Question: ACC 2 0 1 Accounting Data Appendix The following events occurred in June: June 1 : Owner contributed $ 5 0 , 0 0 0

ACC Accounting Data Appendix

The following events occurred in June:

June : Owner contributed $ in cash to the business.

June : Owner purchased a company vehicle in the amount of $

June : Owner took out a small business loan in the amount of $

June : Owner paid rent for June, and prepaid office rent for a month period to cover July through December at $ per month.

June : Owner paid business license fees in the amount of $ to the county.

June : Owner ordered office supplies, on account, in the amount of $

June : Owner performed service for client on account in the amount of $

June : Owner provided service for client in the amount of $ Customer paid $ at time of service. Client will be billed for the balance due.

June : Owner paid $ in advertising costs to the local paper.

June : Owner recorded wages due to the parttime employee in the amount of $ This will be paid on June

June : Owner prepaid business insurance to cover July through December at the rate of $ per month.

June : Owner paid wages due to parttime employee from period ending June

June : Owner paid for plumbing repairs in the office in the amount of $

June : Owner withdrew $ cash for personal use.

June : Customer paid balance due from June service in the amount of $

June : Owner provided service to client in the amount of $ Client paid at time of service.

June : Owner paid balance due for office supplies purchase on June

June : Owner performed service for client on account in the amount of $

June : Owner received telephone bill for month of June in the amount of $ and recorded the expense. This bill will not be paid until July.

June : Last day of pay period; owner owes parttime worker $ for the June through June pay period. This will be paid on July

June : Record depreciation on vehicle at $

tableA Company,,Closing Entries,,Month ending XXDateAccounts,Dehit,CreditJunClose revenues,,JunClose Expenses,,JunClose Income Summary,,JunClose Owners Draw,,

tableTotal Assets:,

Total Liabilities & Equity Total Assets on the left should equal Liabilitie

Equity

Owner Draws

Posting to the ledgert accounts

Don't overthink it

You are just posting each debit and credit from the journal entries to the account yo These accounts are set to calculate your balances for you.

Please be careful not to delete the running totals as those will calculate the ending The ending balance will transfer to the Trial Balance sheet.

If you have posted all entries and your trial balance is not in balance total debits this means that there is an error.

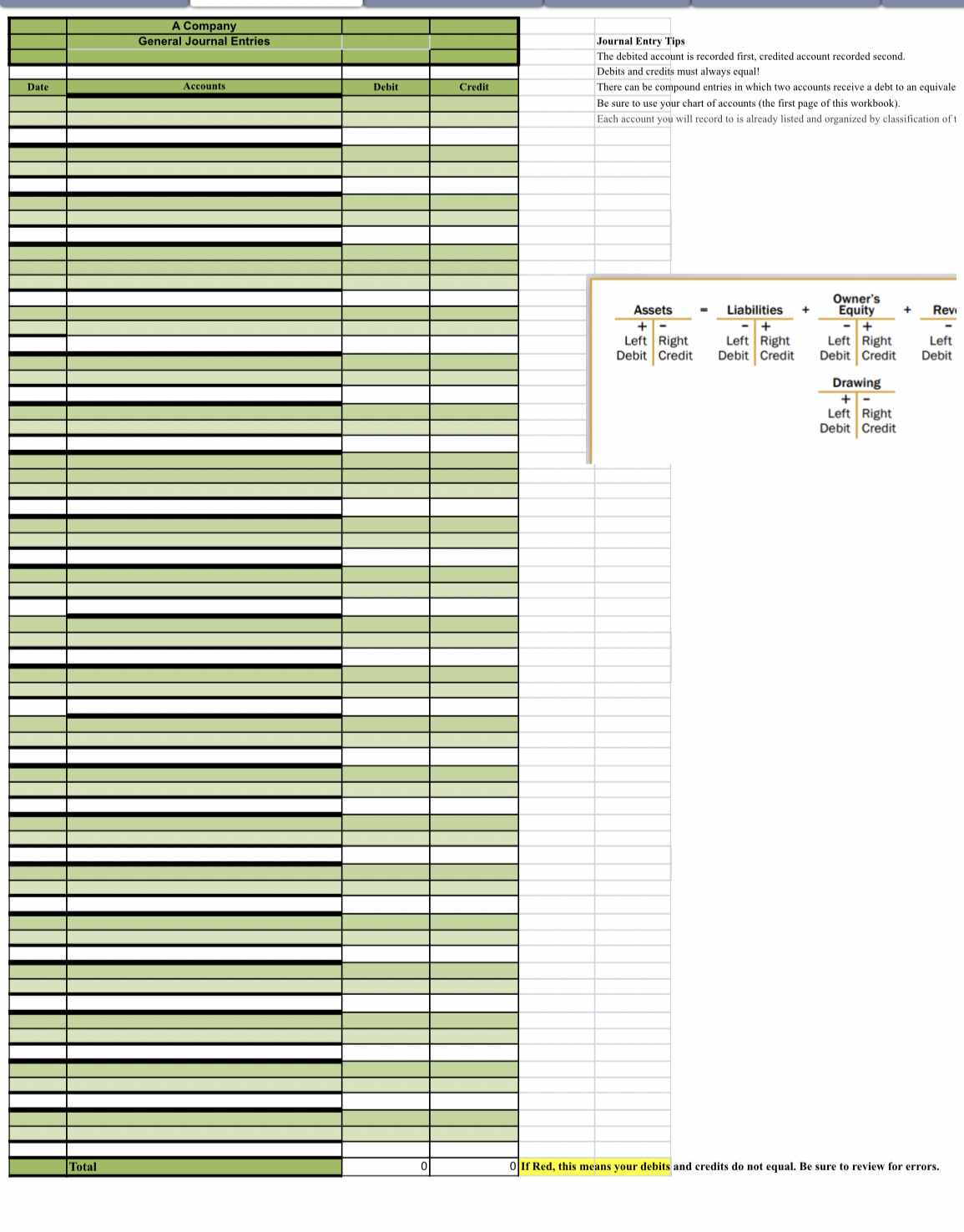

Journal Entry Tips

The debited account is recorded first, credited account recorded second.

Debits and credits must always equal!

There can be compound entries in which two accounts receive a debt to an equivale Be sure to use your chart of accounts the first page of this workbook

Each account you will record to is already listed and organized by classification of

Revi

Left

Debit

Drawing

Left

Right

Credit

If Red, this means your debits and credits do not equal. Be sure to review for errors.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock