Question: AC 2 2 2 Practice for Chapter 1 7 Investments Rich, Inc. acquired 3 0 % of Doane Corporation's voting stock on January 1 ,

AC Practice for Chapter Investments

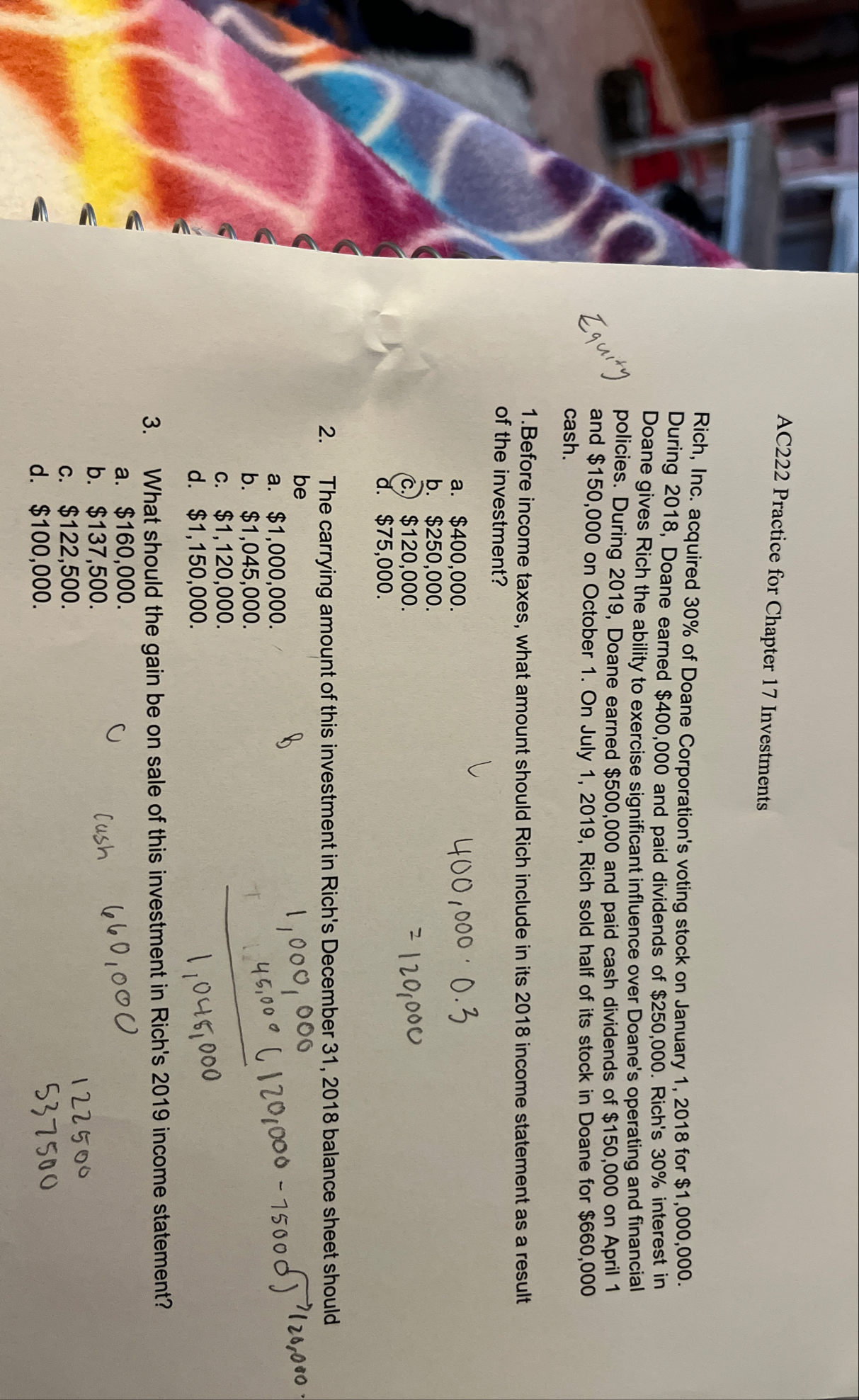

Rich, Inc. acquired of Doane Corporation's voting stock on January for $ During Doane earned $ and paid dividends of $ Rich's interest in Doane gives Rich the ability to exercise significant influence over Doane's operating and financial policies. During Doane earned $ and paid cash dividends of $ on April and $ on October On July Rich sold half of its stock in Doane for $ cash.

Before income taxes, what amount should Rich include in its income statement as a result of the investment?

a $

$

$

d $

The carrying amount of this investment in Rich's December balance sheet should be

a $

b $

c $

d $

What should the gain be on sale of this investment in Rich's income statement?

a $

b $

c $

d $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock