Question: academy.com / lms / AF / R - 2 0 2 4 - txam / 9 2 1 5 8 1 9 2 0 2

academy.comlmsAFRtxam

CCHS Liv...

KDE Licensure

MyAccount Americ...

FastForwardAcademy

Expungement Certif...

You Will Love Histor...

History

Gran

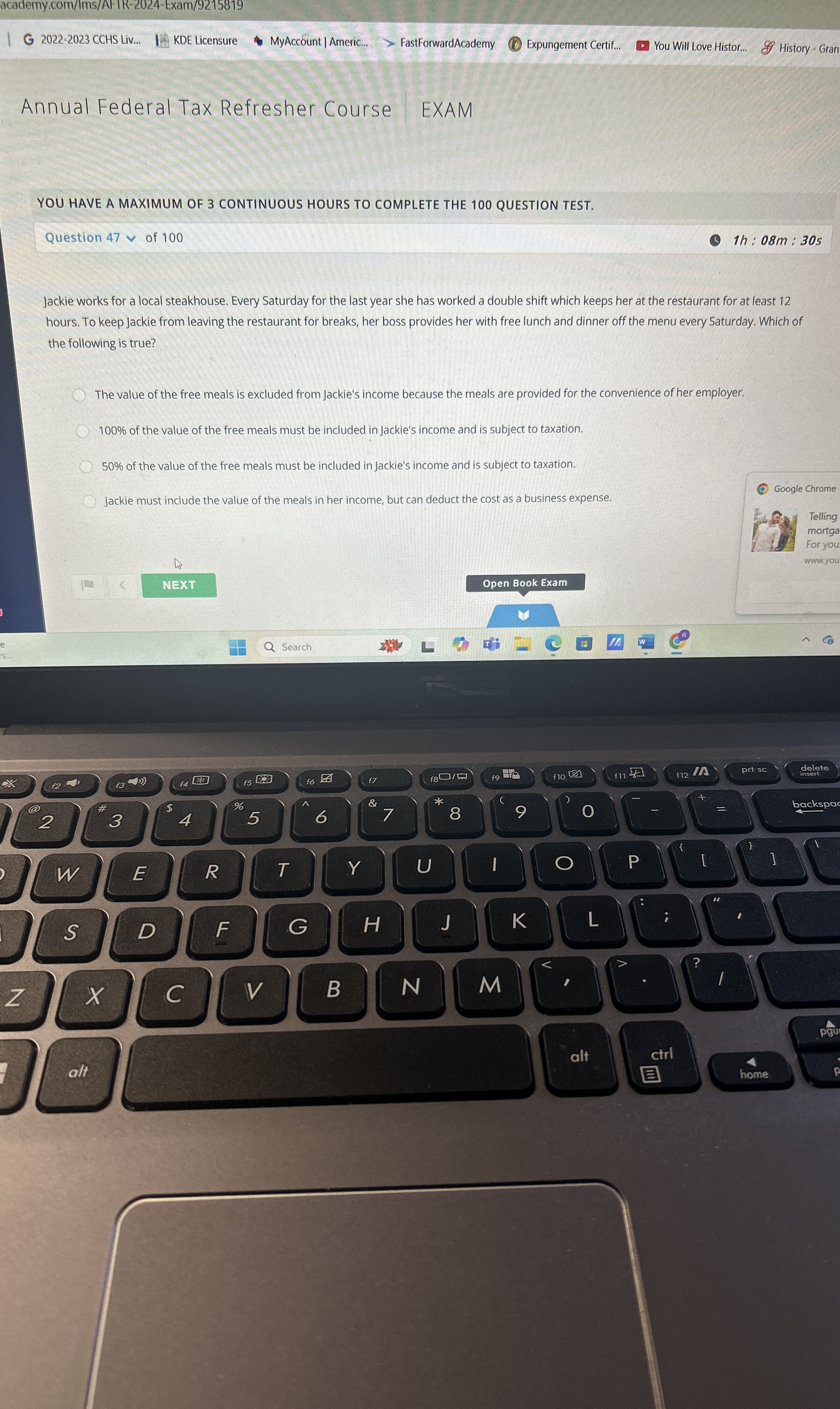

Annual Federal Tax Refresher Course

EXAM

YOU HAVE A MAXIMUM OF CONTINUOUS HOURS TO COMPLETE THE QUESTION TEST.

Question of

::

Jackie works for a local steakhouse. Every Saturday for the last year she has worked a double shift which keeps her at the restaurant for at least hours. To keep Jackie from leaving the restaurant for breaks, her boss provides her with free lunch and dinner off the menu every Saturday. Which of the following is true?

The value of the free meals is excluded from Jackie's income because the meals are provided for the convenience of her employer.

of the value of the free meals must be included in Jackie's income and is subject to taxation.

of the value of the free meals must be included in Jackie's income and is subject to taxation.

Jackie must include the value of the meals in her income, but can deduct the cost as a business expense.

Open Book Exam

Search

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock