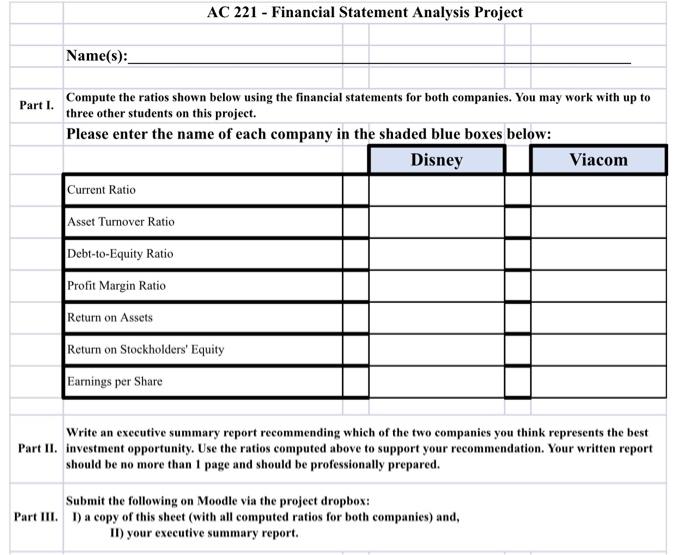

Question: AC 221 - Financial Statement Analysis Project Name(s): Part I. Compute the ratios shown below using the financial statements for both companies. You may work

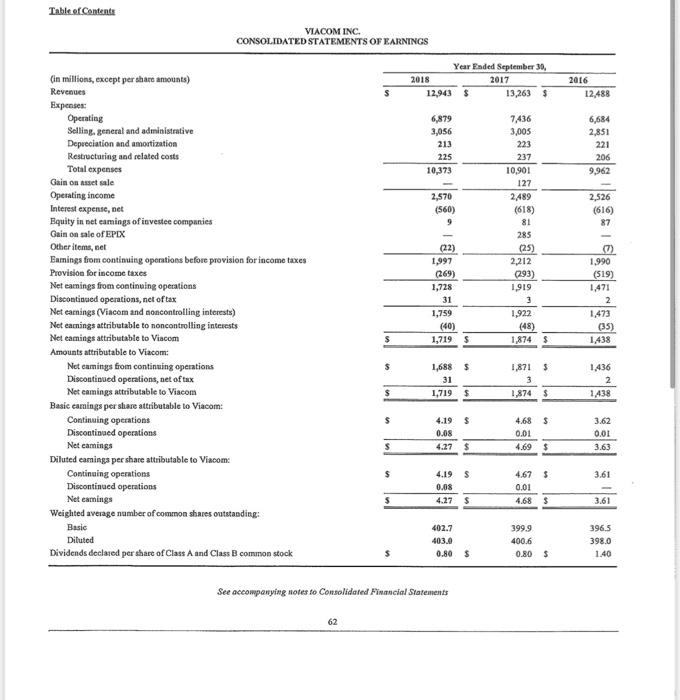

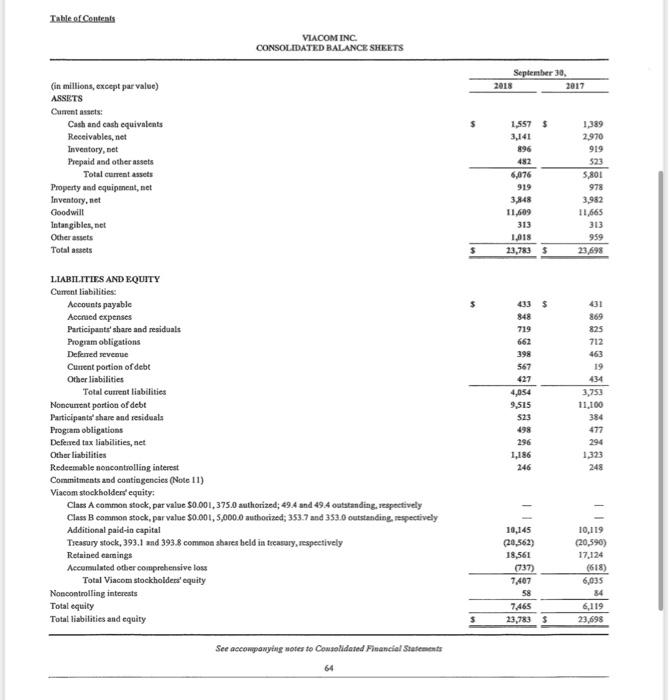

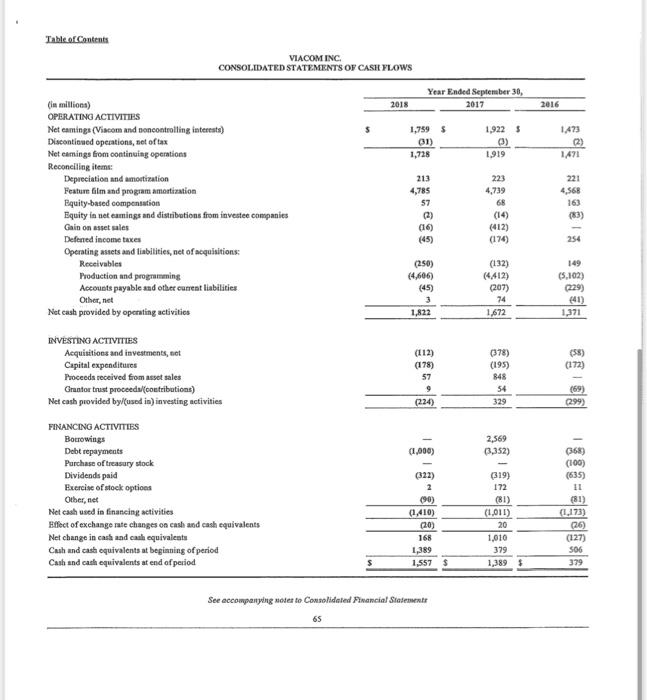

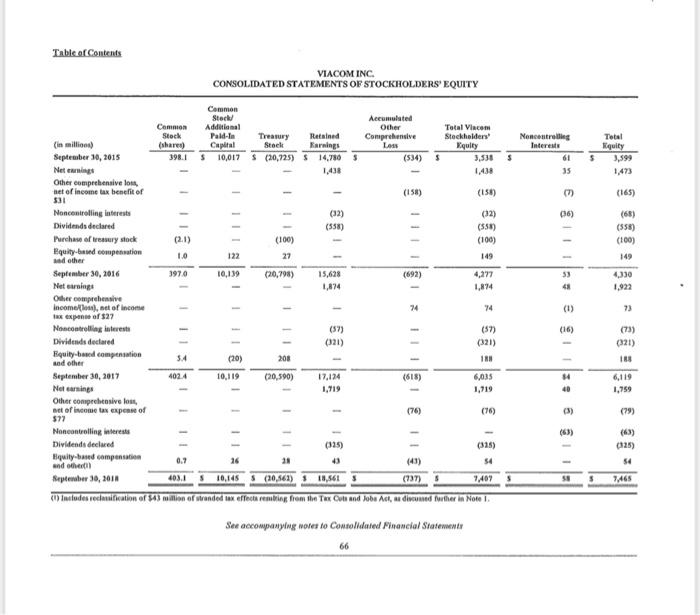

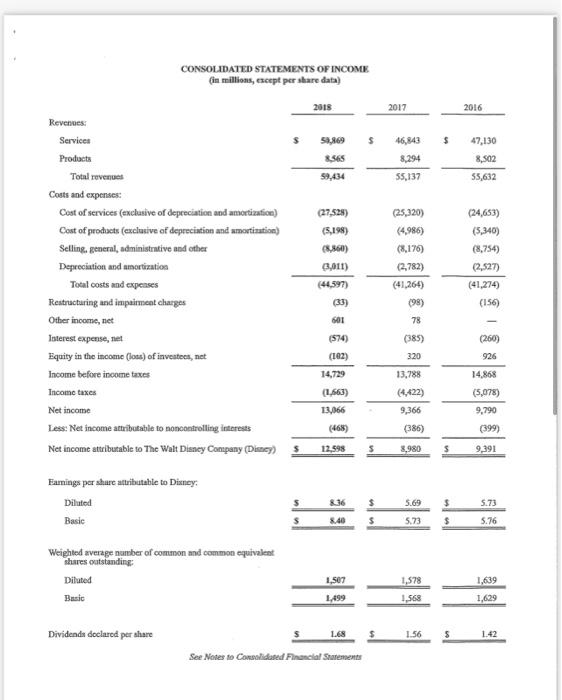

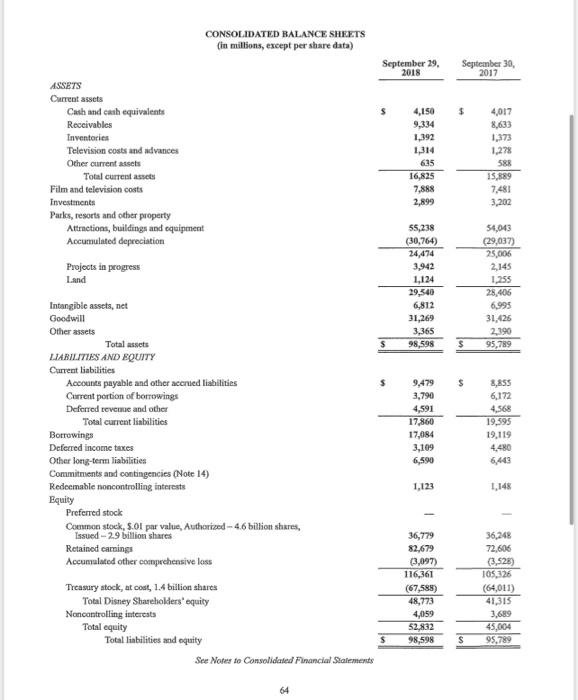

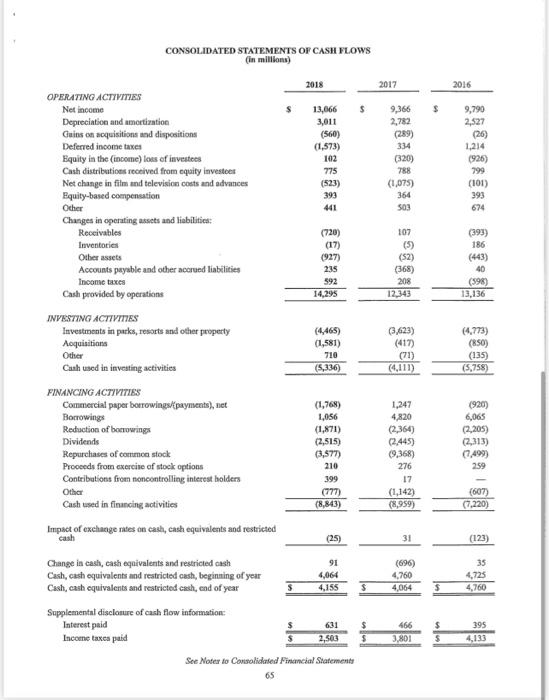

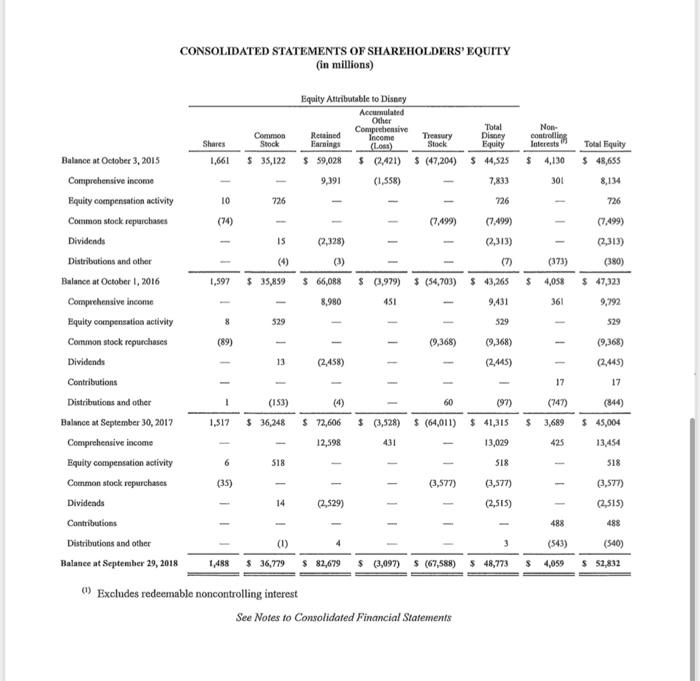

AC 221 - Financial Statement Analysis Project Name(s): Part I. Compute the ratios shown below using the financial statements for both companies. You may work with up to three other students on this project. Please enter the name of each company in the shaded blue boxes below: Write an executive summary report recommending which of the two companies you think represents the best Part II. investment opportunity. Use the ratios computed above to support your recommendation. Your written report should be no more than 1 page and should be professionally prepared. Submit the following on Moodle via the project dropbox: Part III. I) a copy of this sheet (with all computed ratios for both companies) and, II) your executive summary report. See accompanying notes to Comsolidared Financial SYatements Table of Contents VIACOM INC. CONSOL.DATED EALANCE SHEETS LIABIITTIS AND EQUITY Cument liabilities: Commitments and contingencies (Note 11) Viacom stockbolders' equity: Class A common stock, par value $0.001,375.0 anthorized; 49.4 and 49.4 ootstanding, respectively Class B comnson stock, par value 50.001,5,000.0 autbocized; 353.7 and 353.0 outstanding, reypectively Additional paid-in eapital Treasury stock, 393.1 and 393.8 common shares beld in treasury, respectively Retained earnings Aceurmulated other comprehensive loss Total Viacom stockholders' equity Noncontrolling interests Total equity Total liabilities and equity See accangonying notes to Cowsehidated Fieancial Statenents 64 Table of Contents VIACOM INC, CONSOLIDATED STATEMENTS OE CASH FLOWS DivESTING ACTIVITES Aequititions and investments, not Capital expenditures Proceeds received fom asset sales Grantor trust proceeda/(coetribations) Net cash provided by/(used in) investing activities \begin{tabular}{ccr} (112) & (378) & (55) \\ (178) & (195) & (172) \\ 57 & 848 & \\ 9 & 54 & (69) \\ \hline(224) & 329 & (299) \\ \hline \end{tabular} FINANCENG ACTIVITIES Bocrowings Debt repayments Purchase of treasury stock Dividends paid Buercise of stock options Otber, net Net eash used in financing activities Bffect of exchange rate changes on cash and cash equivalents Net change in cash and canh equivaleatu Cash and cash oquivalents at begianing of period Cash and cach equivalents at end of period See accompanying noter to Cowsolidated Financial Stalenucntr 65 Table of Contents. VIACOM INC. CONSOLIDATED STATEMENTS OF INCOME (in millions, except per stare data) Revenues: Farnings per share aftributable to Dixney: Diluted Basic CONSOLIDATED BALANCE SHEETS (in millions, except per share data) ASSETS \begin{tabular}{c} September 29, \\ 2018 \\ \hline \end{tabular} Current assets Cach and eath equivalents Reccivables Inventoriea Television costs and advances Other current assets Total current assets Film and television costs Investments Parlos, resorts and otber property Attrnetions, buildings and equipment Accumulated depreciation Projocts in peogress Land Intangible assets, net Goodwill Other assets Total assets LIARILITIES AND EQUITY Current liabilities Acoounes payable and other acerued liahilities Current portion of borrowings Deferred revemue and other Total current linbilities Borrowings Deferred income taxes Other long-term liabilities Conmitments abd contingencies (Note 14) Redoemable noncontrolling interests Equity Preferred stock Common stock, 5.01 par value, Autharized 4.6 billion shares, Lssued 2.9 billion shares Retained carnings Accumalated other comprehensive loss Treasury atock, at cost, 1.4 billion sharts Total Disney Shareholders' equity Nancontrolling interests Total equity Total liabilities and oquity CONSOLIDATED STATEMENTS OF CASH FLOWS (in millibats) OPERATING ACTIVTIES Net income Depreciation and amortization Gains on acquisitions and dispositions Deferred income taxes Bquity in the (income) loes of investees 201820172016 Cash distributions received from equity investces Net change in film and television costs and advances Equity-based coenpensation Oeher $13,0663,011$9,3662,782$9,7902,527 Changes in operating assets and liabilities: DNVESTING ACTIVIIES \begin{tabular}{lrrr} Investments in parks, ressarts and other property & (4,465) & (3,623) & (4,773) \\ Aoquisitians & (1,581) & (417) & (850) \\ Other & 710 & (71) & (135) \\ Cash esed in investing activities & (5,336) & (4,111) & (5,758) \\ \hline \end{tabular} FINANCING AC7IVITIES Sapplemental discloaure of cash flow information: Interest paid Income taxes paid Soe Noter to Cavsolidaled Financial Statement 65 CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (in millions) see rvotes to Lonsomatea frmancuar staremenrs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts