Question: ACC 2021 Comprehensive Problem (50 POINTS) This project is a review of the accounting cycle that has been covered during class. Prepare all information in

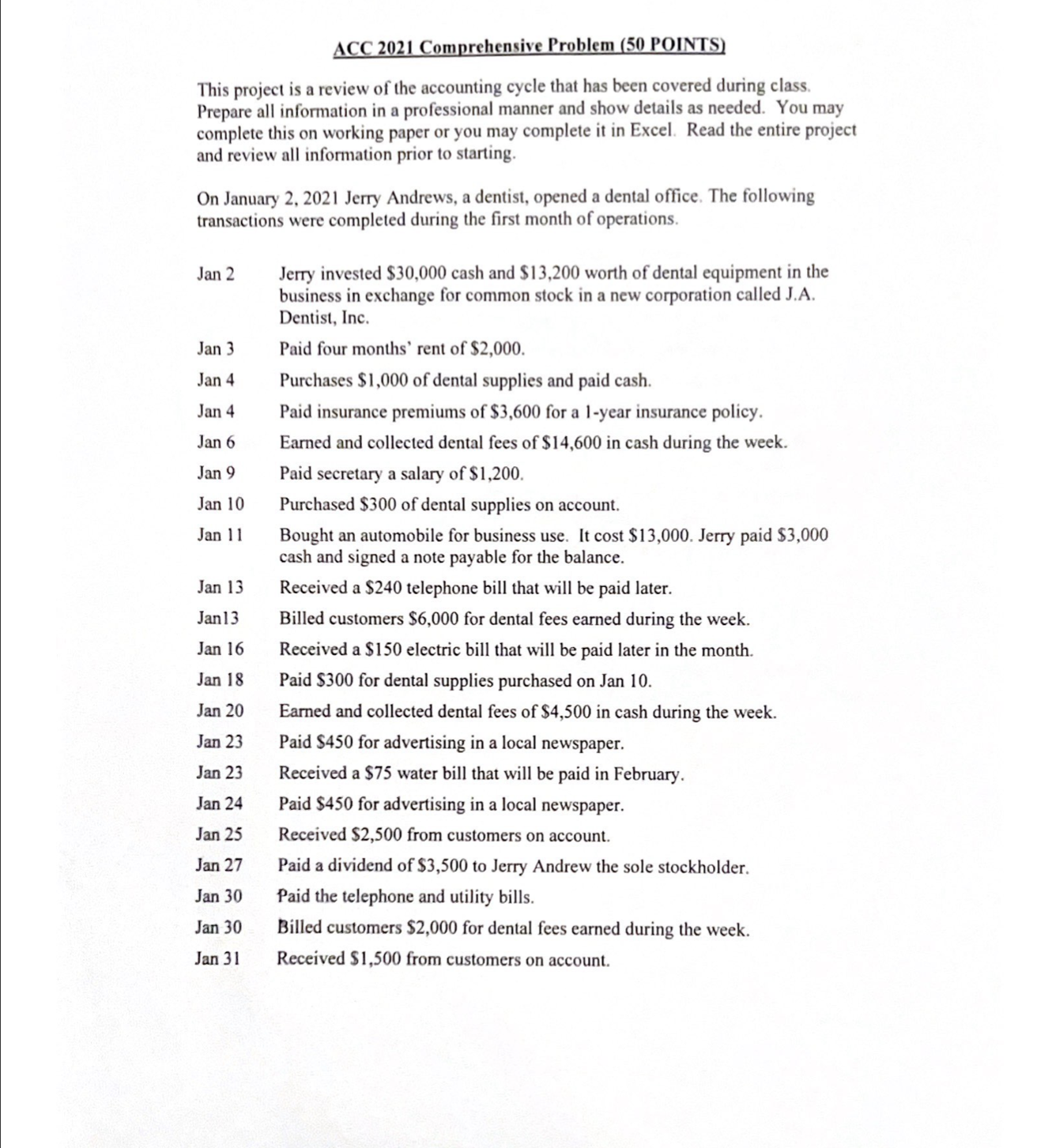

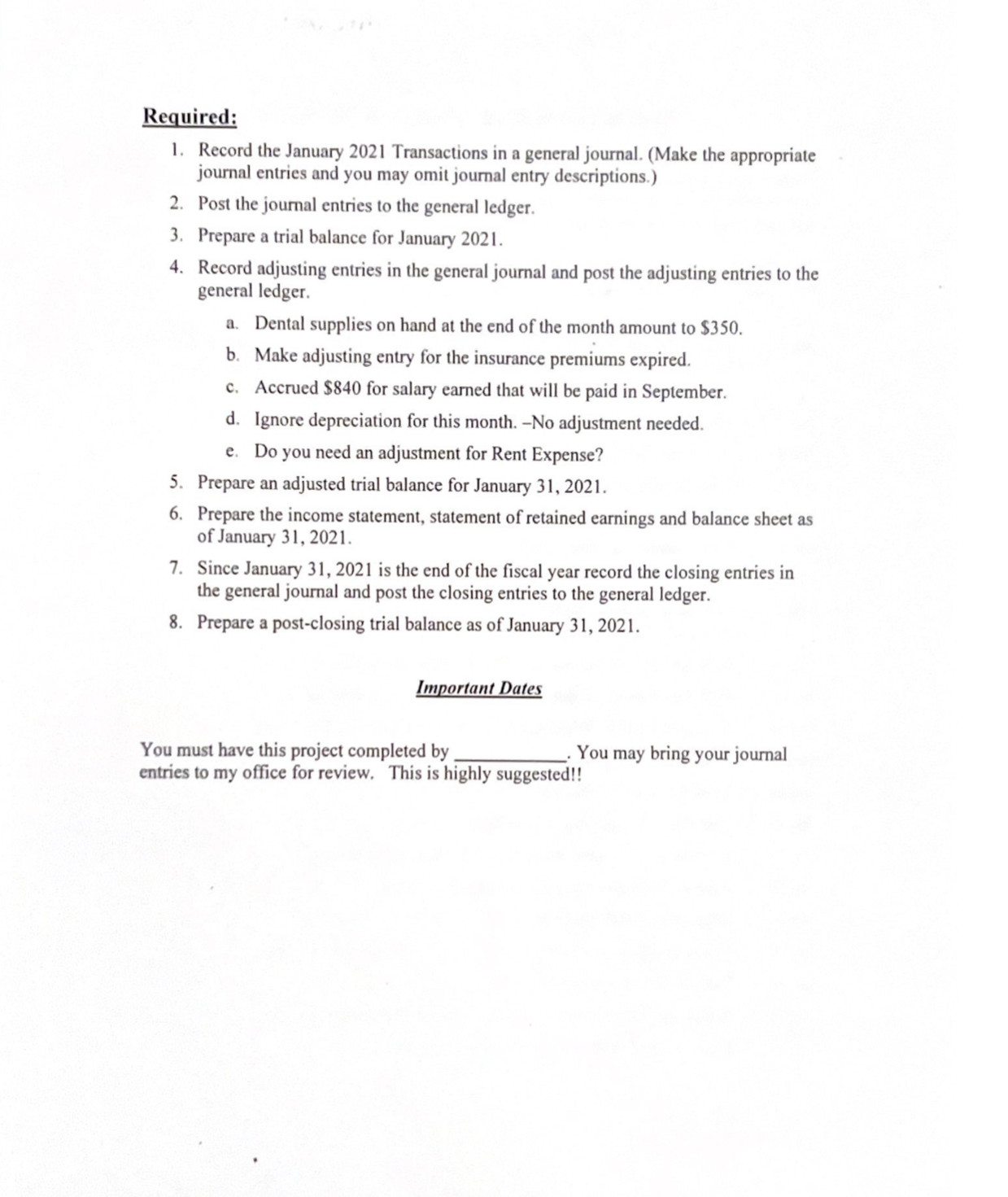

ACC 2021 Comprehensive Problem (50 POINTS) This project is a review of the accounting cycle that has been covered during class. Prepare all information in a professional manner and show details as needed. You may complete this on working paper or you may complete it in Excel. Read the entire project and review all information prior to starting. On January 2, 2021 Jerry Andrews, a dentist, opened a dental office. The following transactions were completed during the first month of operations. Jan 2 Jerry invested $30,000 cash and $13,200 worth of dental equipment in the business in exchange for common stock in a new corporation called J.A. Dentist, Inc. Jan 3 Paid four months' rent of $2,000. Jan 4 Purchases $1,000 of dental supplies and paid cash. Jan 4 Paid insurance premiums of $3,600 for a 1-year insurance policy. Jan 6 Earned and collected dental fees of $14,600 in cash during the week. Jan 9 Paid secretary a salary of $1,200. Jan 10 Purchased $300 of dental supplies on account. Jan 11 Bought an automobile for business use. It cost $13,000. Jerry paid $3,000 cash and signed a note payable for the balance. Jan 13 Received a $240 telephone bill that will be paid later. Jan13 Billed customers $6,000 for dental fees earned during the week. Jan 16 Received a $150 electric bill that will be paid later in the month. Jan 18 Paid $300 for dental supplies purchased on Jan 10. Jan 20 Earned and collected dental fees of $4,500 in cash during the week. Jan 23 Paid $450 for advertising in a local newspaper. Jan 23 Received a $75 water bill that will be paid in February. Jan 24 Paid $450 for advertising in a local newspaper. Jan 25 Received $2,500 from customers on account. Jan 27 Paid a dividend of $3,500 to Jerry Andrew the sole stockholder. Jan 30 Paid the telephone and utility bills. Jan 30 Billed customers $2,000 for dental fees earned during the week. Jan 31 Received $1,500 from customers on account. Required: 1. Record the January 2021 Transactions in a general journal. (Make the appropriate journal entries and you may omit journal entry descriptions.) 2. Post the journal entries to the general ledger. 3. Prepare a trial balance for January 2021. 4. Record adjusting entries in the general journal and post the adjusting entries to the general ledger. a. Dental supplies on hand at the end of the month amount to $350. b. Make adjusting entry for the insurance premiums expired. c. Accrued $840 for salary earned that will be paid in September. d. Ignore depreciation for this month. -No adjustment needed. e. Do you need an adjustment for Rent Expense? 5. Prepare an adjusted trial balance for January 31,2021. 6. Prepare the income statement, statement of retained earnings and balance sheet as of January 31, 2021. 7. Since January 31,2021 is the end of the fiscal year record the closing entries in the general journal and post the closing entries to the general ledger. 8. Prepare a post-closing trial balance as of January 31,2021. Important Dates You must have this project completed by You may bring your journal entries to my office for review. This is highly suggested

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts