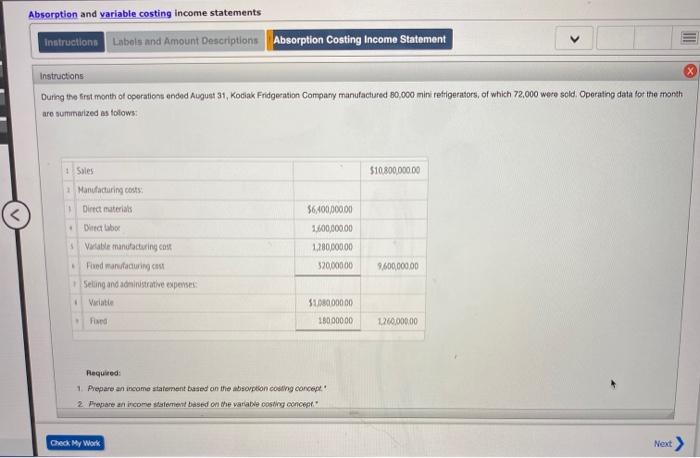

Question: Absorption and variable costing income statements Instructions Labels and Amount Descriptions Absorption Costing Income Statement III > Instructions During the first month of operation ended

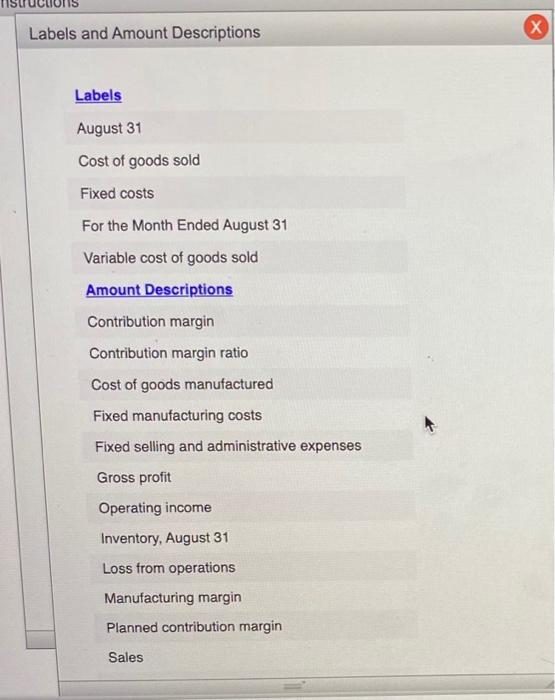

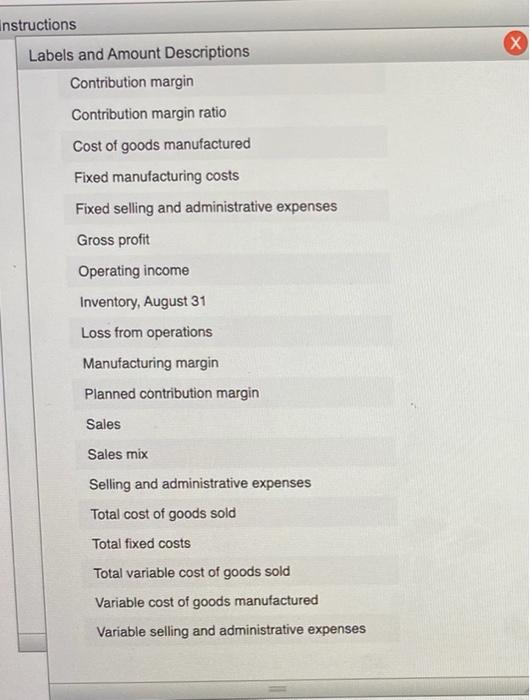

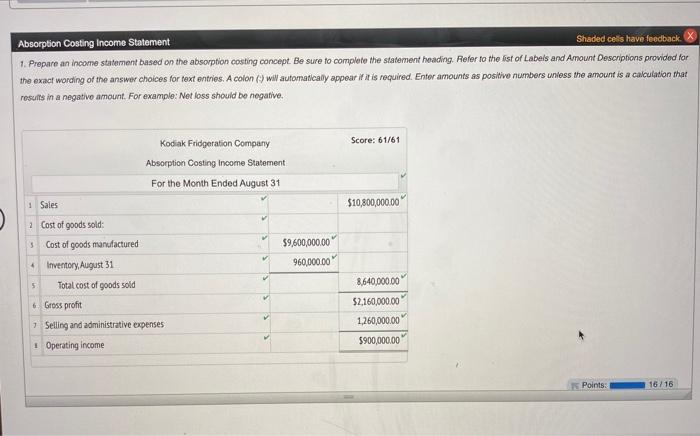

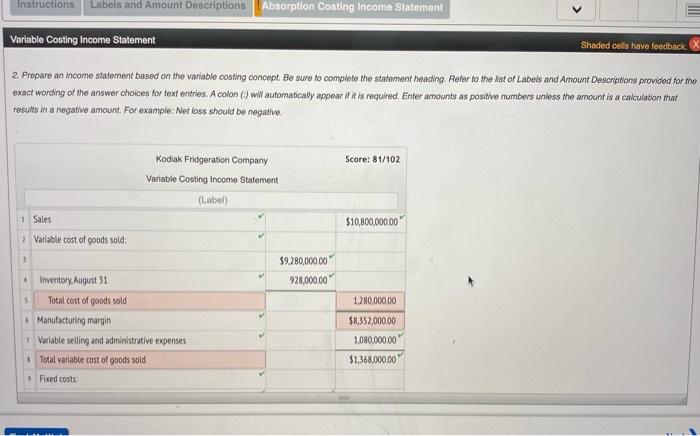

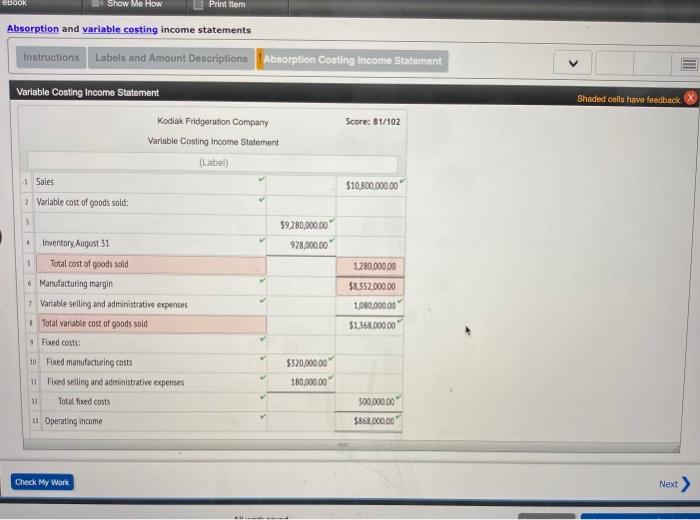

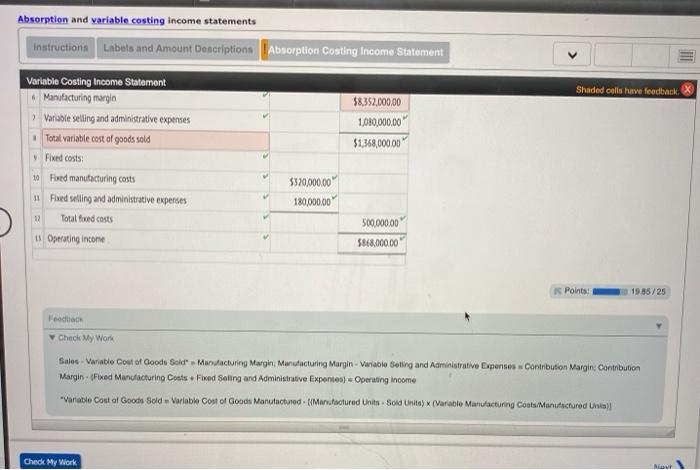

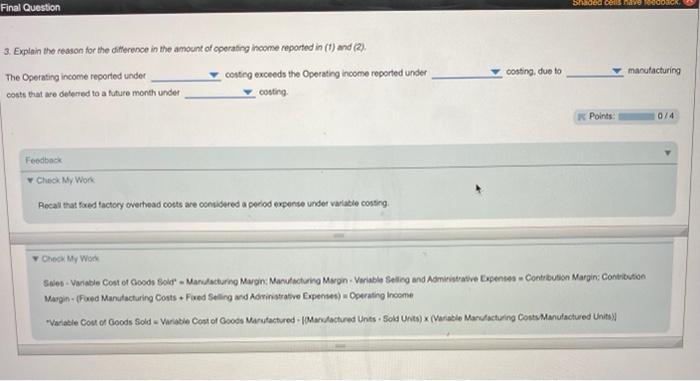

Absorption and variable costing income statements Instructions Labels and Amount Descriptions Absorption Costing Income Statement III > Instructions During the first month of operation ended August 31, Kodiak Fridgeration Company manufactured 80,000 mini refrigerators, of which 72,000 were sold Operating data for the month are summarized as follows: 1 Sales $10800,000.00 Manufacturing costs Direct materials $6,400,000.00 100,000.00 . Direct box 1.780,000.00 320,00000 9.600,000.00 Vatable manufacturing Cost Fived manufacturing com Selling and soninistrative expenses Variate . $100000000 18000000 Find 1260,000.00 Required 1 Prepare an income statement based on the absorption costing concept 2 Prepare an income statement based on the variable costing concer Check My Work Next Labels and Amount Descriptions x Labels August 31 Cost of goods sold Fixed costs For the Month Ended August 31 Variable cost of goods sold Amount Descriptions Contribution margin Contribution margin ratio Cost of goods manufactured Fixed manufacturing costs Fixed selling and administrative expenses Gross profit Operating income Inventory, August 31 Loss from operations Manufacturing margin Planned contribution margin Sales x Instructions Labels and Amount Descriptions Contribution margin Contribution margin ratio Cost of goods manufactured Fixed manufacturing costs Fixed selling and administrative expenses Gross profit Operating income Inventory, August 31 Loss from operations Manufacturing margin Planned contribution margin Sales Sales mix Selling and administrative expenses Total cost of goods sold Total fixed costs Total variable cost of goods sold Variable cost of goods manufactured Variable selling and administrative expenses Absorption Costing Income Statement Shaded ces have feedback 1. Prepare an income statement based on the absorption costing concept. Be sure to complete the statement heading. Refer to the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. A colon () will automatically appear if it is required. Enter amounts as positive numbers unless the amount is a calculation that results in a negativo amount. For example: Net loss should be negative. Score: 61/61 Kodiak Fridgeration Company Absorption Costing Income Statement For the Month Ended August 31 1 Sales $10,800,000.00 Cost of goods sold: 5 Cost of goods manufactured 59,600,000.00 960,000.00 4 Inventory, August 31 5 Total cost of goods sold 8640,000.00 6 Gross profit $2,160,000.00 1 Selling and administrative expenses 1,260,000.00 $900,000.00 1 Operating income Points: 16/16 Instructions Labels and Amount Descriptions Absorption Costing Income Statement Variable Costing Income Statement Shaded cells have feedback 2. Prepare an income statement based on the variable costing concept. Be sure to complete the statement heading. Refer to the Ast of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. A colon () will automatically appear if it is required. Enter amounts as positive numbers unless the amount is a calculation that results in a negative amount. For example: Net loss should be negative Score: 81/102 Kodiak Fridgeration Company Variable Costing Income Statement (Label) 1 Sales $10,800,000.00 ? Variable cost of goods sold: $9,280,000.00 928,000.00 4 Inventory. August 31 5 Total cost of goods sold 1,280,000.00 Manufacturing margin Variable selling and administrative expenses + Total variable cost of goods sold $8,352,000.00 1,080,000.00 $1,568,000.00 Fixed costs Ebook Show Me How Print Item Absorption and variable costing income statements Instructions Labels and Amount Descriptions Absorption Costing Income Statement Shaded calls have feedback. X Variable Costing Income Statement Kodiak Fridgeration Company Variable Costing Income Statement (Label) Score: 81/102 1 Sales $10,800.000.00 2 Variable cost of goods sold: 3 $9280,000.00 4 928,000.00 1280,000.00 59,552,000.00 1,080,000.00 Inventory, August 31 5 Total cost of goods sold Manufacturing margin 1 Variable selling and administrative expenses Total variable cost of goods sold Fixed costs: 10 Fixed manufacturing costs Fixed selling and administrative expenses 12 Totalfixed costs $1.368.000.00 $320,000.00 180,000.00 500,000.00 Operating income $868.000.00 Check My Work Next Absorption and variable costing income statements instructions Labels and Amount Descriptions Absorption Costing Income Statement Shaded cells have feedback. $8.352,000.00 1080,000.00 $1,368,000.00 Variable Costing Income Statement Manufacturing margin > Variable selling and administrative expenses Total variable cost of goods sold Fixed costs 16 Fixed manufacturing costs Pred selling and administrative expenses Total foed costs Operating Income $320,000.00 180,000.00 12 500.000,00 5868,000.00 Points: 1986/25 Feeds Check My Work Sales Variable Cost of Goods Sold" Maracturing Margin Marutacturing Margin. Variable dating and Administrative Expenses Contrbution Margin Contribution Margin-red Manufacturing Coats Flved Soling and Administrative Experten) - Operating income Variable Cont of Goods Sold Variable Cont of Good Manutuctured - (Maritachurad Units Sold Unite) x (arable Manufacturing Contu Manufactured Unity Check My Work Navt STOD D00C Final Question 3. Explain the reason for the difference in the amount of operating income reported in (t) and (2) The Operating income reported under costing exceeds the Operating income reported under couts that are detened to a tuturo month under costing costing, due to manufacturing Points 074 Feedback Check My Work Recall that faxed factory overhead costs are considered a period expense under variable conting Oh My Works Sales - Variable Cost of Goods Bok - Maracturing Muror: Mersuchung Muon Verable Selling and Administrative Expenses - Contribution Marging Contribution Margin(Pod Manufacturing Costs. Fred Seling and Administrative penses) Operating Income Variable Cont of Goods Soldable Cost of Goods Marufactured - Manufactured Unts - Sold Units X (Marble Maracturing Costs Manufactured Units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts