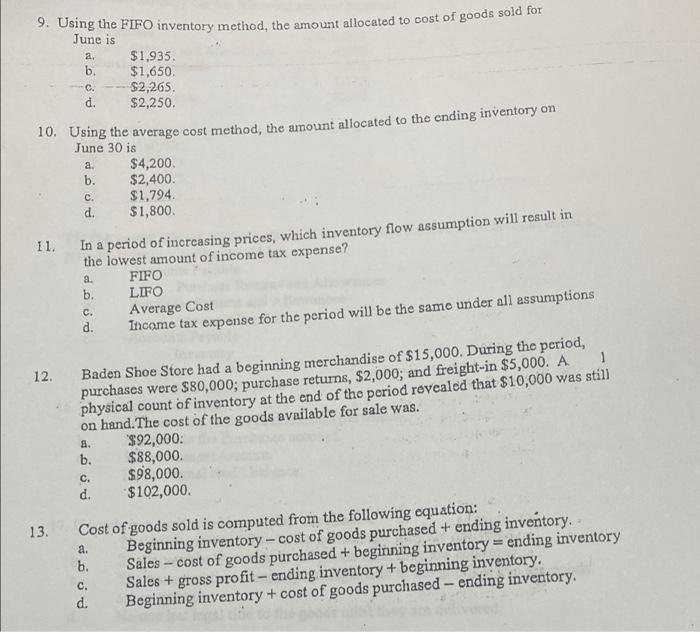

Question: acc 114 multiple a. 9. Using the FIFO inventory method, the amount allocated to cost of goods sold for June is a. $1,935. b. $1,650.

a. 9. Using the FIFO inventory method, the amount allocated to cost of goods sold for June is a. $1,935. b. $1,650. ---- -- $2,265. d. $2,250. 10. Using the average cost method, the amount allocated to the ending inventory on June 30 is $4,200 b. $2,400. $1,794 d. $1,800 11. In a period of increasing prices, which inventory flow assumption will result in the lowest amount of income tax expense? FIFO b LIFO Average Cost Income tax expense for the period will be the same under all assumptions C. a. diod c. 12. Baden Shoe Store had a beginning merchandise of $15,000. During the period, 1 purchases were $80,000; purchase returns, $2,000; and freight-in $5,000. A physical count of inventory at the end of the period revealed that $10,000 was still on hand. The cost of the goods available for sale was. $92,000 b. $88,000 $98,000. d. $102,000. 8. 13. a. Cost of goods sold is computed from the following equation: Beginning inventory - cost of goods purchased + ending inventory. b. Sales - cost of goods purchased + beginning inventory = ending inventory Sales + gross profit - ending inventory + beginning inventory. Beginning inventory + cost of goods purchased - ending inventory, d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts