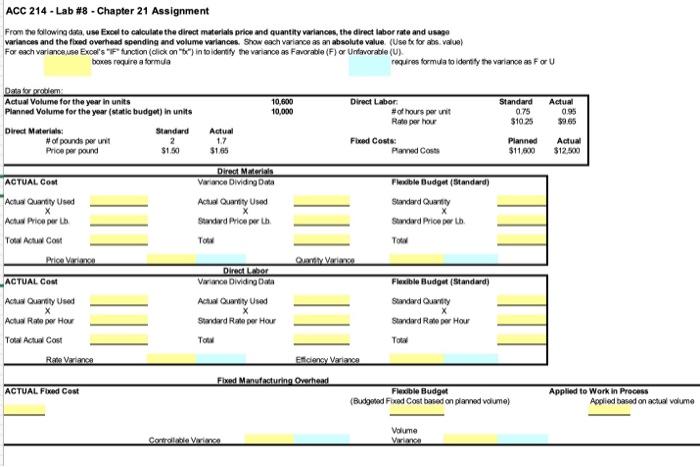

Question: ACC 214 - Lab #8 - Chapter 21 Assignment From the following dista, use Excel to calculate the direct materials price and quantity variances, the

ACC 214 - Lab #8 - Chapter 21 Assignment From the following dista, use Excel to calculate the direct materials price and quantity variances, the direct labor rate and usage variances and the food overhead spending and volume variances. Show each variance as an absolute value (Use tx for abs.value) For each variance use Excel's Function (dick on "")in to identify the variance as Favorable (F) or Unfavorable (U). bones require a formula requires formula to identity the variance as For U Actual 0.95 $9.85 Actual $12.500 Datater protiem Actual Volume for the year in units 10,600 Direct Labor Standard Planned Volume for the year (static budget) in units 10,000 of hours per unit 0.75 Rate per hour $10.25 Direct Materials: Standard Actual #of pounds per unit 2 1.7 Fored Costs: Planned Price per pound $1.50 $1.65 Pared Costs $11.900 Direct Materials ACTUAL COM Vario Diving Dia Fladblo Budget (standard) Actual Quaily Used Actul Ouity Used Standard Qurty Ach Price perb Standard Price perih Standard Price per to TO AI COM Tom Prise Vacanso Vede Director ACTUAL COM Varme Dividing Flexible Budget (Standard) Actis Quantity Used Actual Quantity Used Standard Oy X Actus Rotope How Standard Rate per Hour Standard Rato per How Total Actu Cost TOWN Total Rate Variance Eficiency Varianca Fixed Manufacturing Overhead ACTUAL Fixed Cost Flexible Budget (Budgeted Foxed Cost based on planned volume) Applied to Work in Process Applied based on actual volume Volume Vrancea Sara Vara

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts