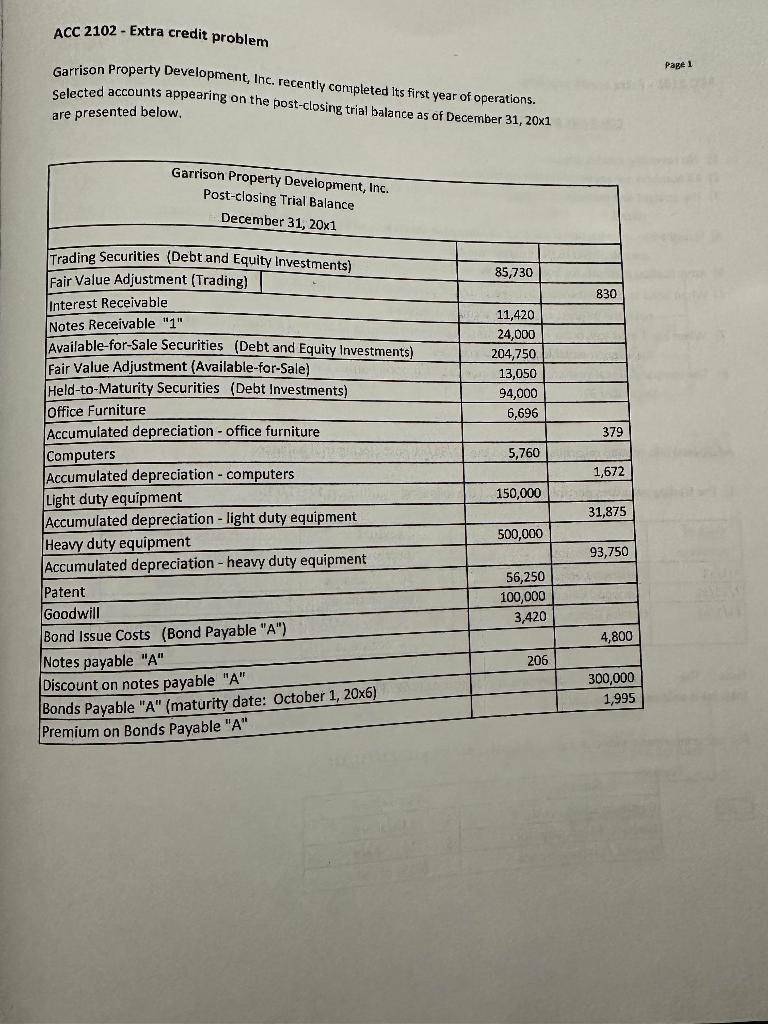

Question: ACC 2102 - Extra credit problem Garrison Property Development, Inc. recently completed its first year of operations. Selected accounts appearing on the post-closing trial balance

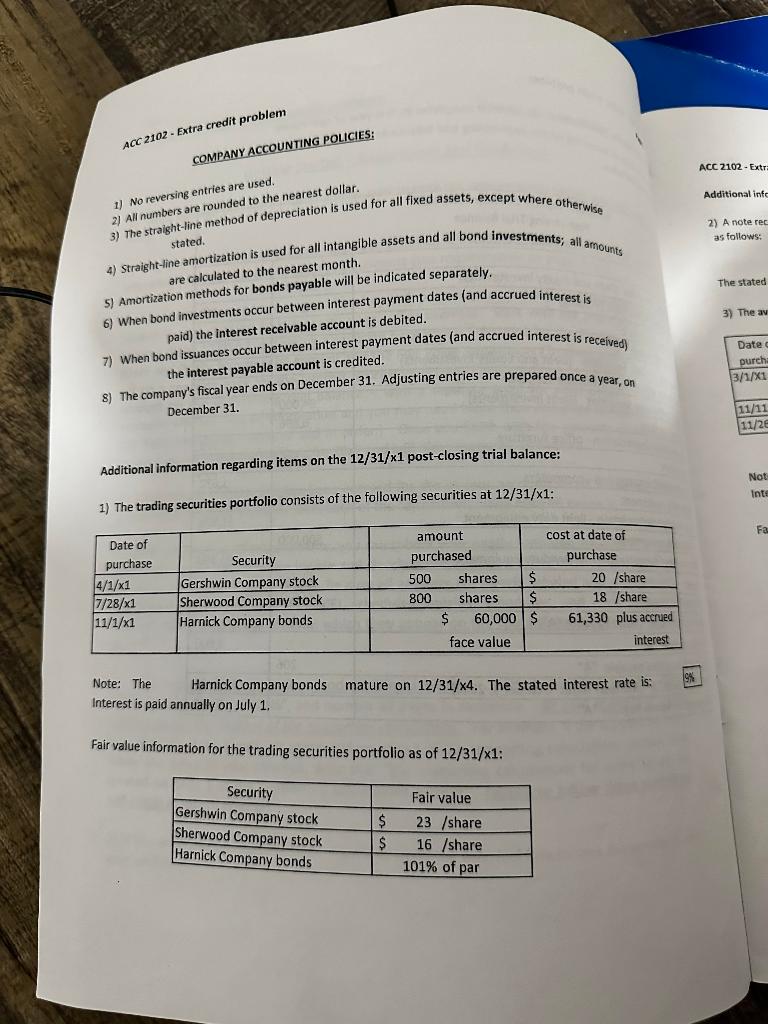

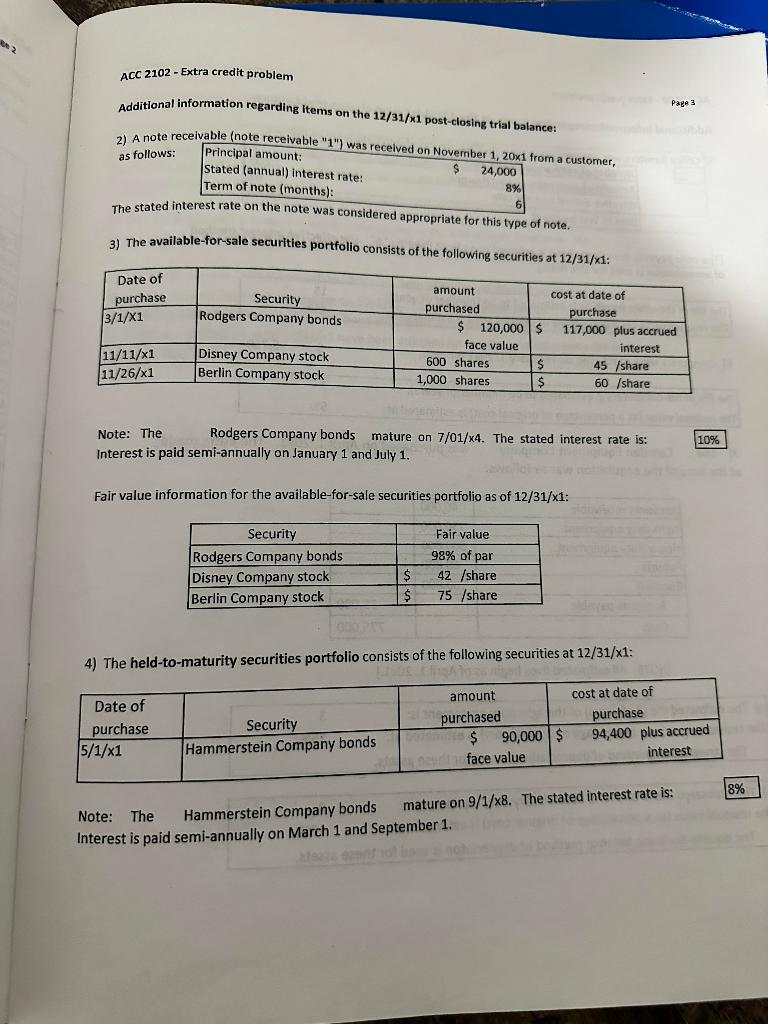

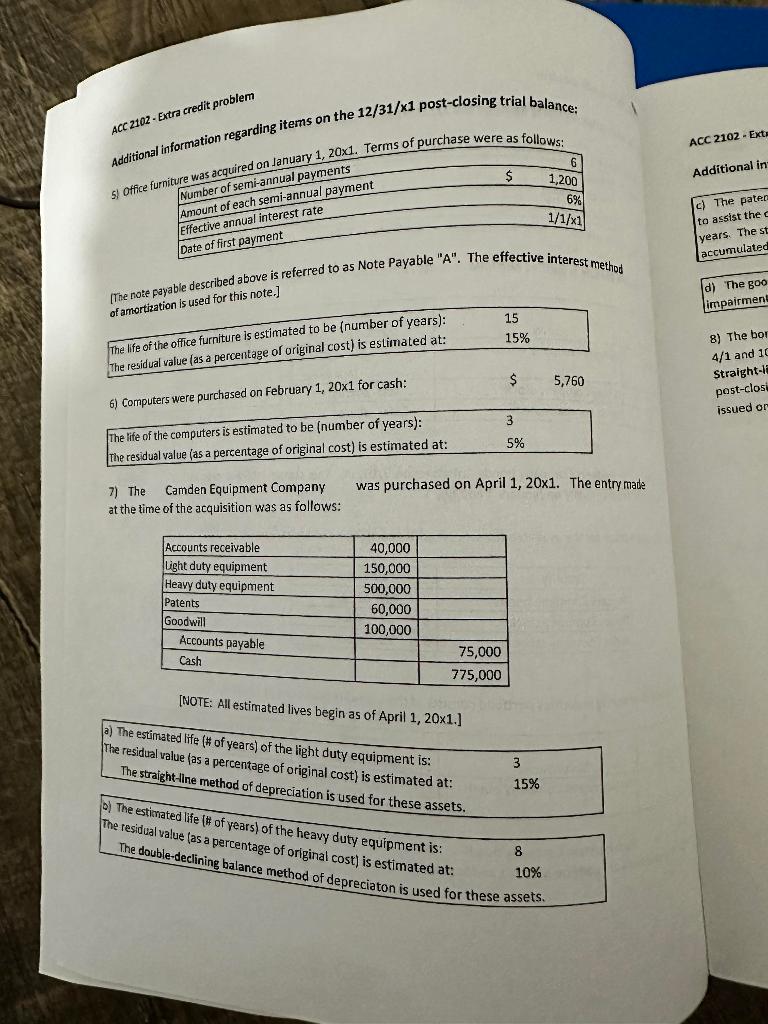

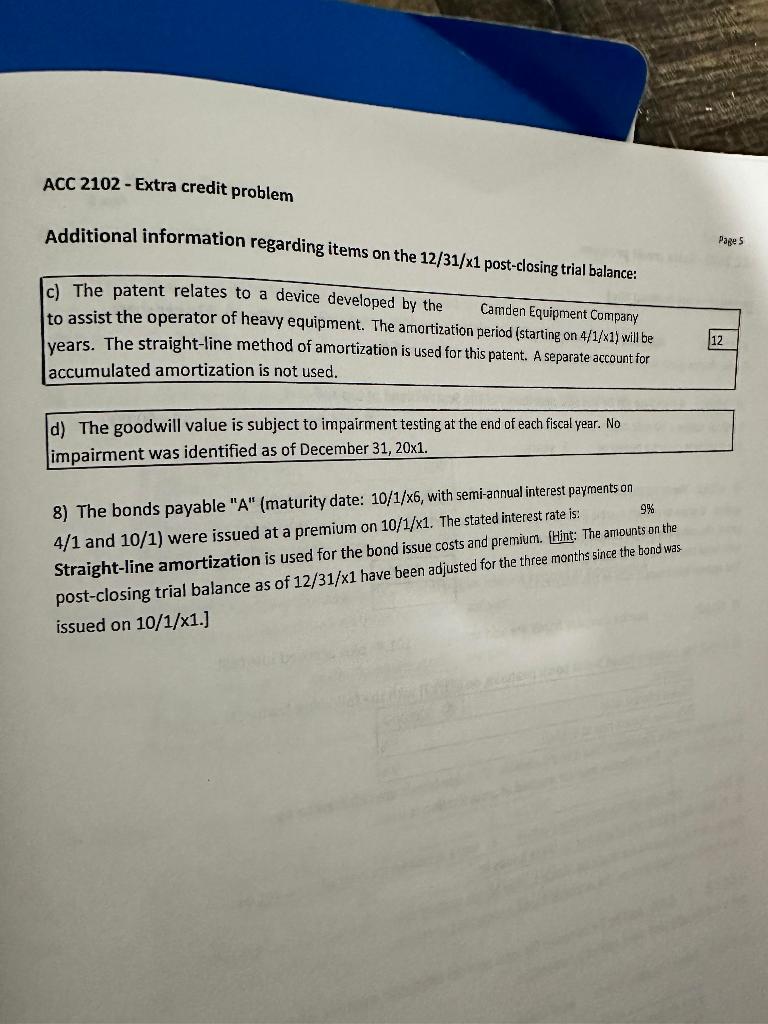

ACC 2102 - Extra credit problem Garrison Property Development, Inc. recently completed its first year of operations. Selected accounts appearing on the post-closing trial balance as of December 31,201 are presented below. 1) No reversing entries are used. 2) All numbers are rounded to the nearest dollar. 4) Straight-li are calculated to the nearest month. 6) When bond investments occur between interest payment dates (and accrued interest is paid) the interest receivable account is debited. 7) When bond issuances occur between interest payment dates (and accrued interest is received) the interest payable account is credited. 8) The company's fiscal year ends on December 31. Adjusting entries are prepared once a year, on December 31. Additional information regarding items on the 12/31/1 post-closing trial balance: 1) The trading securities portfolio consists of the following securities at 12/31/1 : Note: The Harnick Company bonds mature on 12/31/4. The stated interest rate is: Interest is paid annually on July 1 , Fair value information for the trading securities portfolio as of 12/31/x1 : Additional information regarding items on the 12/31/1 post-closing trial balance: 2) A note recel as follows: rom a customer, The stated inter 3) The available-for-sale securities portfolio consists of the following securities at 12/31/1 : Note: The Rodgers Company bonds mature on 7/01/4. The stated interest rate is: Interest is paid semi-annually on January 1 and July 1. Fair value information for the available-for-sale securities portfolio as of 12/31/1 : 4) The held-to-maturity securities portfolio consists of the following securities at 12/31/1 : Note: The Hammerstein Company bonds mature on 9/1/8. The stated interest rate is: Interest is paid semi-annually on March 1 and September 1. ACC2102 - Extra credit problem Additional 5) office fu i fnothis note.] 7) The Camden Equipment Company was purchased on April 1, 20x1. The entry made at the time of the acquisition was as follows: [NOTE: All estimated lives begin as of April 1, 20x1.] 3)Theestimatedlife(Hofyears)ofthelightdutyequipmentis:315% The residual value las a percentage of origith is used for these assets. (0) The estimated life ( of vears) of the heavy duty equipment is: Theresidualvalue(asapercentageoforiginalcost)isestimatedat:Tisedoute810% The double-declining balance method of depreciaton is used for these assets. c) The patent relates to a device developed by the Camden Equipment Company to assist the operator of heavy equipment. The amortization period (starting on 4/1/1 ) will be years. The straight-line method of amortization is used for this patent. A separate account for accumulated amortization is not used. d) The goodwill value is subject to impairment testing at the end of each fiscal year. No impairment was identified as of December 31,201. 8) The bonds payable "A" (maturity date: 10/1/x6, with semi-annual interest payments on 4/1 and 10/1) were issued at a premium on 10/1/1. The stated interest rate is: Straight-line amortization is used for the bond issue costs and premium. Hint: The ambunts on the post-closing trial balance as of 12/31/1 have been adjusted for the three months since the bond was issued on 10/1/1.] ACC 2102 - Extra credit problem Garrison Property Development, Inc. recently completed its first year of operations. Selected accounts appearing on the post-closing trial balance as of December 31,201 are presented below. 1) No reversing entries are used. 2) All numbers are rounded to the nearest dollar. 4) Straight-li are calculated to the nearest month. 6) When bond investments occur between interest payment dates (and accrued interest is paid) the interest receivable account is debited. 7) When bond issuances occur between interest payment dates (and accrued interest is received) the interest payable account is credited. 8) The company's fiscal year ends on December 31. Adjusting entries are prepared once a year, on December 31. Additional information regarding items on the 12/31/1 post-closing trial balance: 1) The trading securities portfolio consists of the following securities at 12/31/1 : Note: The Harnick Company bonds mature on 12/31/4. The stated interest rate is: Interest is paid annually on July 1 , Fair value information for the trading securities portfolio as of 12/31/x1 : Additional information regarding items on the 12/31/1 post-closing trial balance: 2) A note recel as follows: rom a customer, The stated inter 3) The available-for-sale securities portfolio consists of the following securities at 12/31/1 : Note: The Rodgers Company bonds mature on 7/01/4. The stated interest rate is: Interest is paid semi-annually on January 1 and July 1. Fair value information for the available-for-sale securities portfolio as of 12/31/1 : 4) The held-to-maturity securities portfolio consists of the following securities at 12/31/1 : Note: The Hammerstein Company bonds mature on 9/1/8. The stated interest rate is: Interest is paid semi-annually on March 1 and September 1. ACC2102 - Extra credit problem Additional 5) office fu i fnothis note.] 7) The Camden Equipment Company was purchased on April 1, 20x1. The entry made at the time of the acquisition was as follows: [NOTE: All estimated lives begin as of April 1, 20x1.] 3)Theestimatedlife(Hofyears)ofthelightdutyequipmentis:315% The residual value las a percentage of origith is used for these assets. (0) The estimated life ( of vears) of the heavy duty equipment is: Theresidualvalue(asapercentageoforiginalcost)isestimatedat:Tisedoute810% The double-declining balance method of depreciaton is used for these assets. c) The patent relates to a device developed by the Camden Equipment Company to assist the operator of heavy equipment. The amortization period (starting on 4/1/1 ) will be years. The straight-line method of amortization is used for this patent. A separate account for accumulated amortization is not used. d) The goodwill value is subject to impairment testing at the end of each fiscal year. No impairment was identified as of December 31,201. 8) The bonds payable "A" (maturity date: 10/1/x6, with semi-annual interest payments on 4/1 and 10/1) were issued at a premium on 10/1/1. The stated interest rate is: Straight-line amortization is used for the bond issue costs and premium. Hint: The ambunts on the post-closing trial balance as of 12/31/1 have been adjusted for the three months since the bond was issued on 10/1/1.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts