Question: AC114 Unit 6 Lab Learning Activity Question 2 of 2 View Policies Current Attempt in Progress The trial balance columns of the worksheet for Crane

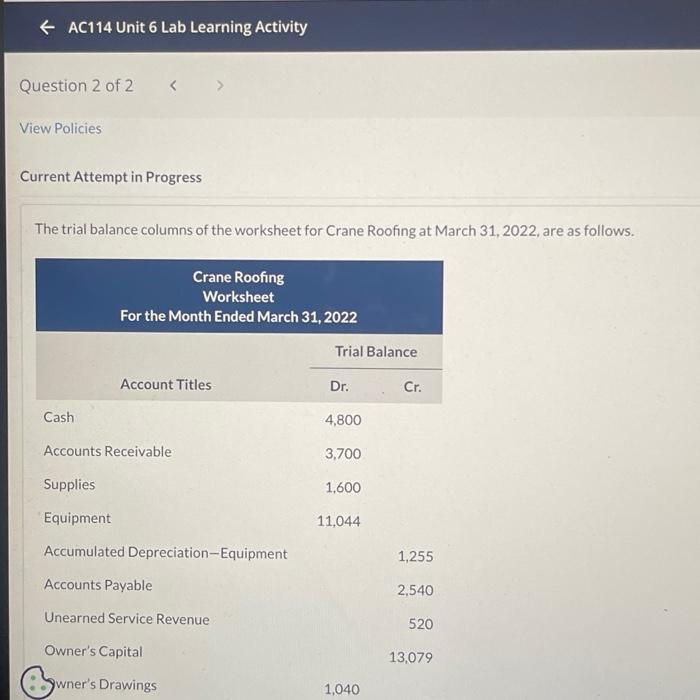

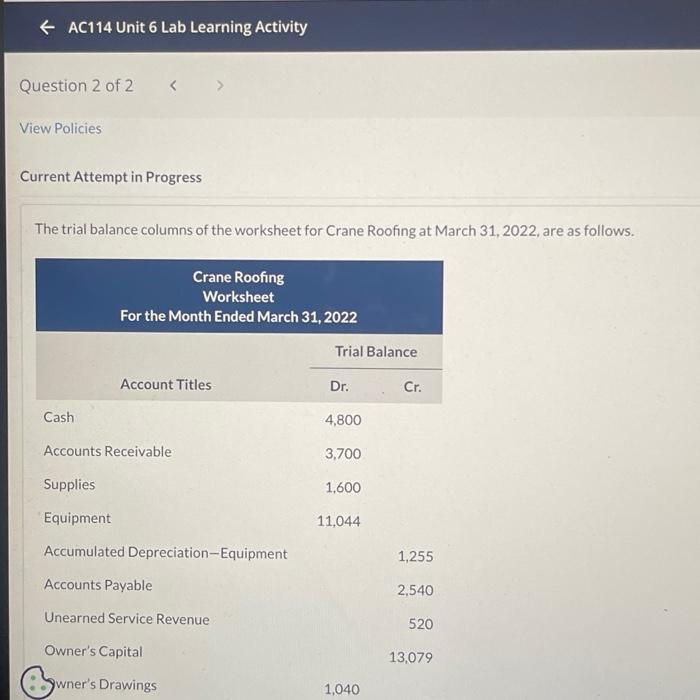

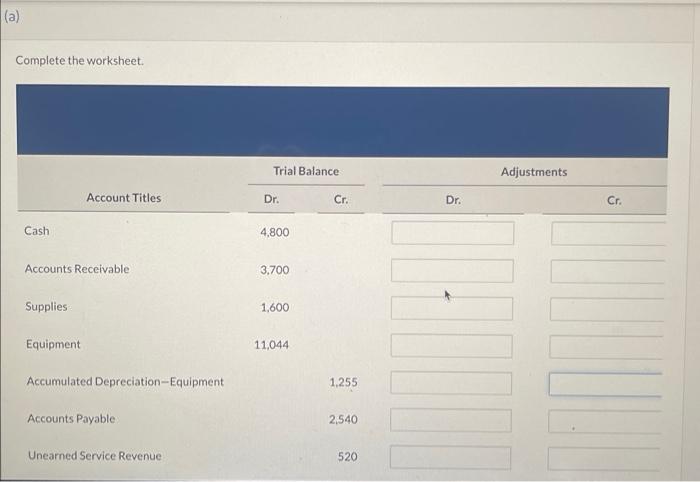

AC114 Unit 6 Lab Learning Activity Question 2 of 2 View Policies Current Attempt in Progress The trial balance columns of the worksheet for Crane Roofing at March 31, 2022, are as follows. Cash

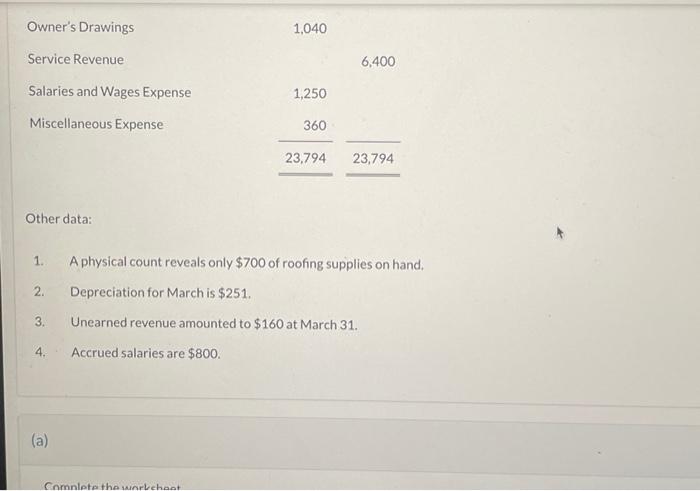

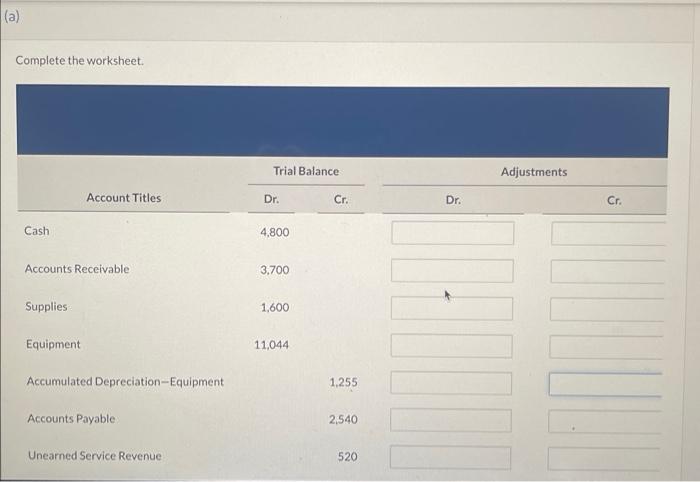

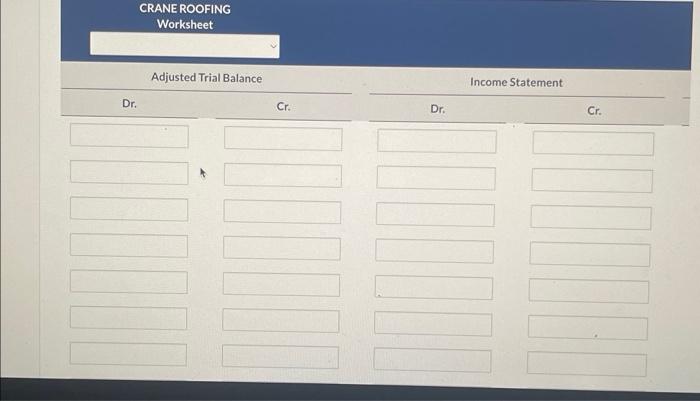

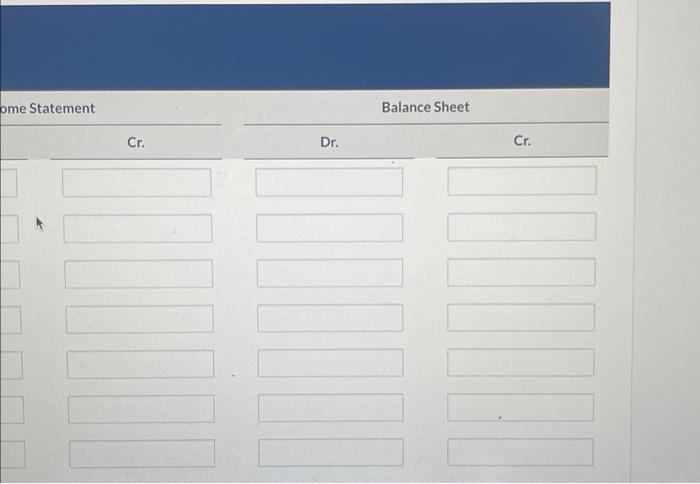

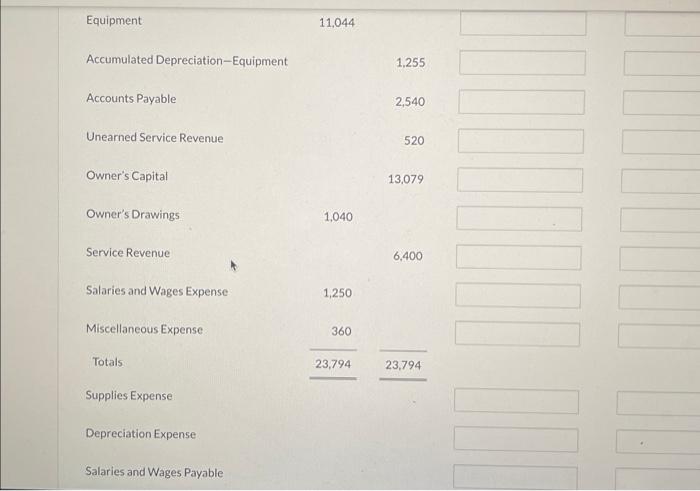

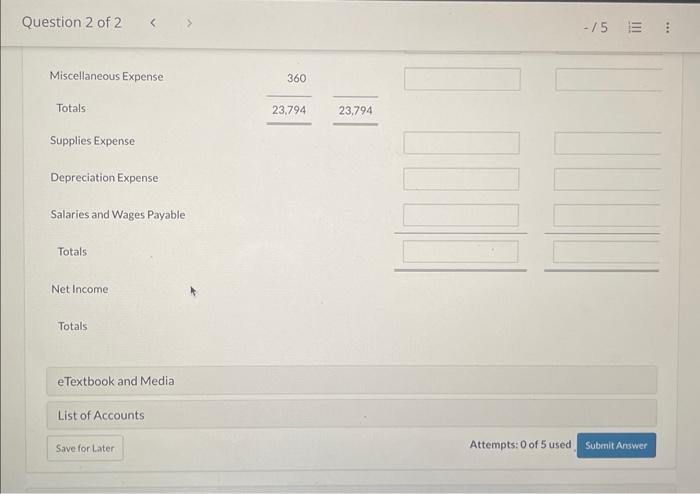

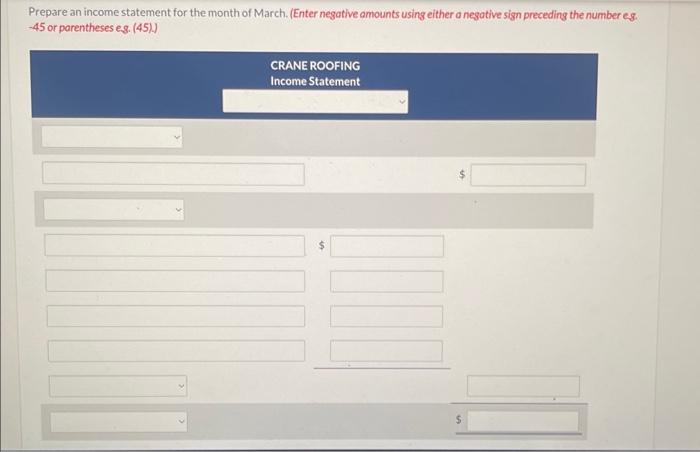

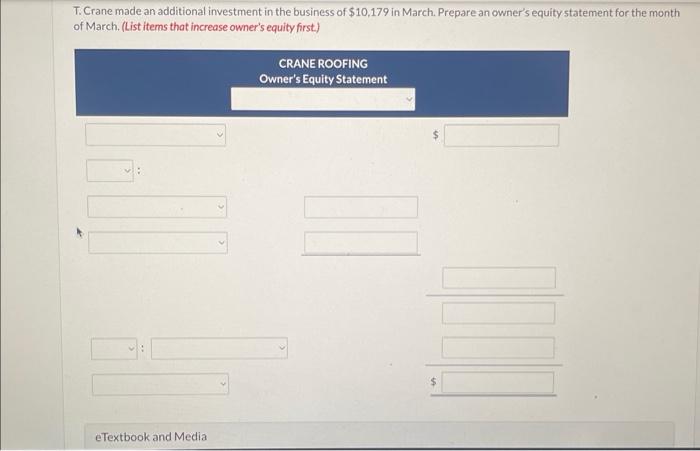

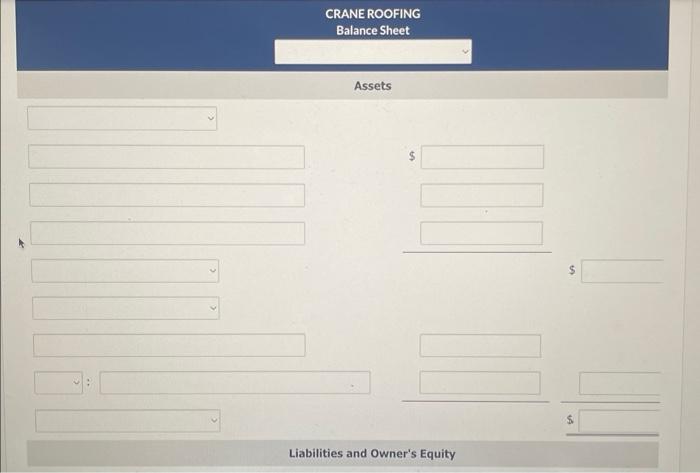

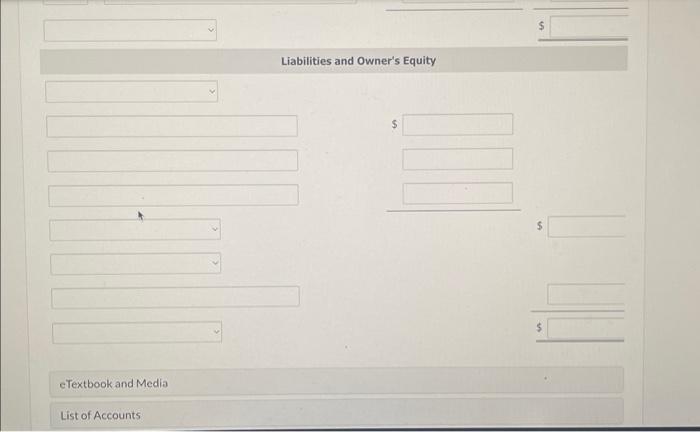

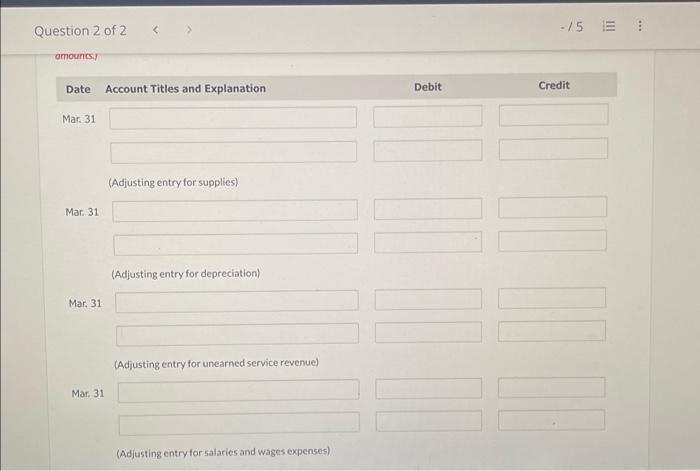

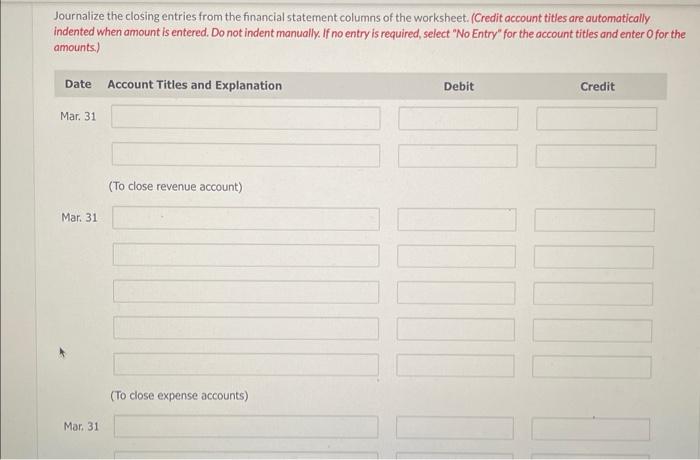

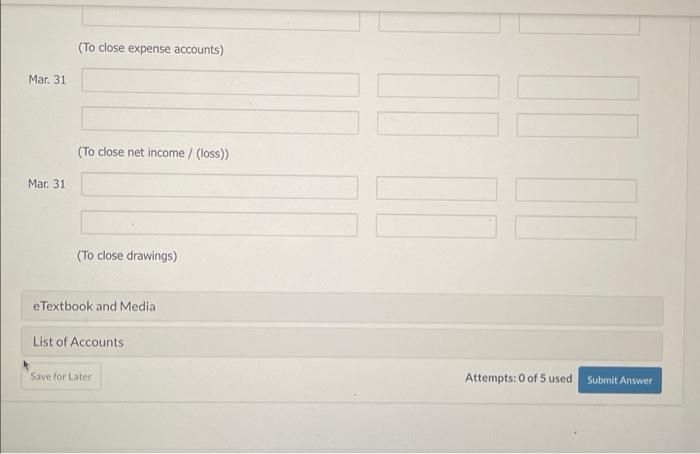

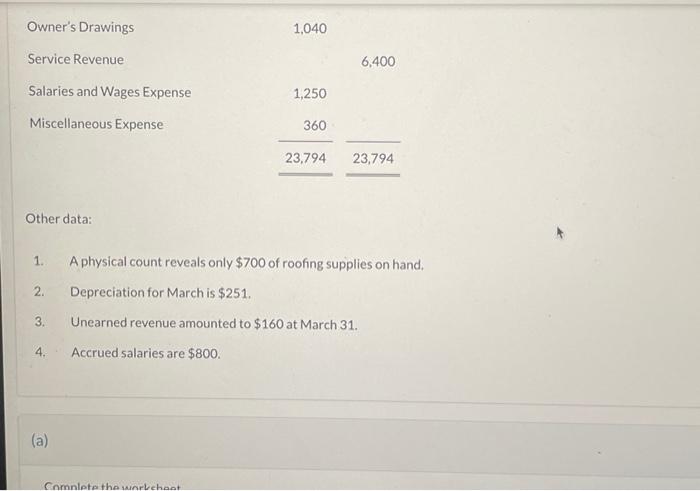

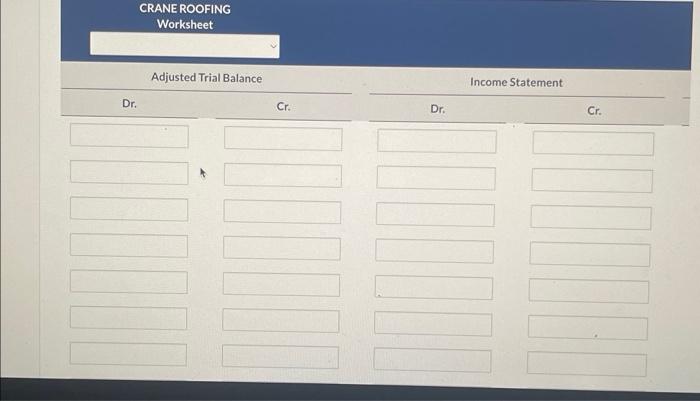

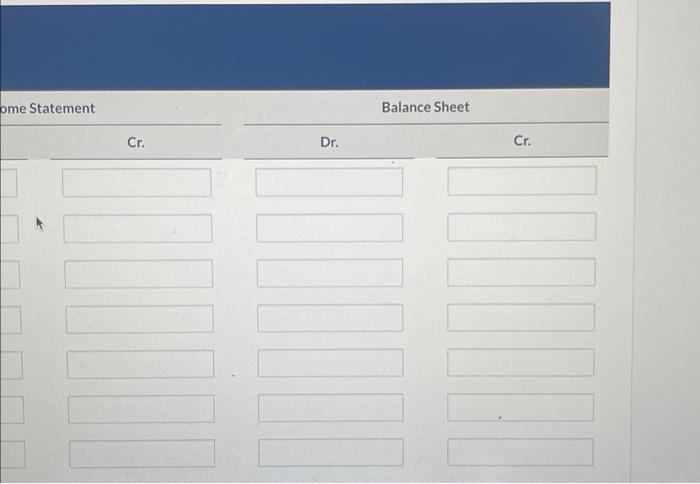

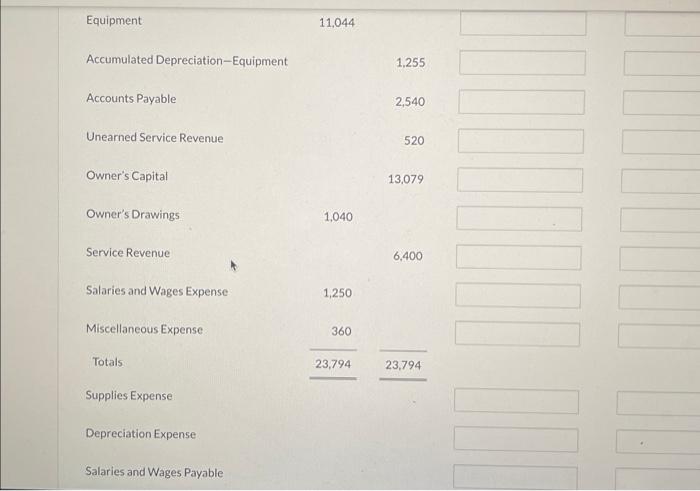

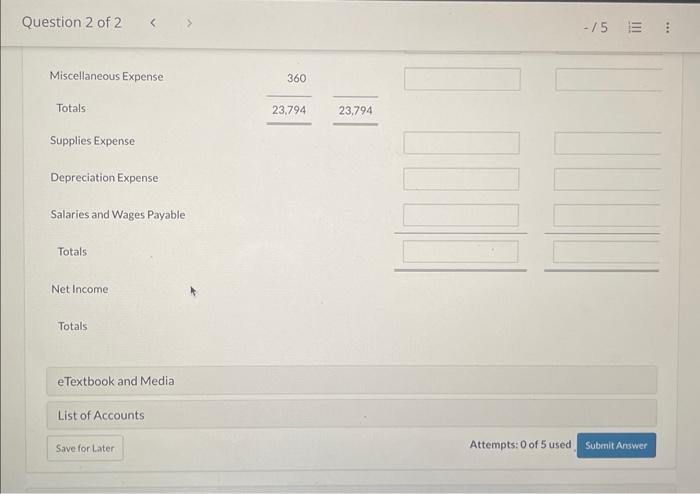

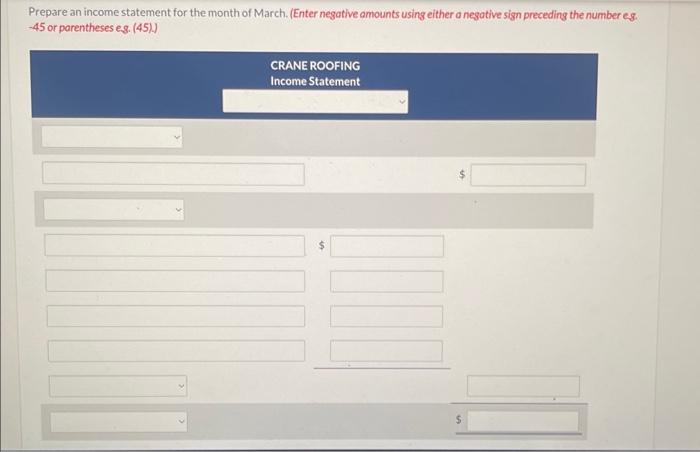

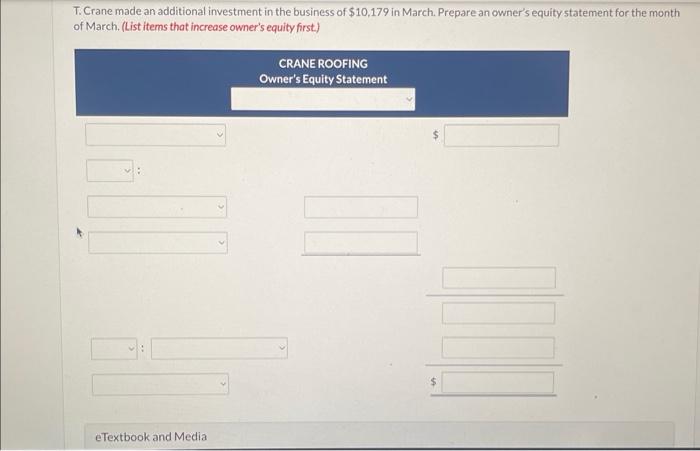

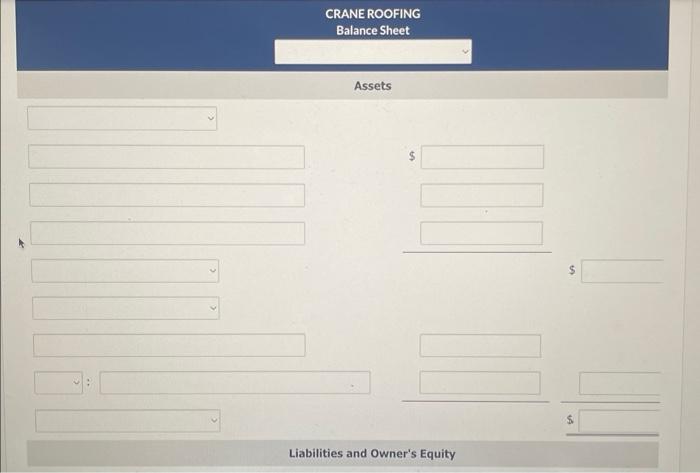

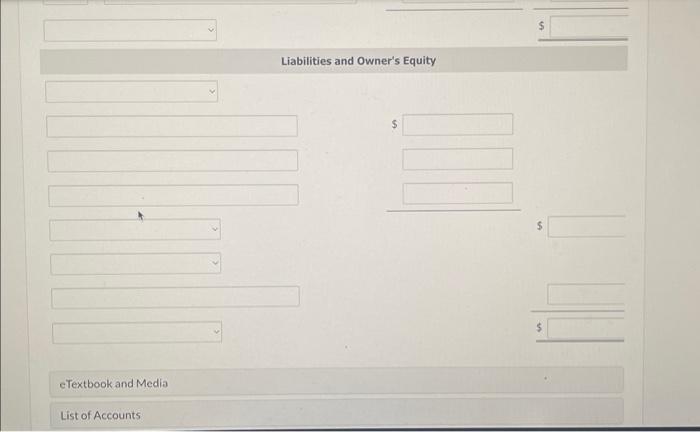

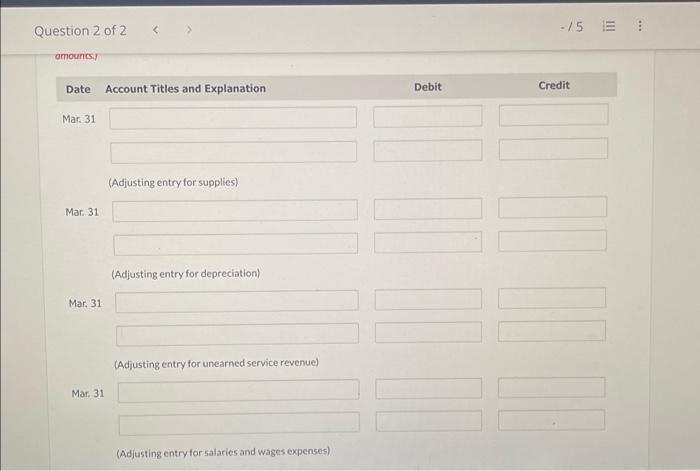

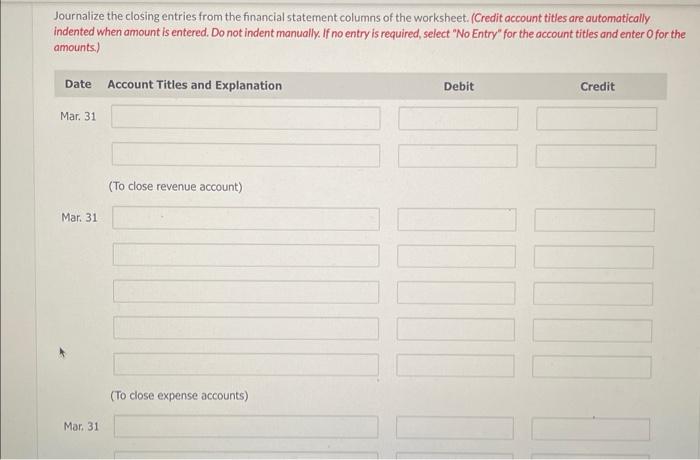

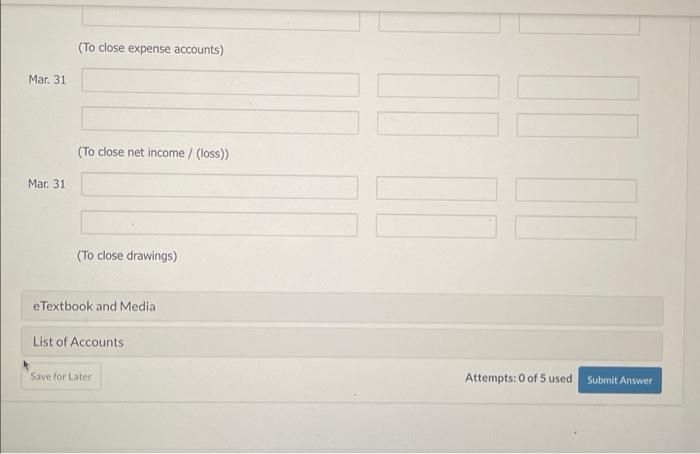

Current Attempt in Progress The trial balance columns of the worksheet for Crane Roofing at March 31,2022, are as follows. Other data: 1. A physical count reveals only $700 of roofing supplies on hand. 2. Depreciation for March is $251. 3. Unearned revenue amounted to $160 at March 31. 4. Accrued salaries are $800. Complete the worksheet. CRANE ROOFING Worksheet Adjusted Trial Balance Income Statement Dr. Cr. Dr. Cr. ome Statement Balance Sheet Dr. Cr. Cr. Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Service Revenue Owner's Capital Owner's Drawings Service Revenue Salaries and Wages Expense Miscellaneous Expense Totals Supplies Expense 11,044 1,255 2,540 520 13,079 1,040 6,400 1,250 360 23,794 23,794 Depreciation Expense Salaries and Wages Payable Question 2 of 2 15 Miscellaneous Expense Totals Supplies Expense Depreciation Expense Salaries and Wages Payable Totals Net income Totals Prepare an income statement for the month of March. (Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses e 3.(45) ) T. Crane made an additional investment in the business of $10,179 in March. Prepare an owner's equity statement for the month of March. (List items that increase owner's equity first) CRANEROOFING Balance Sheet Assets $ $ Liabilities and Owner's Equity Liabilities and Owner's Equity s 5 eTextbook and Media List of Accounts Question 2 of 2 15 amouncis Date Account Titles and Explanation Debit Credit Mar. 31 (Adjusting entry for supplies) Mar. 31 (Adjusting entry for depreciation) Mar. 31 (Adjusting entry for unearned service revenue) Mar. 31 (Adjusting entry for salaries and wages expenses) Journalize the closing entries from the financial statement columns of the worksheet. (Credit account titles are autematically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) (To close expense accounts) Mar. 31 (To close net income / (loss)) Mar. 31 (To close drawings) eTextbook and Media List of Accounts Save for Later Attempts: 0 of 5 used Submit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock