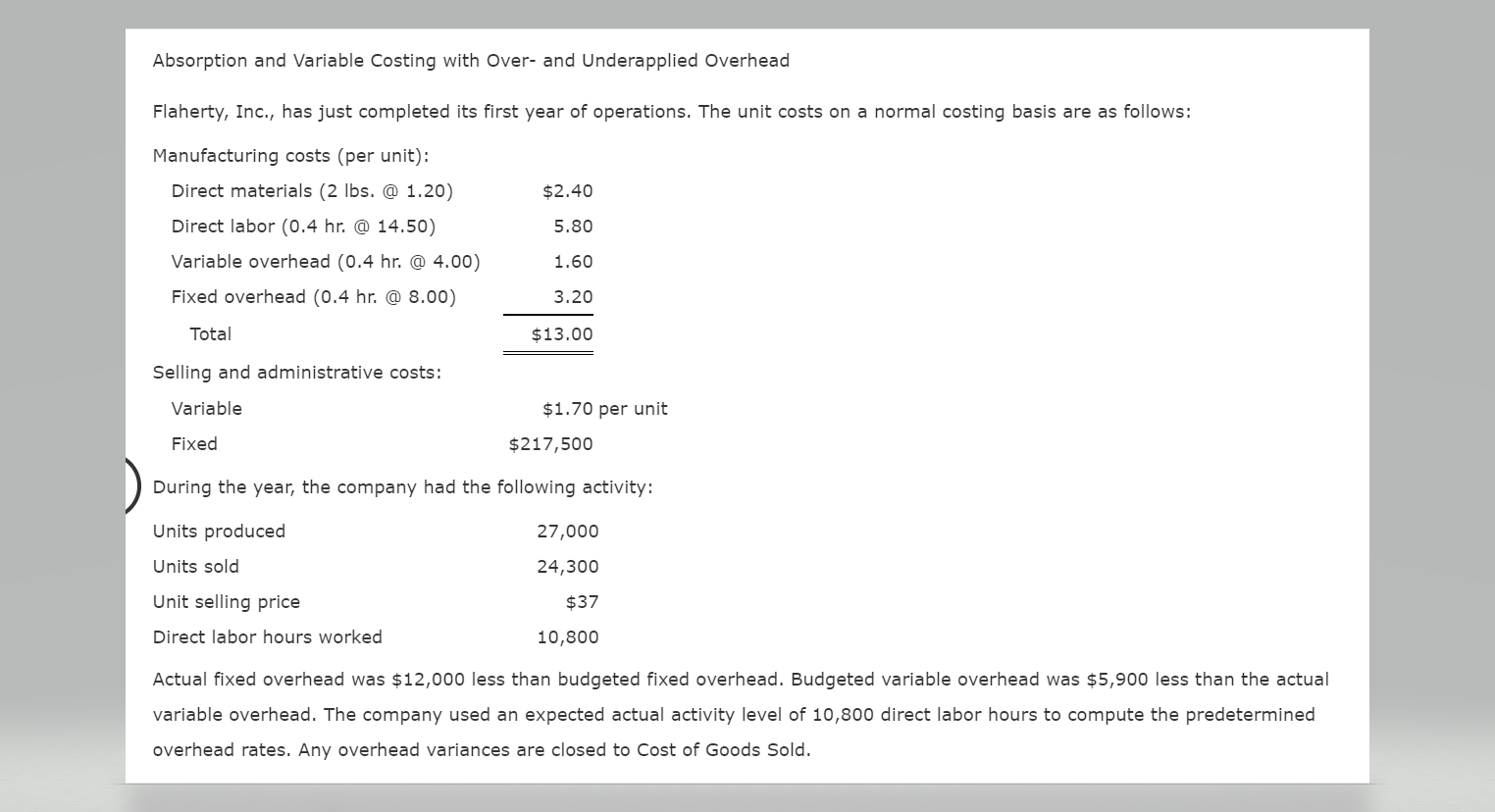

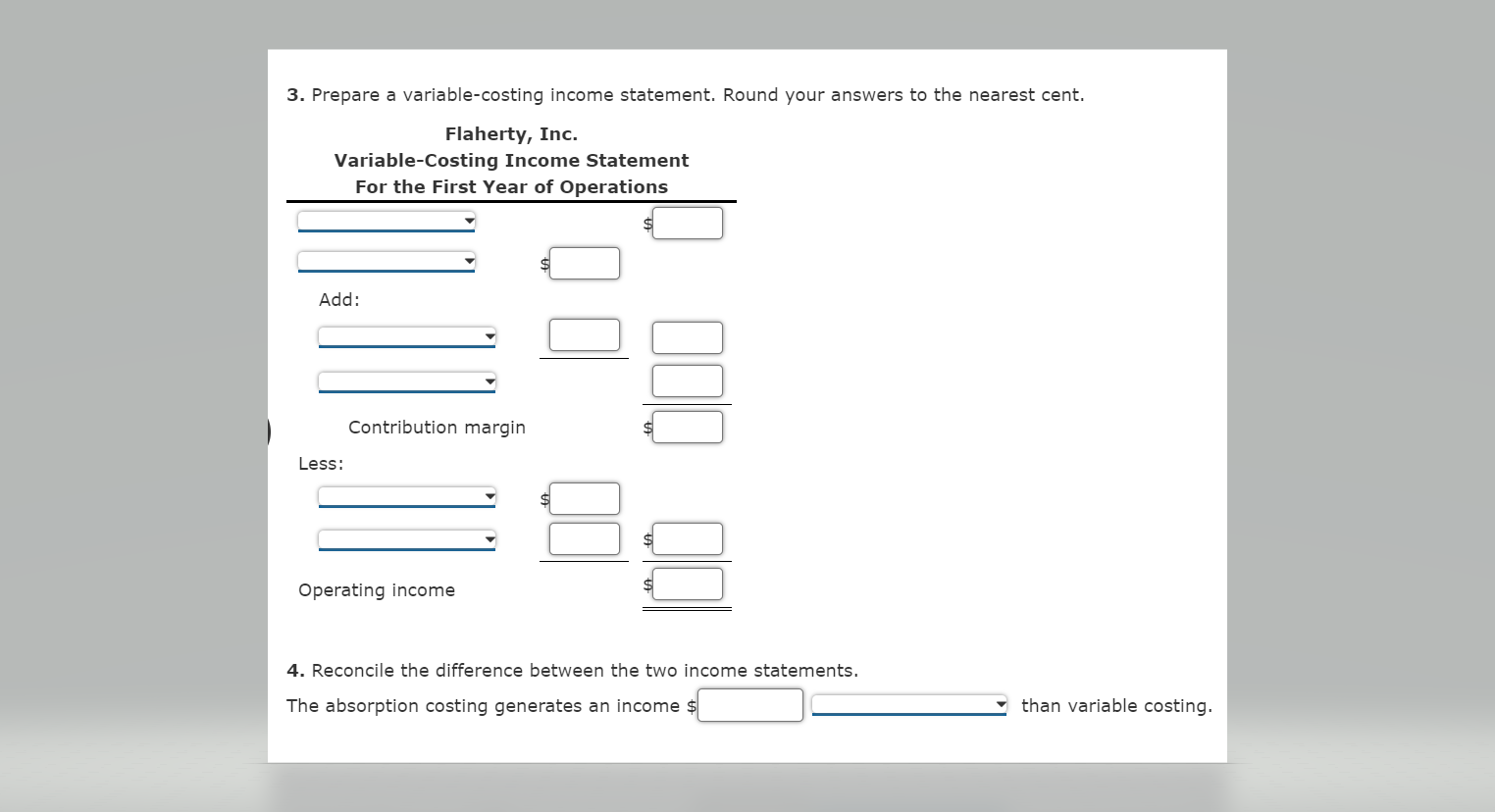

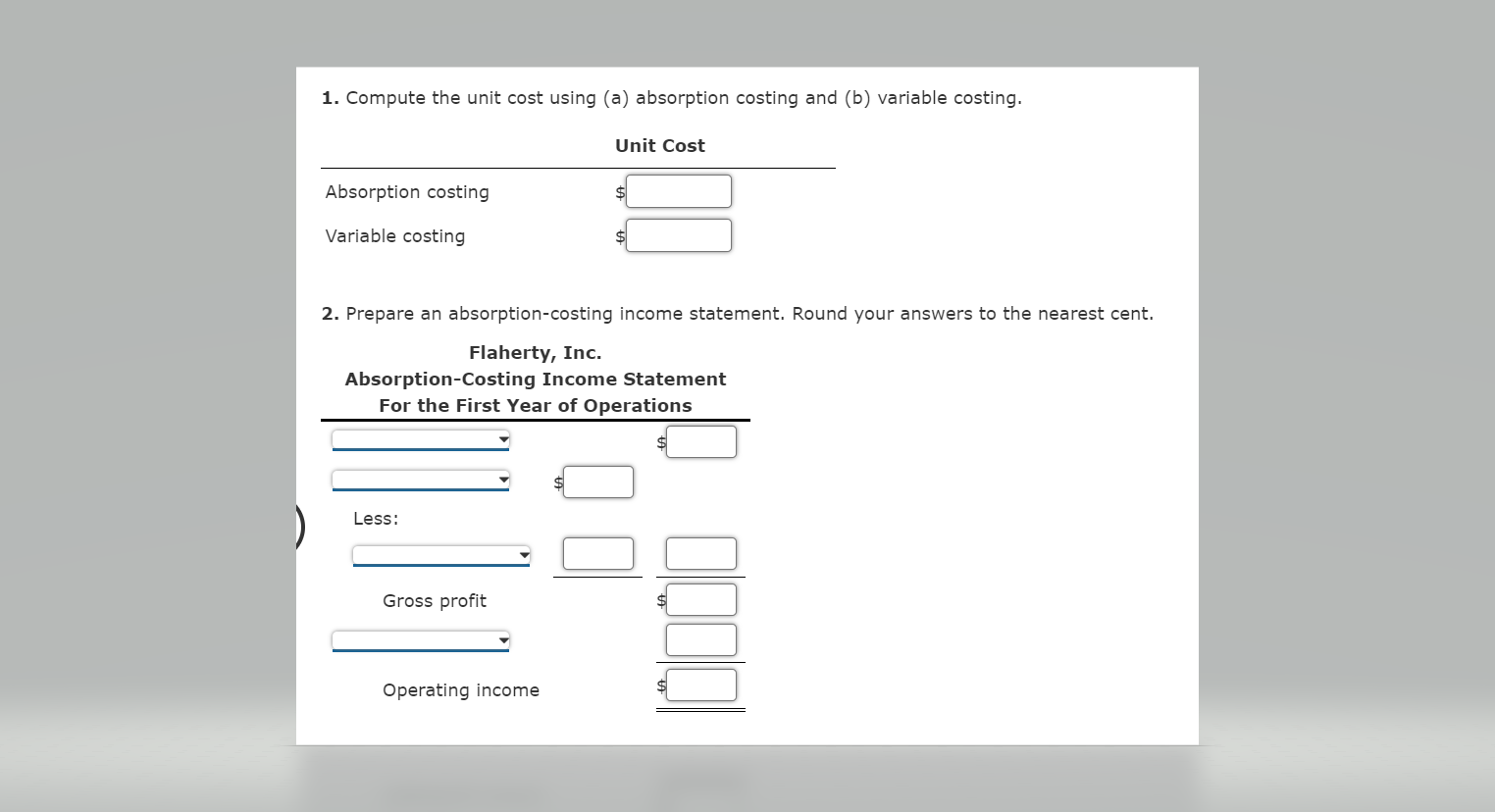

Question: Absorption and Variable Costing with Over- and Underapplied Overhead Flaherty, Inc., has just completed its rst year of operations. The unit costs on a normal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts