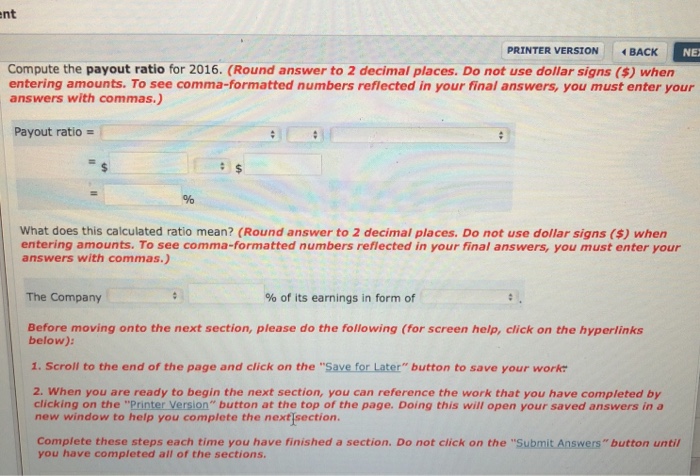

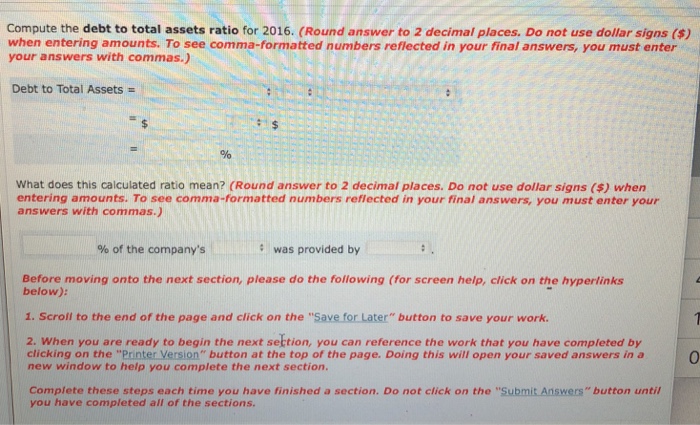

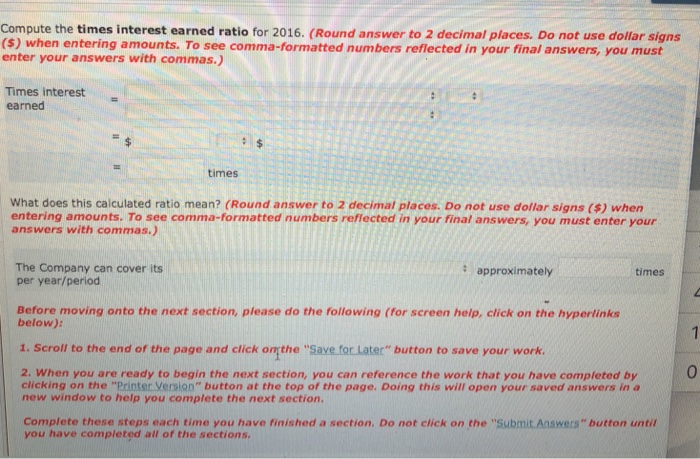

Question: ACC 112 Project 1B The below represents the comparative financial statements of Kamla Corporation. Kamla Corporation Comparative Income Statement For the Years Ended December 31,

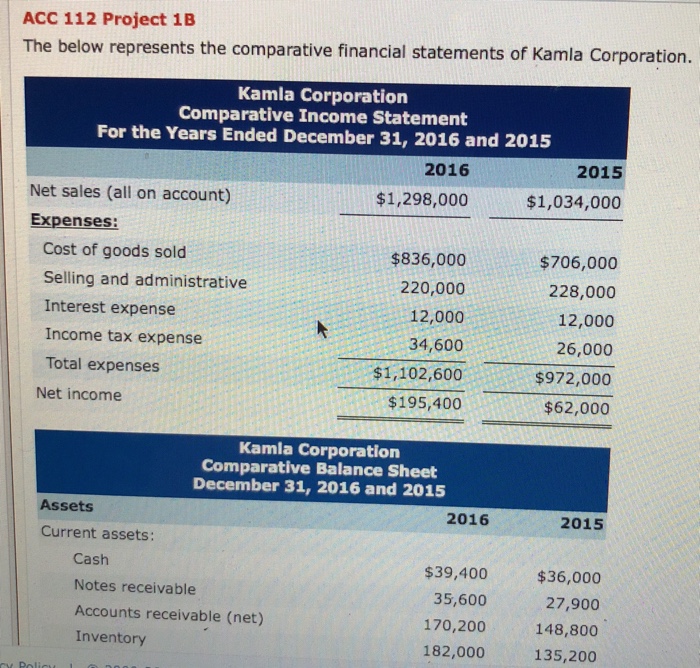

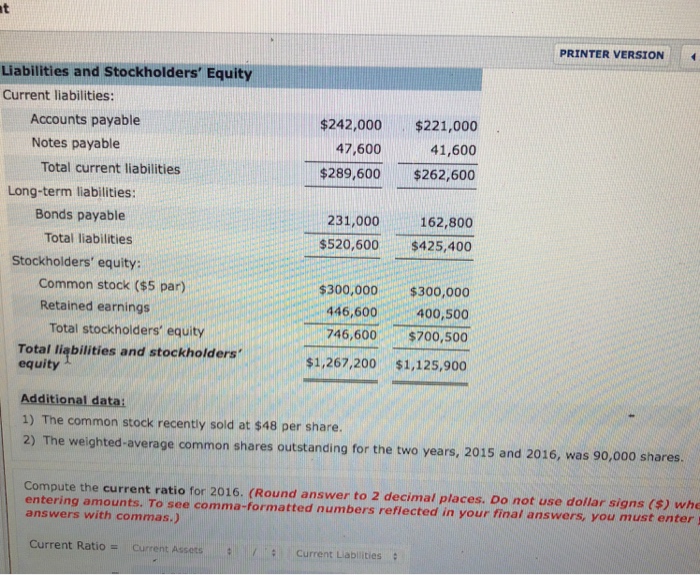

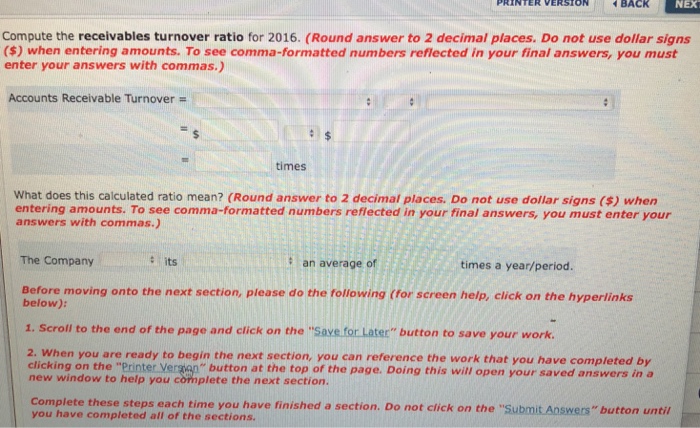

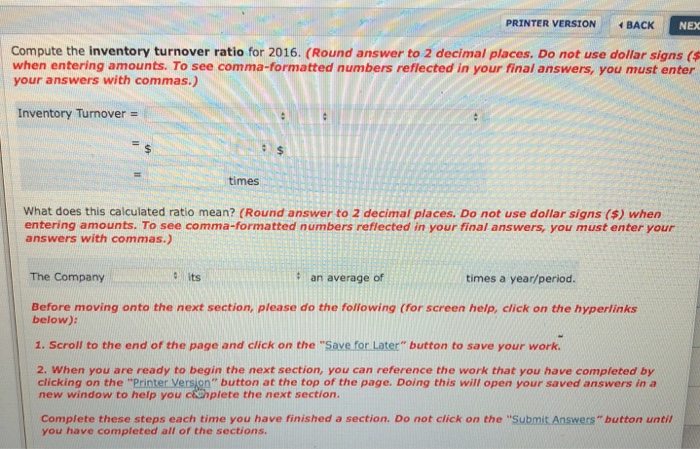

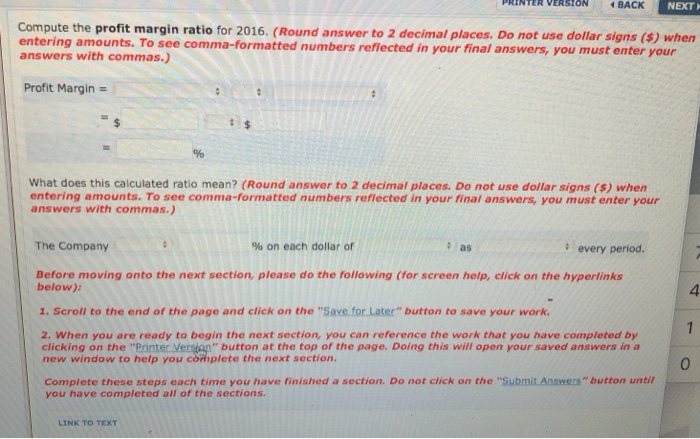

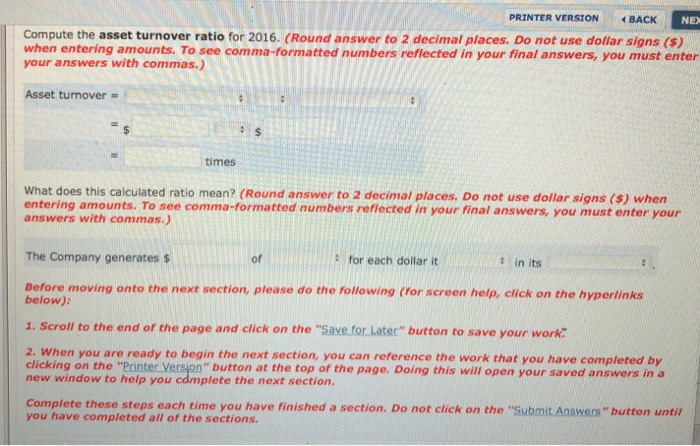

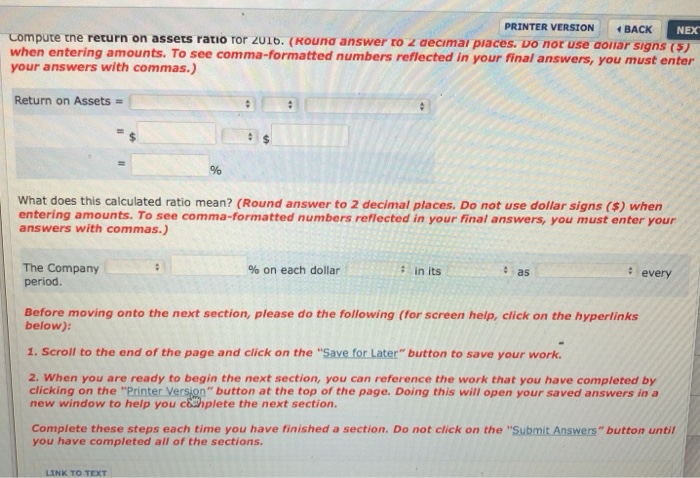

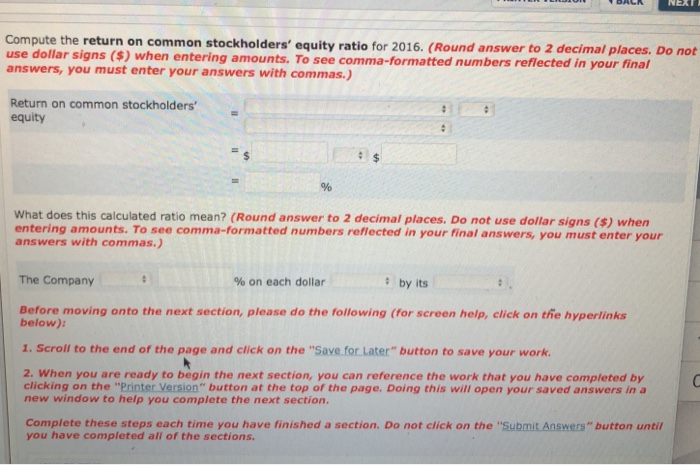

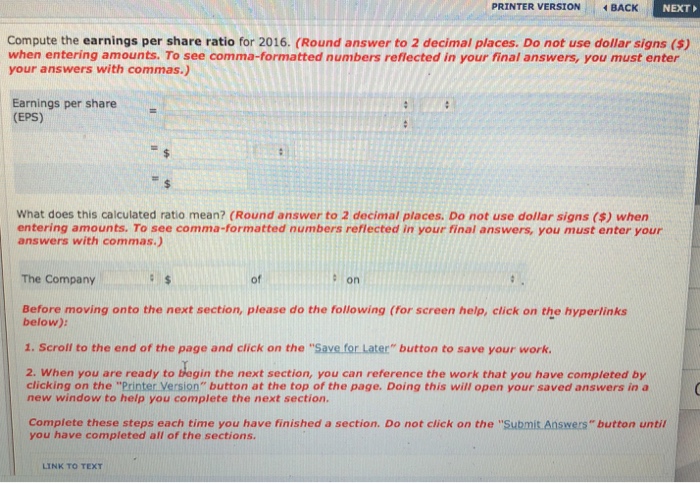

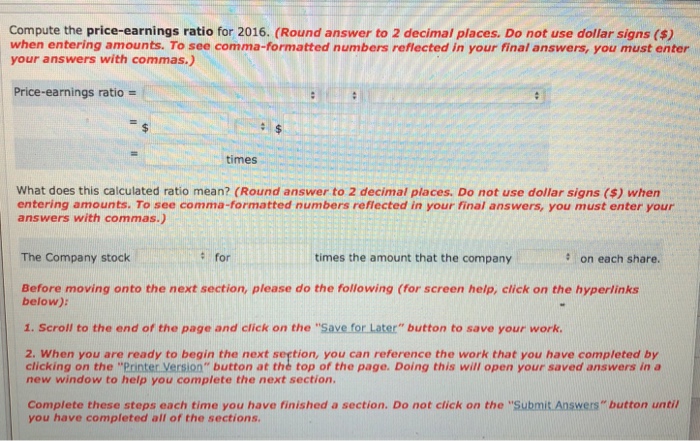

ACC 112 Project 1B The below represents the comparative financial statements of Kamla Corporation. Kamla Corporation Comparative Income Statement For the Years Ended December 31, 2016 and 2015 2016 2015 $1,298,000 $1,034,000 Net sales (all on account) Expenses: Cost of goods sold Selling and administrative Interest expense Income tax expense Total expenses Net income $836,000 220,000 12,000 34,600 $1,102,600 $195,400 $706,000 228,000 12,000 26,000 $972,000 $62,000 Kamla Corporation Comparative Balance Sheet December 31, 2016 and 2015 Assets 2016 2015 Current assets: Cash Notes receivable Accounts receivable (net) Inventory $39,400 35,600 170,200 182,000 $36,000 27,900 148,800 135,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts