 16,600 30,000 $406,600 Amount of direct materials cost Number of batch moves Number of batches Rounding instructions: Do not round until your final answers. Round total cost answers to the nearest dollar and per unit answers to the nearest cent. (a) Determine the total and per-unit costs of manufacturing the Gas Cooker and Charcoal Smoker for the month, assuming all manufacturing overhead is assigned on the basis of direct labor dollars HINT: Use 8.4708 for overhead rate calculations. Total cost Gas Cooker S239.42 per unit Charcoal Smoker s 52.17 per unit (b) Determine the total and per-unit costs of manufacturing the Gas Cooker and Charcoal Smoker for the month, assuming manufacturing overhead is assigned using activity-based costing. Total cost 227,280X Gas Cooker S 227.28 per unit Charcoal Smoker s 53.9 per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts